Covered Bonds

-

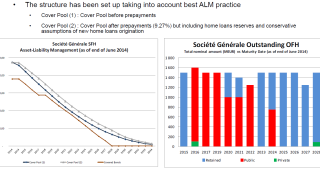

Société Générale issued and retained over €5bn of covered bonds, spread over eight deals with maturities between six and 15 years on Monday. The supply provides contingency backstop liquidity for the bank, and forms a normal part of its liquidity management activity.

-

The mortgage cover pool backing Aareal Bank’s Pfandbriefe is expected to grow by roughly a fifth following its integration with the assets originated by Corealcredit, according to Commerzbank research analysts. The German exposure will rise, as will the proportion of residential loans.

-

UniCredit Czech Republic and Slovakia has returned to the covered bond market after first roadshowing in November. The bank has mandated two leads this time round and will be hoping to capture an international investor base with the first covered bond to be backed by a mix of Czech and Slovakian mortgages.

-

Sparebanken Vest Boligkreditt priced the first Norwegian covered bond of 2015 flat to its existing curve on Wednesday. The deal illustrates that rare issuers from core regions are still able to get superb execution despite the more skittish tone in credit markets lately.

-

KBC priced its second €1bn covered bond of the year on Wednesday, this time opting for a 2021 which fits neatly into the borrower’s maturity profile and dips into mid-swaps negative territory for the first time. The deal also priced almost flat to its curve.

-

Van Lanschot Bankiers printed its inaugural conditional passthrough covered bond on Tuesday. A good quality book and a well flagged deal helped the issuer price flat to NIBC’s recent trade. Bankers said it paid a minimum market entry premium to make a successful debut.

-

The issuance of longer dated covered bonds in the first quarter compared to any other time in the past four years is credit positive according to Moody’s. This is because longer dated supply reduces the mismatch between assets and liabilities and lowers the probability of a fire sale, said the agency on Monday.

-

The covered bond primary market is expected to maintain momentum on Wednesday as books for the first deal from Norway and the third from Belgium are expected to open.

-

Van Lanschot Bankiers is expected to open books on Tuesday for its inaugural conditional pass through covered bond. The first Norwegian deal of the year could be announced soon. Meanwhile Berlin Hyp is on the road with its Green covered bond.

-

Nationwide Building Society is continuing its funding run after already setting a strong precedent in 2014. The bank has priced its first sterling covered bond of 2015 following an earlier euro covered bond, a multi currency RMBS and two senior deals issued this year.

-

Northern Rock Asset Management (NRAM) announced on Monday that it expects a meeting, to be held in relation to a previously announced covered bond tender offer, to be quorate.

-

Structured finance and covered bond issuers hoping their deals will escape the waves of downgrades likely to hit the European banking system have had one of their routes out of the bind closed by Fitch. The agency, which could downgrade a third of European banks this year, is consulting on proposals which could effectively block issuers from including “rating removal language” in their deals, by stopping these deals reaching a triple-A rating.