Chief among these was the impact of the European Central Bank’s prospective withdrawal from the covered bond purchase programme (CBPP3) which is expected to take place next year. The large amount of bonds that could potentially be reinvested back into the market suggests the spread impact will be gradual and moderate. But even so, credit fundamentals should come back into play leading to greater price differentiation.

Dollar covered bonds will continue to play an important diversification role and with the end of central bank subsidies, their importance for issuers could begin to grow. And though the market offers tempting relative value, it is not likely to take off without a law that is tailored to the actual needs of US issuers.

In a rising interest rate environment the relative value of floating rate bonds could start to have appeal, and though there is potential for the market to grow, demand in euros has so far proved lacklustre. The low rate environment has provided a great opportunity for issuers to extend duration, and while it is likely there will always be residual demand to buy, appetite for duration may start to wane as the low rates environment begins to draw to a close.

Proposed rules on the Net Stable Funding Ratio could have a negative effect on covered bond supply but as the product still has a strategic funding role to play, the strength of that impact should be minimal.

Harmonisation poses another area of potential legislative change, although the European Commission is unlikely to want to undertake major alterations for fear of disrupting the market which has so far worked well.

But one area that could have more far-reaching consequences is the development of European Secured Notes. As market conditions change, and with some regulatory lift, the sector — which has so far struggled — may yet come to surprise.

Another area with great potential is the green covered bond market as the European Covered Bond Council’s effort to standardise green mortgage loan origination is expected to spur production and, in time, more supply.

Participants in the roundtable were:

Andreas Denger, portfolio manager and covered bond analyst, Munich Ergo Asset Management

Florian Eichert, head of covered bond and SSA research, Crédit Agricole CIB

Nadine Fedon, chief executive, Crédit Agricole Home Loan SFH

Sami Gotrane, head of treasury and financial markets, Caffil

Ivan Hrazdira, global sponsor of US dollar DCM, Crédit Agricole CIB

Arnaud-Guilhem Lamy, portfolio manager, BNP Paribas Asset Management

Kristion Mierau, portfolio manager and head of covered bonds, Pimco

Guy Volpicella, head of structured funding and capital, Westpac

John Arne Wang, head of treasury management, SEB

Andreas Wein, head of funding and investor relations, Landesbank Baden-Württemberg

Bill Thornhill, moderator, GlobalCapital

The end of CBPP3

Andreas Denger, MEAG: We’ve already seen that covered bond purchases have gone down quite significantly. But I expect the ECB will make a more formal announcement in September and I imagine this will take place over a six month period starting from January 2018. Our base case is that purchasing comes to an end by mid-2018. But if eurozone markets come under renewed pressure then it’s likely that the programme will be extended.

Kristion Mierau, Pimco: Our view is that they’re probably just going to maintain course with the volume of purchases likely to be a function of primary supply. If they maintain their secondary rate of purchases at around €100m-€150m per session we could see monthly volumes down to €2bn-€3bn in the next few months.

Florian Eichert, Crédit Agricole CIB: Our house view is for tapering to begin in March 2018 and last until the end of 2018. The ECB buys covered bonds whenever they can source them but it is happy to sit back when nothing is on offer. That means net settlements could fall or even turn negative in the next few months — just because of increasing portfolio redemptions rather than a change in strategy.

Mierau, Pimco: We expected them to look more to CSPP or PSPP as scarcity of covered bonds increased, but they seem to be adhering to their mandate. They clearly do not seem to be concerned with distorting natural market pricing mechanisms or putting too large a ‘footprint’ on the market. On the other hand, one could make the observation that they have been successful at inducing desired portfolio rebalancing by crowding out investors into riskier assets.

John Arne Wang, SEB: Looking back, I thought there was a rather successful attempt at introducing the tapering discussion in the market at the end of last year, but then the ECB completely backtracked on what was actually a rather good position that they had. They very solidly went out and said that tapering was not on the agenda whatsoever.

Wang, SEB: They were given a helping hand by introducing this to the market with minimal impact, but then they put themselves in a corner again. So right now I would think it will take some time before they introduce tapering of asset purchases. This obviously needs to be communicated in a delicate manner and somewhat more strategically than how the ECB has handled such matters so far.

Spreads

: How do you think spreads will react when they do slow down?

Arnaud-Guilhem Lamy, BNP Asset Management: Though the ECB is likely to reinvest redeeming bonds over a long period after the programme has stopped, I expect we’ll see a spread widening. Some 25%-50% of primary market issues are purchased by the ECB so that means issuers will have to find investors to fill the demand gap. So I guess new issue premiums will rise and that will lead to a repricing of the secondary curve, a bit like what we saw in 2015.

Lamy, BNP AM: In AAA countries somewhere between 20bp-30bp. You see for example in France that covered bonds traded 10bp-15bp below OATs in the 10 year before the elections and they are also below the mid-swaps reference out to the seven year which I believe is not sustainable.

For Spain and Italy I would say spreads may widen up to 40bp but the big question is whether or not the market is likely to be tapped much by these banks. Given that we don’t have any more TLTROs I would expect covered bond supply to bounce back more strongly in the second half of 2018 and 2019 compared to last year and this.

Eichert, CA-CIB: Spreads, especially those in Spain have compressed as much as they possibly can in our view. With French political risk behind us, the focus will turn to tapering as well as political risk in Italy. We tried to model spreads in a non-CBPP 3 world and based on the model believe CBPP3 eligible core markets look fairly valued at the short end. Curves would have to steepen 5bp-10bp, though and peripheral markets should be wider by 20bp-30bp. Non-eligible core markets are slightly too wide at the moment versus the model values.

Wang, SEB: I think the way tapering would be communicated is critical and I’m also slightly concerned as to how this will be carried out. Looking at the actual quantity purchased by the ECB last month, you’re talking about only €1bn and €10bn-€11bn year to date. From that perspective, tapering should not have a major impact. Additionally, the underlying supply dynamics are quite beneficial for issuers right now.

