Africa Bonds

-

Anglo American, the South African mining company now headquartered in London, returned to the sterling bond market after an 11 year absence on Wednesday, the day after an upgrade by Standard & Poor’s to BBB (stable), and two days after a parallel raise by Moody’s.

-

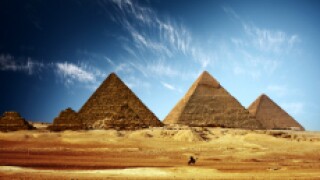

Egypt’s triple tranche $4bn bond drew a huge book of over $19.5bn on Tuesday in a deal that bankers away from the mandate said was a huge success, underscoring the phenomenal market conditions available to issuers.

-

Middle East issuers are expected in the bond market in droves, with Egypt and Mashreqbank leading the charge this week.

-

The Arab Republic of Egypt has released initial price guidance for its triple tranche bond at levels that have caught investors’ attention. A large deal is expected.

-

Renaissiance Capital has hired a new vice president of financial services research at its branch in Cairo.

-

The hopes of emerging markets participants proved well founded on Wednesday when US Federal Reserve chair Jerome Powell pulled back from the aggressive trajectory of rate hikes previously promised.

-

The Middle East and North Africa region will provide a large chunk of emerging market bond supply in 2019, investors said this week. The region provides excellent value, in spite of fluctuations in the oil price.

-

Georges Elhedery will be moving from Dubai to London in order to take up a new role as head of global markets at HSBC. He replaces Thibaut de Roux, who reportedly left in September after an accusation of inappropriate conduct.

-

CDC, a development financial institution, has hired a former regional head of global banking at Standard Chartered to mobilise investment in developing countries.

-

Egypt is revamping its capital markets presence, lining up a debut in the green bond market, a first deal in an Asian currency, and dollar and euro benchmarks all by the end of its fiscal year in June.

-

Renaissance Capital has hired a former Morgan Stanley managing director to the roles of chairman of the board of directors for South Africa and head of investment banking for Africa. The hire marks the latest development in the bank’s push into Africa.