Covered Bonds

-

Toronto-Dominion has mandated leads and announced initial price thoughts for its first benchmark US dollar covered bond under Canadian legislation.

-

The Spanish housing market has started to stabilise as the fall in the value of repossessions has steadied, and house prices have begun to rise for the first time in seven years, according to a report published by Fitch on Thursday.

-

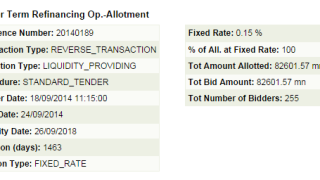

The ECB announced it has allotted €82.6bn to 255 banks in the first targeted long term refinancing operation (TLTRO) — a figure far below consensus expectations from eurozone economists. While the impact on covered bond secondary markets is likely to be marginal, the news could have positive implications for primary supply, analysts told The Cover on Tuesday morning.

-

Royal Bank of Canada returned to the dollar covered bond market for the first time this year, issuing the third benchmark in that currency this month. The $1.75bn deal priced at 27bp over mid-swaps, making it the equal largest this year and tightest in dollars for several years.

-

Danske Bank opened books on Wednesday on a triple-A rated five year euro benchmark, its second euro deal of the year coming soon after its seven year sterling transaction early last week. A solid book build blew away Tuesday’s concern that a soft credit market and a series of upcoming potentially disruptive events may have turned the deal sour.

-

Münchener Hypothekenbank (Muhyp) has priced the first covered bond backed by environmental and social governance (ESG) mortgage loans. The €300m deal attracted a rich new seam of demand from investors that had never bought covered bonds from this issuer, in a move that is expected to spur other borrowers to consider ESG covered bond deals of their own.

-

Proposed changes to Danish mortgage regulation could reduce credit risk in Danish covered bond pools, potentially leading to lower target credit enhancement, said Standard and Poor’s (S&P) on Wednesday.

-

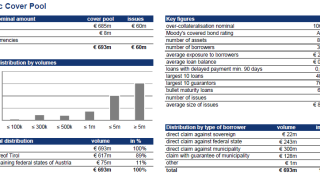

Hypo Tirol has mandated leads to roadshow its inaugural syndicated €300m public sector backed Pfandbrief starting this week.

-

Despite two mandate announcements on Tuesday, event risk will keep supply well below last week’s booming level, bankers and traders told The Cover on Tuesday morning.

-

Danske Bank has mandated leads for a five year euro benchmark, its third benchmark this year and second in euros. The deal is expected to be launched on Wednesday.

-

Royal Bank of Canada (RBC) mandated and launched the fifth US dollar covered bond benchmark of the year on Tuesday. The issuer followed the lead of Bank of Nova Scotia which priced the first US dollar denominated Canadian covered bond a fortnight ago.

-

La Caisse Centrale Desjardins du Quebec (CCDJ) has hired Barclays, Crédit Agricole and DZ Bank to organise a series of European investor meetings for its second euro covered bond.