Obviously ending the programme will mean that certain categories of the covered bond market should adjust to levels that are more in line with the credit risk and not what’s happening today. Peripheral issues should widen the most, depending on how government bonds move in those regions.

Nadine Fedon, Crédit Agricole SA: I think, for some peripheral countries, it would be quite difficult if they stopped buying completely at once so that’s why the ECB is likely to try and lengthen the tapering period to smooth the impact.

Eichert, CA-CIB: We expect more peripheral issuers to hit the market by year end and into Q1 2018 to benefit from the CBPP3’s existence.

Andreas Wein, LBBW: I would very much hope that the ECB understands the impact it has had on the market and that they consequently act with great diligence and a sense of responsibility when they do eventually exit.

Sami Gotrane, Caffil: We are conscious that a moderate repricing will happen after the end of the CBPP3. But first I would like to add one comment regarding the performance of French covered bonds versus OATs. The situation in the run-up to the first round of French elections was not so much because covered bonds were overvalued but because market nervousness about the French election was undermining OATs.

We have not been very comfortable with CBPP3 because we believe the market really has to be made up of genuine investors and not hugely supported by the central bank. That’s why we have forecast a repricing in our different budgets over the next few years. So yes, I would agree we should expect spreads to widen but only moderately so.

Mierau, Pimco: At this point there is little differentiation between the different programmes, legislative frameworks and credit fundamentals of the various issuers. A large segment of the market currently trades within a few basis points which I think is symptomatic of what the CBPP3 has done. We have a slightly negative net supply, but on the demand side, with CBPP3 you are not seeing much rational price sensitivity. Because the Eurosystem is buying methodically on a daily basis you have this constant demand backstop which is steadily compressing spreads.

On the other side of the equation you have the Street and their function of providing liquidity to the markets has also become dependent on CBPP3. When there is some type of adverse market move the Street is more willing to absorb bonds. Because of this technical situation I suspect they are more willing to warehouse the risk of sitting on longs.

The question is not if valuations will decompress after the ECB steps away from the market but rather the scope and magnitude. I expect only a gradual and modest repricing for the broader covered bond segment but also expect increased differentiation based on fundamentals across the covered bond credit spectrum.

Guy Volpicella, Westpac: By definition, a non-European Australian or New Zealand bank like Westpac doesn’t qualify for the purchase programme. So there may be volatility, but that should be less likely than eligible bonds. And therefore we should in theory benefit most from the decompression in spreads.

Wang, SEB: I’m not especially worried about Nordic covered bond spreads. The end of CBPP3 is likely to lead to some widening in most sectors, but it is likely to be somewhat limited for the best Nordic issuers.

Swedish covered bonds have indirectly benefited from the CBPP3, but the tightening has also been a function of decreased supply and the fact that credit spreads in general have plummeted.

If you believe Swedish covered bond spreads are going to widen a lot that means you should also have a very negative view on where senior spreads for that region are going since the senior-covered spread differential is at very tight levels. Such a move does not seem very likely.

Eichert, CA-CIB: While I am quite confident about our model estimates for core eligible and peripheral markets, I assume that non-eligible core markets will suffer first before they can benefit from the disappearance of the CBPP3. Many investors have overweighted non-eligible markets for two to three years now, and in the absence of sizeable pick-up, I just don’t see how they could push this overweight further.

CBPP3 reinvestments and price differentiation

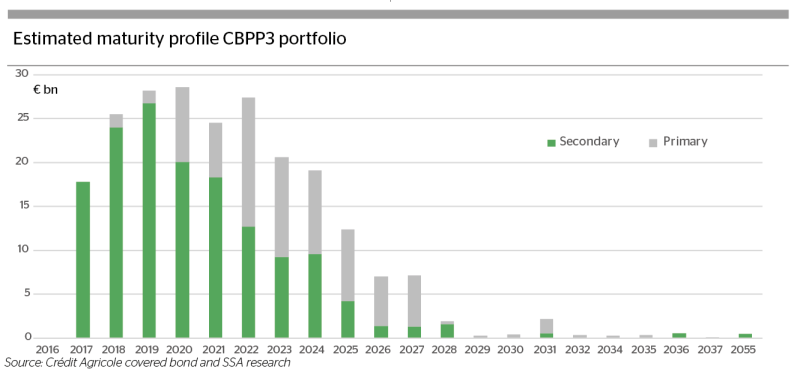

Fedon, Crédit Agricole SA: As far as covered bonds are concerned we believe the ECB will reinvest maturing principal. And then we are hoping, in that context, about between €25bn and €30bn per year of reinvestment.

Eichert, CA-CIB: Portfolio redemptions have already become a major phenomenon for the CBPP3. Until the end of April we have seen €16.5bn of bonds maturing in the portfolio with the weekly number at times being as high as €1.1bn. For now, redemptions have been reinvested in the covered bond space, the Eurosystem seems to have even tried to stay in the same sectors. Going forward we don’t see this approach changing, which means we are looking at between €25bn and €30bn of reinvestments per year and QE in covered bond markets continuing well beyond the official end date.

Mierau, Pimco: I see no reason why they would reinvest coupons and redemptions in a post-QE world. In terms of taking their foot off the gas pedal not reinvesting the coupons/redemptions of their €215bn covered bond portfolio would hardly be noticed, not to mention their ownership of over 33% of the eligible universe that will actually increase if we continue to have negative net supply.

Remember their mandate is not about funding or anything covered bond specific but rather about expanding the balance sheet. Not reinvesting would be consistent with the assumption that they, at some point, want attrition of their balance sheet.

