Covered Bonds

-

◆ New deal offers half the spread of the last one ◆ Investors pile into rare trade's book ◆ Pick up provided over govvies

-

◆ South Korean lender enters sterling for the first time ◆ Spread move the biggest in 18 months ◆ Deal lands flat to fair value and euros

-

◆ Higher spread deals from established jurisdictions attract demand ◆ RLB Steiermark returns after more than two years away ◆ No premium needed for CCF's third of 2025

-

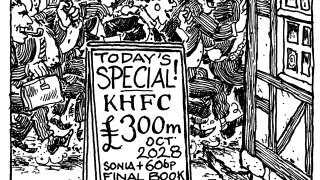

◆ No premium needed for 'well-funded' name ◆ Final book the biggest in four weeks ◆ Deal attracts strong asset manager bid

-

◆ Demand sticky despite tight spread ◆ Next to no concession offered ◆ Pick-up to SSAs not a concern

-

Spread convergence between EU and non-EU covered bonds will take time, but is expected

-

◆ Dutch bank takes €1.5bn at four years ◆ Little resistance to pricing through 20bp ◆ Sticky book allows for tight final level

-

◆ Belgian bank deal attracts biggest book of week so far ◆ Deal bid 2bp tighter, through fair value post-pricing ◆ Treasury accounts drive Wüstenrot bid

-

◆ Maybank gathers sticky, high quality demand ◆ No premium needed ◆ Prima prices tight

-

Regulator in favour of equivalence in long awaited report

-

-

◆ Post-Seville conference pipeline builds ◆ Traffic jam possible but ample liquidity is there ◆ Kookmin takes €600m at four years