Russia

-

In late 2016 a clutch of Russian borrowers shrugged off Western sanctions and domestic stagnation to return to the global bond markets. But will investors’ returning appetite for Russian risk survive a global repricing? Lucy Fitzgeorge-Parker reports

-

China and Russia are forging ahead with closer financial market ties, with the Moscow Exchange (Moex) and Shanghai Stock Exchange (SSE) looking to facilitate two-way investments between the countries. This comes as the Russian ministry of finance is still finalising plans for the first RMB-denominated bond to be issued in Russia.

-

Alfa-Bank defied low pre-Christmas liquidity levels to print a $300m increase of its AT1 that was sold to a greater proportion of international investors than the original October print, according to a lead banker.

-

Gazprom plans to borrow $4.7bn in external debt next year, it said in its 2017 budget.

-

Russia’s Alfa-Bank re-opened its $400m Basel III additional tier one trade on Tuesday morning, marketing the perpetual note at 8%.

-

Russia’s Alfa-Bank is planning a tap of its additional tier one securities and will open books on Tuesday this week, according to the leads. As the deal was sold mostly to Russian domestic investors, there are not the usual concerns about pre-Christmas liquidity.

-

It’s that time of year when analysts dust off their crystal balls and make predictions for the next 12 months. In December 2015 not many were forecasting that Britain would vote to leave the EU, and even fewer were betting on a Donald Trump presidential victory, so investors would be wise to treat such missives with caution. Political risk is a capricious beast, even for the most seasoned market observers.

-

Russia is planning to launch its first renminbi denominated bond on the Moscow Exchange in early 2017.

-

Having issued twice in the Eurobond markets last month, Russia's Gazprom has turned its attentions to the loan market with an €800m four year deal.

-

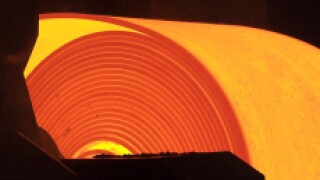

Vladimir Lisin, the Russian billionaire, has sold a 1.5% stake in Novolipetsk Steel (NLMK), the Russian steel producer he controls, for $156m, through an accelerated bookbuild launched on Thursday night.

-

Plans for a loan to fund the €10.5bn purchase of a 19.5% stake in Russian oil company Rosneft by a consortium of Glencore and the Qatar Investment Authority, announced on Thursday, have left loans bankers in Europe baffled. It is not clear whether it will be syndicated or supplied by only one lender, and there are suggestions that domestic Russian lenders could provide the funding.

-

The identity of the bank arranging a loan to fund the privatisation of Russian oil company Rosneft has loans bankers in Europe baffled, which suggests domestic lenders will provide the funding.