Lamy, BNP AM: In my opinion it is unlikely that, after stopping the purchases, the ECB will then want to go down the route of strongly deleveraging its balance sheet. They could maybe begin by stopping growth of the CBPP3 programme. But, in order to maintain the same size and prevent a rapid deleveraging it will be necessary for them to reinvest redemptions over a period of say three or four years.

Dollar covered bonds

Wein, LBBW: This is a section of the covered bond market that had to function without the ECB’s participation which made selling into it a more interesting exercise. Having said that, if you compare funding spreads after the Eurodollar cross-currency basis affect, then the final cost was for us pretty much on a par with what we get in euros.

We marketed our name in dollars a lot more actively than we would typically do for a standard euro bond issue. We put great diligence into understanding our investor base and talking to them so we could get comfort on each occasion we launched a dollar bond. We therefore had a good feeling about the likely outcome of our transactions and their performance.

The best advantage of dollar covered bond funding is that, in our case, it simply helps us meet our objective to raise dollar liquidity and offers investor diversification. We were less concerned about funding arbitrage.

Volpicella, Westpac: That’s right. For us, it’s always going to be around the diversification it provides. It also increases Westpac’s overall issuance capacity. That’s clearly the key benefit, of not just the dollar market, but also the euro dollar market. They go hand-in-hand.

Ivan Hrazdira, Crédit Agricole CIB: There are some clearly appealing aspects of the dollar market: the ability to tap into a different investor base, build ‘brand equity’ in terms of issuance and diversify your source of funding in an economically advantageous way. Relatively frequent borrowers — such as the Canadians and Aussies — are generally not worried about every last basis point and will rightfully take advantage of market liquidity when it is there. Others who have well developed domestic markets are clearly much more opportunistic in accessing dollar funding.

Wein, LBBW: Oh yes, absolutely. Local, international, also good demand from outside Europe — so it’s a lot broader.

Wang, SEB: We have not been active in dollar covered bonds recently due to somewhat lower funding needs. In addition to the domestic Swedish market, the main focus would be the euro covered bond market. The euro market will always be the first choice before we start considering dollars, unless dollars offers a compelling arbitrage opportunity. But for issuers that have larger funding and diversification needs dollar covered bonds is a good alternative.

Fedon, Crédit Agricole SA: We issued a dollar covered bond back in 2011 which had to be swapped back into euros. Given where we would have to issue covered bonds today, the dollar market is absolutely not cost-efficient for us and it is also very complicated in terms of documentation. But also I think the dollar covered bond market is very small in comparison to Europe, partly because US investors prefer to buy securitizations which they understand well, and which offer more spread compared to covered bonds. And since we don’t have dollar assets in our cover pool and would have to bear the cost of a currency swap, I don’t see us returning to the dollar market.

Wang, SEB: The dollar bond market is likely to be limited as long as the domestic US investor base is rather small and impacted by US regulatory treatment. Until we see a change in that respect, dollar covered bonds will primarily be driven by Canadian and European treasury investment interests, some central banks and a rather small contingent of 144a investors, the latter group being rather price-sensitive.

Volpicella, Westpac: It’s quite interesting that one of the unintended consequences of the current TLTRO and covered bond purchase programme is that it is deterring core European banks from issuing into the dollar market. That’s clearly a problem area as a result of the incremental cost of funding versus the benefits that those programmes can provide. So one clear thing is that reducing these temporary initiatives would incentivise European issuers to tap dollar covered bonds.

Volpicella, Westpac: That’s right. And, when you think of it from an Australian issuer’s perspective, Westpac can’t take advantage of these initiatives and, as a result, the pricing of our issuance is more likely to more closely reflect the credit fundamentals. That should mean investors are getting appropriately rewarded for the risk they’re taking, as opposed to being skewed by temporary market initiatives. Once you take away these programmes you’re more likely to see Europeans follow suit and issue more dollars than what they have done traditionally.

To that end, we see the pricing of our euro covered bonds as very much in line with US dollar pricing. It’s no surprise, therefore, that when you look at our issuance over the last five years or so, roughly 50% of it has been in US dollars and the other half has been in euros. So that’s meant we’ve been more agnostic in terms of where we issue in today’s markets. The euro market has traditionally been able to provide longer-dated covered bonds where we have been issuing around the seven-year bucket, while the value in the US dollar market is typically up to five years and at the moment it offers a slightly tighter spread compared to euros.

Mierau, Pimco: Obviously a US legislative framework would be a good thing but I think with the agency MBS model in place, that’s probably not going to happen any time soon. What we are more likely to see out of the US are other covered bond innovations under contractual frameworks which could introduce a broader range of assets as collateral besides mortgages. This could even broaden the covered bond issuer spectrum beyond banks to corporates.

Hrazdira, CA-CIB: Aside from the development of a legislative framework, one thing you have to remember is the US has the Federal Home Loan Bank system which is essentially a direct competitor from the standpoint of the issuer. American banks have the ability to borrow from the FHLBs at very attractive rates using on-balance sheet collateral, the same way covered bonds work. The system has been around since the 1930s, and it is extremely efficient in providing quick, compelling funding in a very well developed framework. So this is what a potential domestic US covered bond market would have to compete against.

Mierau, Pimco: Because in the context of current covered bond valuations it could make sense for issuers to monetise certain less liquid assets on their balance sheet and for investors who would be compensated for providing liquidity and price discovery for the new asset class.

Mierau, Pimco: Looking at dollar covered bonds versus the same bonds issued in other currencies is certainly one relative metric we look at, but even if there is not an arbitrage, there may be a fit for a variety of other reasons.

Looking at the relative value of dollar covered bonds versus other unsecured instruments lower in the capital structure is one relative value metric which has made dollar covered bonds a compelling alternative for US investors, to say IG credit or senior unsecured bonds from the same covered bond issuers.

Hrazdira, CA-CIB: I don’t disagree there is a lack of liquidity in dollar covereds but, that aside, there is a very interesting value proposition here. You can invest in, say, triple-A Canadian legislative covered bonds with a three year maturity at around 30bp over mid-swaps.

Then you have Apple — a terrific company for sure — but rated one notch below AAA which just printed a three year 8bp over mid-swaps. So I’d argue there is a value proposition that incorporates the element of illiquidity.

Mierau, Pimco: Often times, we can swap into covereds without giving up more than a few basis points. With premia as compressed as it currently is across the credit risk spectrum, swapping into dollar covereds is a no-brainer from a risk-reward standpoint.

The thing is, many US investors are not familiar or comfortable investing in the asset class and supply tends to be sporadic due to low involvement from domestic issuers. Secondary liquidity in the dollar segment is thus symptomatic of the developing nature of the asset class.

Denger, MEAG: I can more or less underline what Kristion is saying, plus there is this lack of liquidity in dollar covereds. We don’t invest much in dollar covered bonds and we mainly hedge back into euros so our investment decision always depends on the hedging costs, which we decide on a case-by-case basis.

For US investors covered bonds still don’t seem to be the preferred product in terms of investments. Several US issuers proposed a US covered bond law to make the product more popular with US investors, but that failed.

To spur growth in dollar covered bonds you would need to have some domestic issuer interest and you’d need to have regular benchmark issuance. So when you put all these things together, for us it’s not that interesting. But mainly that’s due to its very low liquidity. But if you could get more liquidity in the market I think it could become more interesting, especially if the hedging costs go your way.

FRNs

Lamy, BNP AM: I definitely believe there’s potential there for the market to grow. We have seen rates going down for the last 20 years, so I guess that’s why people have preferred fixed rate. But with the current yield levels, I believe FRNs are — more than ever — attractive. And if we see supply, I would expect demand.

However, one thing to keep in mind is that covered bond issuers like to issue long-term bonds where a good part of the demand is from insurers who may not like the FRN format but would potentially prefer more 10 year issuance.

Eichert, CA-CIB: In an environment of rising interest rates, FRN covered bonds are a logical option for many investors. For now, however, some of the benchmark FRNs were priced quite aggressively and new issues did not do too well. We also have issues around the documentation and whether they should include explicit interest rate floors at 0%, and the ECB will be increasing haircuts on FRN covered bonds as the central bank will allocate FRN bonds into the maturity bucket that corresponds to the actual maturity rather than placing them into the zero to one year maturity bucket for repo haircut purposes.

Volpicella, Westpac: We have explored FRNs in the UK and US and to some extent we have been reasonably successful. The problem you have in the European market is you’re taking on the risk of a negative spread. You don’t want to go down that path of potentially having to subsidise the trade.

Volpicella, Westpac: Based on all those scenarios some investors could decide to take that risk. In other words, if there is a negative spread environment, they don’t get paid with a floor of zero. That could also entice us to look at the FRN market in euros. But right now what we’re seeing is that there really is stronger depth in the European fixed rate market in covered bonds. But, to the extent you saw inflation and rates pick up and much greater demand for the product, clearly, we’ll look at that very seriously.

Wang, SEB: We have issued FRNs in the past, successfully so, but stopped more than half a year before rates went into negative territory in the eurozone and Sweden. We have therefore been more active on the investment side taking advantage of the cheap or in some cases free interest rate floor option offered.

Right now, I expect rates to gradually rise, so the challenge with negative rates will hopefully go away. But let’s say we would have headed even deeper into negative rates, then having coupons that are floored at zero becomes expensive funding.

Fedon, Crédit Agricole SA: Our covered bond vehicle is mainly backed by assets which are fixed rate and that reflects the fact that the French market is more than 95% fixed rate. As we prefer to have a natural hedge between assets and liabilities it makes far more sense for us to issue fixed rate bonds.

Gotrane, Caffil: That’s correct. More than 60% of the covered bonds that we have issued since 2013 had a maturity of 10 years or more. But we have had a look at the FRN market, which could be interesting in small size, though so far we’ve never been able to issue a decent size. I think it’s still a difficult format and not typically the kind of deal that you can issue.

Wein, LBBW: As Sami says, until now we haven’t seen sufficient demand. Plus, I do not really see us issuing a bond at negative rates.

Denger, MEAG: Currently we prefer fixed-rate format.

Mierau, Pimco: Fixed coupon format is in most cases a better fit for us. The main deterrent for us not being more involved in the FRN market is the comparably poor liquidity which is not compensated for in valuations.

Lamy, BNP AM: Hedge fund and short-term duration — or no duration — managers for one are interested. We see more and more inflows in our non-duration, non-benchmark funds. These investors are keen to buy FRNs. That’s really, at least for us, a very strong trend we have seen with a lot of flows in our funds which are just benchmarked against Eonia. And definitely in this case FRNs are really interesting for us.

Duration

: FRNs are one thing which we would typically see used at the short end but what about duration? What’s the investor view on 10 year duration and longer in the new interest rate environment?

Mierau, Pimco: For covereds, duration is less of a factor than the credit spread term structure. In portfolio structuring we can use a variety of liquid instruments to express or hedge duration.

Denger, MEAG: When we talk about covered bonds with a maturity of 15 or 20 years then I think there’s some remaining demand, but in the private placement format and from specific types of investor. Especially insurance and pension funds need duration for asset liability matching. But overall, interest in longer duration covered bonds has gone down

Lamy, BNP AM: I’m not much interested in the longer-term maturities. And in addition you see that the government bond yield curve is much steeper than the covered bond yield curve. So from a relative value perspective long covered bonds make less sense versus govies. The long end of the covered bond curve is not an area we like.

Gotrane, Caffil: We do not exclude issuing such deals in the future if the market appetite is there. We could have interest to issue even longer than 20 years as this provides a match for our long dated assets. We know the assets really well and they would be the best match with our long term liabilities.

Wein, LBBW: Not really because we’re absolutely driven by the maturity profile of the assets we need to refinance. What we’ve issued so far is a good reflection of our assets. We have very little need to do anything beyond 10 years.

Wang, SEB: We have no appetite beyond 10 years as the actual maturity of our asset side is not long enough to consider going that far out on the curve. We do, however, typically have appetite for duration when using the euro market, since the domestic market has historically been more limited to around the five year point.

Fedon, Crédit Agricole SA: Our funding mix includes various maturities up to 20 years, even if the average duration of mortgages is much shorter. The 20 year was issued on the back of reverse enquiry. In my view, the covered bond spreads would not be at such levels if the ECB were not buying. The 25bp spread was particularly interesting in the 20 year and seemed to be too low not to take advantage of. The opportunity was even better, ahead of the French election, and allowed us to have a fairly good proportion of our long dated funding needs already realised.

Fedon, Crédit Agricole SA: Maybe one day, but certainly not soon. As part of the natural asset and liability management process we monitor very closely the concentration of maturities. The bunching up of maturities on our liability side is something we try to avoid.

Volpicella, Westpac: I wouldn’t say zero but I think we’d probably be more selective in terms of those transactions beyond seven years. We’ve done some quite long-dated covered bonds out to 20 years which shows we don’t exclude those transactions. But what I can say is that the core of our issuance is between five and seven years. Then from time to time, based on some of the opportunities that present themselves, we’ll look at doing longer dated transactions. The issue, for us, is that our assets, even our residential mortgages, more or less have a life of around five years. The longer you go the more you start to create an asset and liability mismatch. So clearly we’re going to be more selective in terms of doing those transactions.

Eichert, CA-CIB: We have seen some very successful long dated covered bond new issues despite the outlook for higher rates. Nonetheless the shorter dated five and seven year deals have tended to do better. Books for five year new issues were on average twice oversubscribed in 2017 compared to only 1.4 times for 10 year and longer deals. The distance between initial price thoughts and the re-offer spread was 1bp larger in five years compared to 10 years and longer, and new issue premiums in the five year were a third of those at the long end.

NSFR / LCR

Volpicella, Westpac: APRA has set out our NSFR requirements which we have comply by January 1st 2018, and it’s fully-loaded on day one. That is pretty much the final standards as to how NSFR will be implemented in Australia.

Volpicella, Westpac: Yes, very much so, and particularly around how covered bonds are treated, as well. As we built into our NSFR requirements we favoured senior over covereds over the last 12 months. So what you have seen over the last 12 months is that our covered bond volume has been slightly less than previous years.

But, once you get over the level of making sure that you’re over the 100% stable funding threshold and also into a substantial buffer, you can get to more of a steady state and you can go back to your normal issuance pattern. So, while I’d say the NSFR has already impacted us, it is mostly behind us now. Going forward we are likely to operate at more of a normal rhythm. There’s probably two or three transactions that we look at between the US and euro market, or roughly A$6bn-A$8bn a year.

Gotrane, Caffil: No. I think that first and foremost the concern of the covered bond community has been taken into account by regulators. Under the regulation proposed by the Europe Commission, issuers of CRR and Ucits-compliant covered bonds may be in a position to treat assets and liabilities as inter-dependent. Obviously there are a few points where the market is waiting for clarification but overall I would not expect NSFR to have a big impact on covered bond issuance for European issuers.

Eichert, CA-CIB: The EC has defined interdependent assets and liabilities very broadly with all U-cits covered bonds being considered inter-dependent. This approach could lead to more covered bond issuance. After all, by encumbering assets in a cover pool they would be taken outside of the scope of the NSFR. Should the definition end up being very strict — in other words only Danes being eligible to be classified as interdependent and encumbered mortgages being treated worse than unencumbered ones — it could actually have a dampening effect on covered bond issuance.

Fedon, Crédit Agricole SA: It’s true that we are still not clear on the NSFR treatment for covered bonds. The balance sheet of our SFH is between €20bn-€25bn but the home loan portfolio is more than €300bn. Given that proportion I don’t think that we would reduce our covered bond issuance by much. Of course, we still have to take into account all impacts once the full details are known and then we will be able to model them accurately.

Wang, SEB: We have already taken the NSFR proposal into account in our funding strategy and have for that reason been relatively more active in senior than covered bond issuance over the past 12 months. The NSFR is important but there are more aspects to our funding strategy than optimizing for NSFR. From a pure NSFR perspective one shouldn’t have necessarily issued covered bonds as senior has been more efficient given the tight spread differential.

Wang, SEB: Swedish issuers are not likely to start issuing MREL qualifying debt before a change of the insolvency legislation in Sweden, probably in late 2018 or early 2019. As you pointed out, this could coincide with end of CBPP3. At that time one could possibly make a case for tighter preferred senior as it will become increasingly rare and may thus continue to tighten versus covered. If such a scenario happens, then optimising for NSFR will for us translate into reduced covered bond issuance.

Still, maintaining the Swedish covered bond market is priority number one as this is our most important term funding instrument. Therefore from a strategic point of view we will always issue some Swedish cover bonds, even if it is, strictly speaking, too expensive versus senior. You could to some extent also make the same case to issue in euros — meaning that we will at least issue sufficient levels to be relevant to investors. But on top of that, optimising the mix with a view to the regulatory frameworks is key.

Denger, MEAG: It will make life more complicated and it may lead us to concentrate on fewer banks than we did before but it’s all quite unclear. We still need to see what banks have in store for us in terms of the type of packages they are going to offer and how granular these packages are. We also still need to see what types of assets under management will be affected by MIFID.

Harmonisation

: When we talk about incoming regulations affecting our market, I am very mindful of the discussion that has been taking place around harmonisation. We have the European Banking Authority proposing changes to the definition of covered bonds in the Capital Requirement Regulation and Ucits. So my question is do you see net benefits to harmonisation?

Wang, SEB: In general I welcome harmonisation but it very much depends on what sort of harmonisation we’re talking about. If harmonisation is implemented on a more voluntary, non-legislative basis based on market best practice it’s a good thing. If harmonisation means that one should have a common EU legislative framework that harmonises all national laws that could lead to conflicts.

The obvious issue is with national insolvency and resolution regimes. I’m not convinced that harmonisation will give the same end result in all jurisdictions. We could have some unintended consequences, if there is harmonisation for harmonisation’s sake. The top priority will be to ensure that the covered bond remains a safe investment and that is our real concern.

Eichert, CA-CIB: The approach by the EBA and EC seems sensible in my view. The European Parliament’s own initiative report contained a few strange ideas but the details will be fleshed out by the EC. It will require changes to the frameworks in virtually all countries and potentially slightly increase the cost of running covered bond programmes but the EC does not want to distort a market that is working well.

Mierau, Pimco: Theoretically it would be a good thing because then we could rely less on models to differentiate valuations which are limited by transparency and subjective assumptions on implications of structural difference in legislative frameworks.

Of course there may be exceptions where standardisation may arguably weaken certain investor protections specific to individual jurisdictions. If we take Spain for example, the statutory minimum over-collateralisation is 25% for mortgages and 42.9% for public loans which is substantially higher than all other jurisdictions.

Lamy, BNP AM: I think the proposals definitely make sense and especially on the maturity side. It seems that there’s a real differentiation from the proposals between hard bullet, soft bullet and conditional pass-through. Currently we don’t have any price differentiation between a hard and soft bullet.

In some cases it’s not really clear what the event would be that could lead to an extension of the maturity of the covered bonds. An extension may happen not just because there is a default of the bank, it could be something else. It seems that the proposals that have been made on harmonisation will bring through more clarity on what would trigger the maturity extension.

Mierau, Pimco: Arnaud makes a good point. Evaluating different structures of programmes is probably one of the most difficult things for investors to wrap their arms around. You have SPVs, on-balance sheet structures and now a multitude of maturity profiles such as the soft bullet and conditional pass-throughs. From an implementation standpoint, these sorts of features are going to be difficult and costly to harmonise. Thus, I wouldn’t expect harmonisation to be major game-changer for investors or issuers.

Wein, LBBW: I can’t really foresee any major changes right now. Plus, at the end of the day, these would need to be reflected in a legal amendment to the German law which I don’t see happening for the time being. I do not believe that for the time being we will see much of a change.

Fedon, Crédit Agricole SA: Since a new covered bond directive was first talked about we’ve been saying that the existing French and European market works very well. We already have a specific controller and many regulations which, in our mind, protect the investors and have a very good function. We don’t see the need for a change with the soft bullet and we have lobbied to make our position understood. We think that the EBA have heard us and we think that the final position will be close to what is already in place. The intention is to regulate the soft bullet a little, but in a way that we could accommodate.

Gotrane, Caffil: Our programme is hard bullet and I believe there is benefit to clarifying circumstances for a soft bullet extension. But in the end we prefer to keep a hard bullet as, even though it may be less efficient, we strongly believe that when CBPP3 ends there will be more price differentiation between hard and soft bullet than there is today.

Volpicella, Westpac: I’d say there is always merit in harmonising everything that you practically can. But I think the difficulty you have is that sometimes it depends how far people want to go and sometimes that becomes sort of an aspirational target. You’ve got different types of mortgages written in different jurisdictions, with different programme documents under different jurisdictional law, with different regulatory and legislative requirements and drafted by different lawyers.

So, there is always going to be a limit in terms of what you can or can’t harmonise to a pragmatic or a reasonable level. The issue that we have from the Australian issuers’ perspective is that most of the regulators ignore non-European issuers. We comply with every element of the ECB’s requirements, except our assets sit outside Europe and we can’t change that. So my concern is that when things go down the harmonisation route non-European issuers will become an afterthought, or just not thought about. Then as a result of some technical issue we just don’t comply.

Eichert, CA-CIB: In my view, harmonisation would be quite a positive thing for third country covered bonds as it would give the EC a basis to assess equivalence and possibly grant them equal regulatory treatment to European covered bonds.

Volpicella, Westpac: Absolutely.

Volpicella, Westpac: I find it perplexing in a way because it really does show how far you can skew the market away from your pure credit fundamentals. Where we sit here today we don’t qualify for ECB repo eligibility and we’ve got a more harsh treatment in respect of the risk weights allocated to our assets and, clearly, don’t directly partake in the covered bond purchase programme.

If I was looking through an investor’s lens, clearly one of the key values you’d get is the diversification that Australia provides as the assets are sitting outside Europe. But on top of that the rating we have is AAA, but whether it stays there or moves to AA+ going forward, it is one of the highest in the world. The issuing banks have among the highest standalone ratings in the world, we have a very stable government, legal framework and our covered bonds are AAA.

Volpicella, Westpac: Adversely. People are not deciding against buying our covered bonds based on quality or diversification features but because they can’t tick certain boxes and say that it qualifies for a level one liquid asset or its repo eligible. But what is really scary from an investor’s view is that a BBB-rated regional bank in Europe could issue a tighter spread than us simply because European initiatives have skewed investments away from pure credit fundamentals.

Volpicella, Westpac: It is not up to us to go to the regulators, they won’t listen to us. It is up to investors themselves to offer a groundswell of support and ask for us to be compliant with the broader regulations in Europe. If they really want to truly access the Australian market and add more diversification into their books then it’s probably warranted that we at least have similar treatment as European issuers.

Eichert, CA-CIB: I am quite certain that we could have an equivalence regime whereby the commission allows for third country covered bonds to be given equal treatment if they fulfil a number of criteria. The bigger problem for the Aussies however is the lack of ECB repo eligibility and as far as that goes we have not seen any comments or positive signs from the ECB unfortunately.

ESNs

: The other thing that we’ve seen on the harmonisation debate is that there is now a clear differentiation between traditional mortgage and public sector assets on the one side, and then on the other side pretty much any other asset you care to mention potentially being used for European Secured Notes. Does this approach make sense?

Eichert, CA-CIB: Whether ESNs take off will largely depend on how they are treated by regulators going forward. The EC is talking about incorporating them into the covered bond directive while the European Parliament is essentially proposing to create a whole new regulatory category for ESN but not giving them much preferential treatment over senior unsecured debt.

Denger, MEAG: The big question is what is the ultimate goal of the European Commission? Do they want to harmonise the existing covered bond market, which means setting hard boundaries on the types of cover asset, or do they want to open up the covered bond market to many types of collateral such as SME loans?

With EBA’s idea you could have covered bonds backed more or less by any kind of collateral. This would be supportive for, say, SME-backed covered bonds but would make it less obvious why one would need the term ‘ESN’ in the first place.

If you look at other proposals which are going more in the direction of harmonising and ring-fencing the existing covered bond world, then all the other types of collateral would need to be written into a new directive for the European Secured Notes.

Which one of the two would eventually be more supportive for the evolution of a market backed by non-traditional cover assets is hard to say at this point. It of course depends on how the precise regulatory treatment in frameworks such as the LCR will be for, say, SME-backed covered bonds or ESNs.

Denger, MEAG: It depends on the price. There are good reasons why SME-backed covered bonds should trade with a good premium compared to covered bonds backed by preferred mortgage loans or public sector loans. SMEs are different in many ways compared to old style covered bond collateral. Analysing SMEs is different and much more time-consuming. It was previously done by our ABS colleagues who used to buy at different spread levels. Therefore our investment decision would strongly depend on the premium offered by SME backed covered bonds and of course the quality of the collateral.

Lamy, BNP AM: If SMEs go into covered bonds we would definitely have no interest at all but if they go into ESNs then yes we would definitely look at it. The focus we would need to make would be on the concentration risk in the pool and we would need to have a very large number of loans with very little concentration risk. In general with the SME pools you have, say, the top 10 obligors representing 15%-20% of the pool, in this case, that would be an issue. But otherwise if we can get the data and analyse it and we feel there is a low concentration risk then we would definitely look at it, yes.

Mierau, Pimco: Given covered bonds’ inherent risk mitigating features such as dual recourse, simple structure and priority claim to segregated assets, sure, an SME covered bond could be appealing to the investor. The benefit to the investor could be the way an SME covered bond behaves in terms of its volatility characteristics.

Introducing dual recourse lowers default probability and potential loss severities thus covered bonds typically have low betas to oscillations in market risk appetite. Thus an SME covered bond could translate into a high Sharpe Ratio for investors. And for investors with the resources and know-how to evaluate individual deals, the introduction of this new asset type may present an opportunity to be compensated for providing price discovery and liquidity.

Green

: Another asset where we have seen a lot of talk but so far not much product is green covered bonds. What’s holding the market back?

Wein, LBBW: I think there is a good potential in that market but I think the potential can only come into play if spread differentiation comes into play as well. That is currently not the case but once differentiation does takes place then I could well imagine that the relative value of green covereds, both for investors and for issuers, becomes a lot more relevant.

Wein, LBBW: Absolutely, yes. There are certain investor bases that actually need to buy that product, so if you have a green mandate and assets are scarce then obviously I would expect potential for them to price tighter.

Wang, SEB: I am positive on the idea of green covered bonds and expect the market to develop gradually. Being one of the pioneers in the green bond market, SEB has chosen to put our efforts into creating a dark green framework of which we have issued a senior unsecured green bond from so far. Further development of that infrastructure has been more important to us in increasing climate awareness than developing a green covered bond at this time.

On the covered bond side, standardisation will be one of the major issues. So in principle I’m positive to green covered bonds as a vehicle in order to promote sustainability into the real estate sector, but there are several challenges. One is the definition of greenness which requires standardisation. There have been examples of using EU building codes, but we feel that will not be good enough.

The other thing to mention is that issuance of senior unsecured green bonds has taken place at the same time as investors have been setting up dedicated green funds, i.e. to some extent, as a direct response to investors’ demand. On the green covered bond side there hasn’t been the same pressure or focus from dedicated green bond funds. Possibly the reason for less interest can be found in the very low yield levels we are experiencing.

Wang, SEB: Yes, I would expect this to come about. But I also hope that the standards will be set in a properly green and responsible manner, and that the market doesn’t turn out to become like a light green edition. That would not be what we would like to see.

Fedon, Crédit Agricole SA: I think that green covered bonds is an important topic for the market and for our group and it’s something that we’re currently looking at. But we are not ready yet and have not taken a decision. Nevertheless, I definitely consider that it is favourable to have a growing number of issues in green and socially responsible bonds. The major advantage for us is that you have a specific investor focus for the green product.

Volpicella, Westpac: What’s holding the green covered bond market back a bit is that you’ve got to set up a programme and have assets that sit within it. There are a lot of implementation costs and on the other side you don’t know for sure whether there is a deep and liquid market for what you’re going to be issuing.

Right now, I think it’s probably more likely that we would issue in the senior unsecured green market, mainly because you can be a little bit more nimble in terms of what assets you’re funding. With a covered bond market there’s additional constraints. It would be very hard to work out what qualifies as a green residential property. Then you need a bunch of mortgages to put into a pool and segregate from everything else.

But once you see more and more precedent transactions that could be replicated in the Australian context, then I think it would become an easier decision. Right now we would wait for more to happen before piling in, and in the meantime focus on the senior unsecured green bonds.

Gotrane, Caffil: We have not taken any decision but we have seen deals in the market backed by green buildings and social housing. Our portfolio is made of loans to local authorities and public hospitals and we will in coming months start to assess the potential to issue green or social covered bonds. Clearly the fact that we are lending to the healthcare sector is something which is a key advantage.

Gotrane, Caffil: We have analysed the investor base of some recent agency deals and it is quite different so in terms of diversification it's clearly a good opportunity.

Gotrane, Caffil: It’s worthwhile. The cost is not really huge so it is not really a key element in our decision process. At this time no decision has been taken but obviously you have seen that the French sovereign has issued a green bond. That gives a good signal to all the French agencies like us, and we have the assets.

Eichert, CA-CIB: For now, we only have one green covered bond issuer — Berlin Hyp with the others focussing on social and sustainable programmes. The main issue for now has been the problem of how to identify and verify ‘green’ assets when we are talking about residential mortgage pools with thousands of individual loans. Berlin Hyp used larger volume commercial mortgages to reduce the workload here. Should the ECBC succeed with their green mortgage project, this could be a starting point for green covered bond issuance.

Lamy, BNP AM: If issuers do not have enough green assets at the end of the day you will have to fill the gap with non-green assets and that may be an issue for the development of the market. You have to be sure that you have a lot of assets at any time to make sure you can issue a covered bond.

Green ESN

: If the European Commission is serious about promoting European Secured Notes, do you believe there could be potential for green ESNs?

Lamy, BNP AM: We strongly believe that there will be a new type of asset which will come onto the market in the future which would be a green secured bond, maybe not on the back of a specific, dedicated mortgage loan like covered bonds are today. But it could be a bank issuing bonds secured on other types of green loans or a corporate such as a utility that gives security on a wind farm or any other really green asset.

We strongly believe that this could help the green bond market a lot, though not strictly the green mortgage covered bond, but the green bond market overall because it could help borrowers to lower the spread compared to senior unsecured.

Lamy, BNP AM: Exactly, a green dual recourse instrument secured both on the banks or corporates, and either on a green cover pool of loans or secured on the cashflow of real assets such as windfarms or something similar. We think that such deals will offer an advantage for the issuer because they will price at a tighter spread as you have the issuer’s guarantee as well as the security, which means it will potentially also have a better rating.

Lamy, BNP AM: There are a lot of folks saying that the regulator should favour the green bond market by assigning a lower capital requirement for bank investors. But I don’t see the point of doing that if there is no difference between a green unsecured bond and any other unsecured bond in terms of actual risk. But if you have a green secured bond where there is a real difference in terms of risk, then maybe the regulators could look at potentially giving it an advantage like covered bonds have.

So for me you have a lot of advantages for this kind of bond, both on the issuer and investor sides, especially when you keep in mind the potential for spread differentiation between the green secured bond and the brown unsecured bond in terms of funding cost.

New markets

: Growth of the green market is still all about the potential which contrasts somewhat with the recent developments we have seen in new markets such as, for example, Poland. But the problem is the challenge in getting to a €500m benchmark size which could be a problem no?

Denger, MEAG: For large investments we clearly prefer benchmark sizes but I wouldn't rule out buying sub-benchmark. Again, as with the dollar market, liquidity is much lower with this type of asset. With the countries themselves, the political system and the political structure is very important. Let’s take Turkey for example. It’s not just the bank itself but the cover pool that’s going to be potentially affected by the socio-political landscape. This is the main driver for the position or not to invest in Turkey, which we are currently not invested in.

Denger, MEAG: I think we would rather hold back.

Mierau, Pimco: The Turkish covered bond that came last year was from one of the smaller names in the Turkish banking complex. It would be interesting to see one of the stronger names launch a covered bond programme. Although the macro-political backdrop is likely to remain a key factor for investment decisions in Turkey for the foreseeable future.

Mierau, Pimco: Singapore is a good example of the benefits of growing diversity of the asset class. From a fundamental standpoint you can pretty much tick all the boxes with Singapore covered bonds. For an EM country, the political/legal backdrop is relatively sanguine and the sovereign, banking, and consumer balance sheets are pretty much in order. So from a bottom-up and top-down standpoint, valuations have been compelling and the bonds have been a good diversifier in our portfolios.

Mierau, Pimco: There are some obvious political tensions which are concerning and warrant close monitoring but this is nothing new for Korea. In general, as diversity of covered bond jurisdictions increases, geopolitical considerations will play an increasing role in assessing relative valuations.

Lamy, BNP AM: Yes, for a lot of our funds there are some restrictions in terms of countries. They have to be within the OECD which would limit a lot the potential investments in new markets. Investments outside the OECD would be much more for our emerging market team than for our standard euro covered bond team.

Denger, MEAG: We are in general open to invest in most countries but it would depend on the spread and the macro-political situation. We can rely on the analysis of our emerging market team that are actively covering these countries and therefore I think, in general, emerging market covered bonds can offer nice opportunities to diversify the portfolio if the price and risk is adequate.

Brexit

: Talking of risks, what do we think of Brexit?

Lamy, BNP AM: I don’t think there will be a strong issue with the cover pool and overall with the banks themselves. But I believe spreads will widen a bit, the widening being limited by the lack if issuance.

Mierau, Pimco: We don't see a material impact at this point on recovery rates in the cover pool or have heightened concerns about viability of UK banks. There’s still tail Brexit scenarios with negative investment implications but there’s a lot of moving parts and it’s really too early to assess what the outcome will be. There’s currently not much additional compensation in UK covered bonds for negative outcomes thus you have to be somewhat of an optimist to be invested in them.

So the question to me is whether the market is pricing correctly. Going back to the earlier discussion, I would say differentiation is definitely not there. All things being considered, I don’t think those risks are priced in.

Mierau, Pimco: You would need some type of a regulatory implication where banks, who are the largest investor in the segment, have an incentive to either sell or become less involved in future issuance.