Asia's private banking clients are a hard lot to please. Many are entrepreneurial, accustomed to building their own businesses and handling their own money. But growing wealth makes the region an attractive market for private banking businesses. Asia is the fastest growing region in high net worth wealth management, but the opportunity remains immense. An estimated 80% of high net worth wealth in Asia is not under professional management.

Given the potential, private banking has become an enormously competitive market in Asia, with a mix of global and local banks as well as pure-play Swiss-style private banks vying for business.

The pool of talented private bankers who speak the region's languages and understand its varied cultures is shallow, however. Added to that, increasingly stringent regulation has raised the cost of doing business. Banks that succeed have learned to balance customers with relatively high-risk appetites — it’s not uncommon to hear of customers who demand returns of 10% or more.

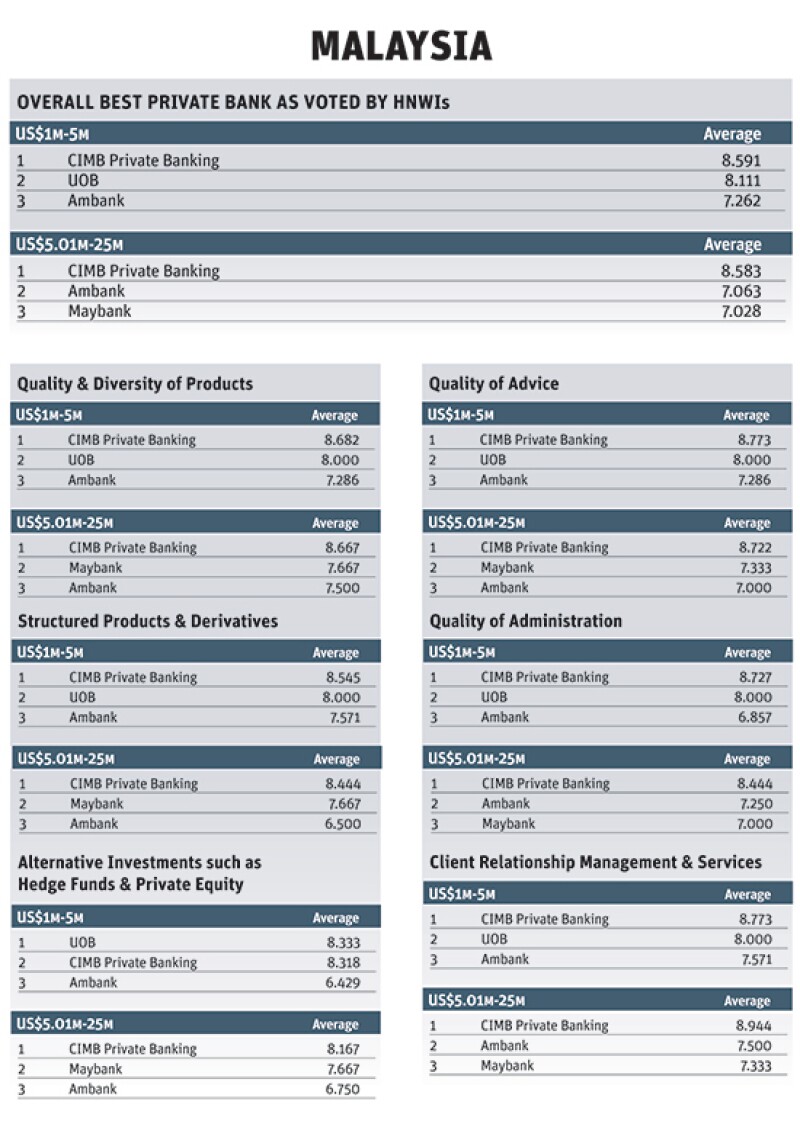

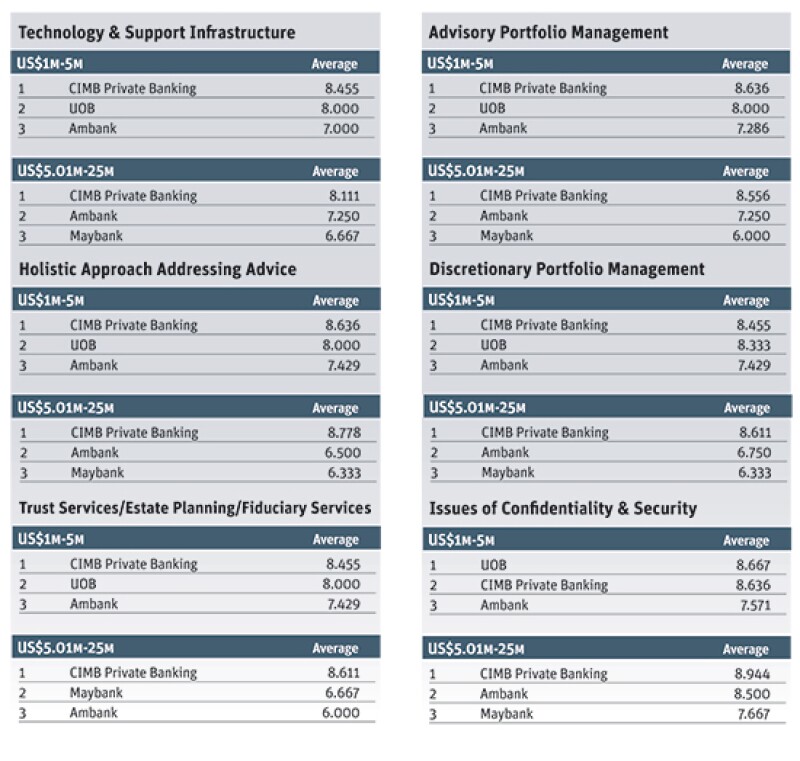

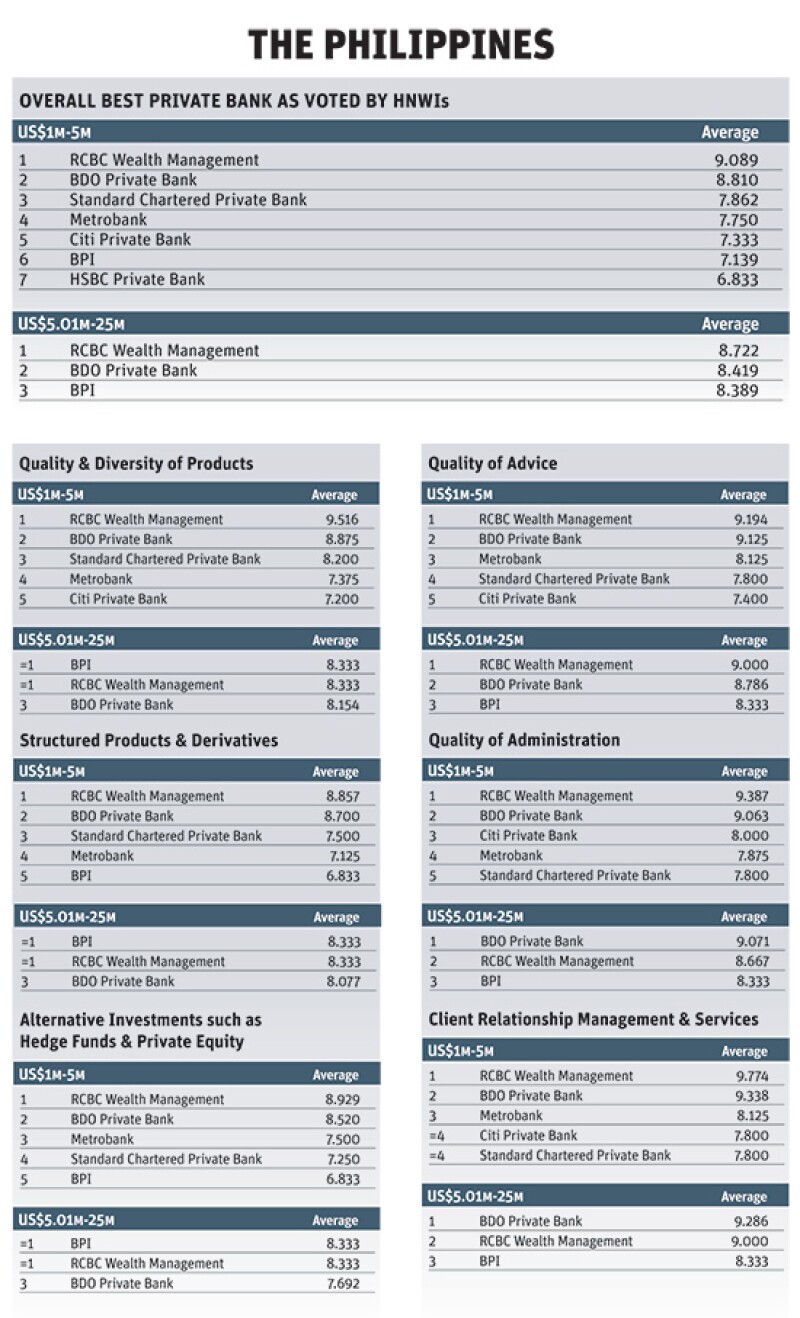

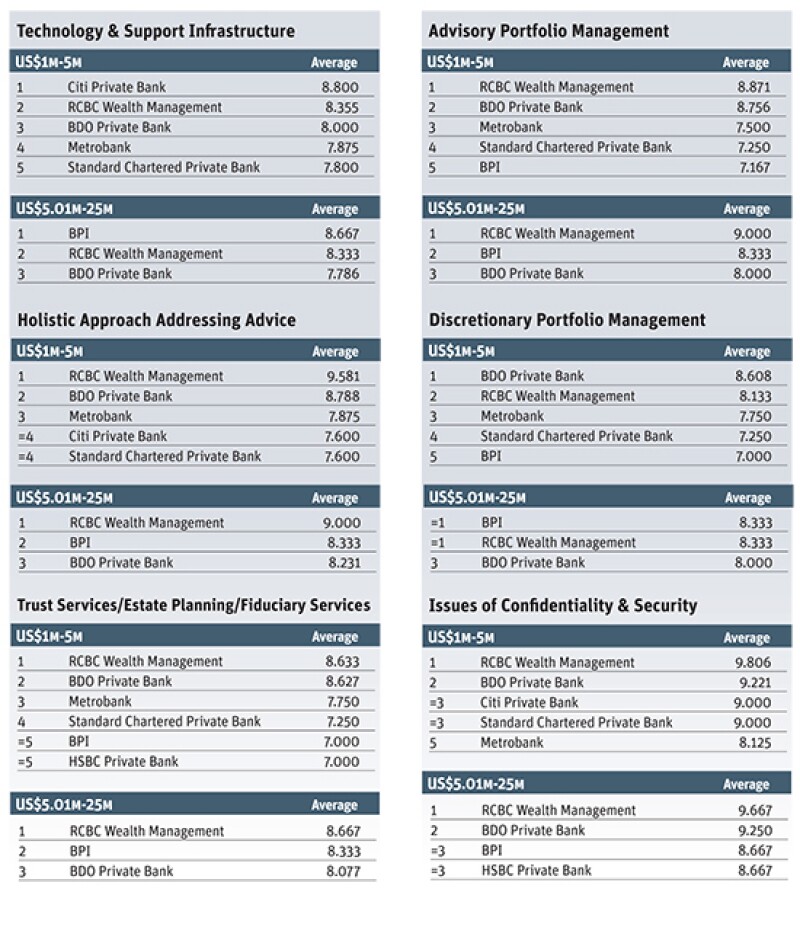

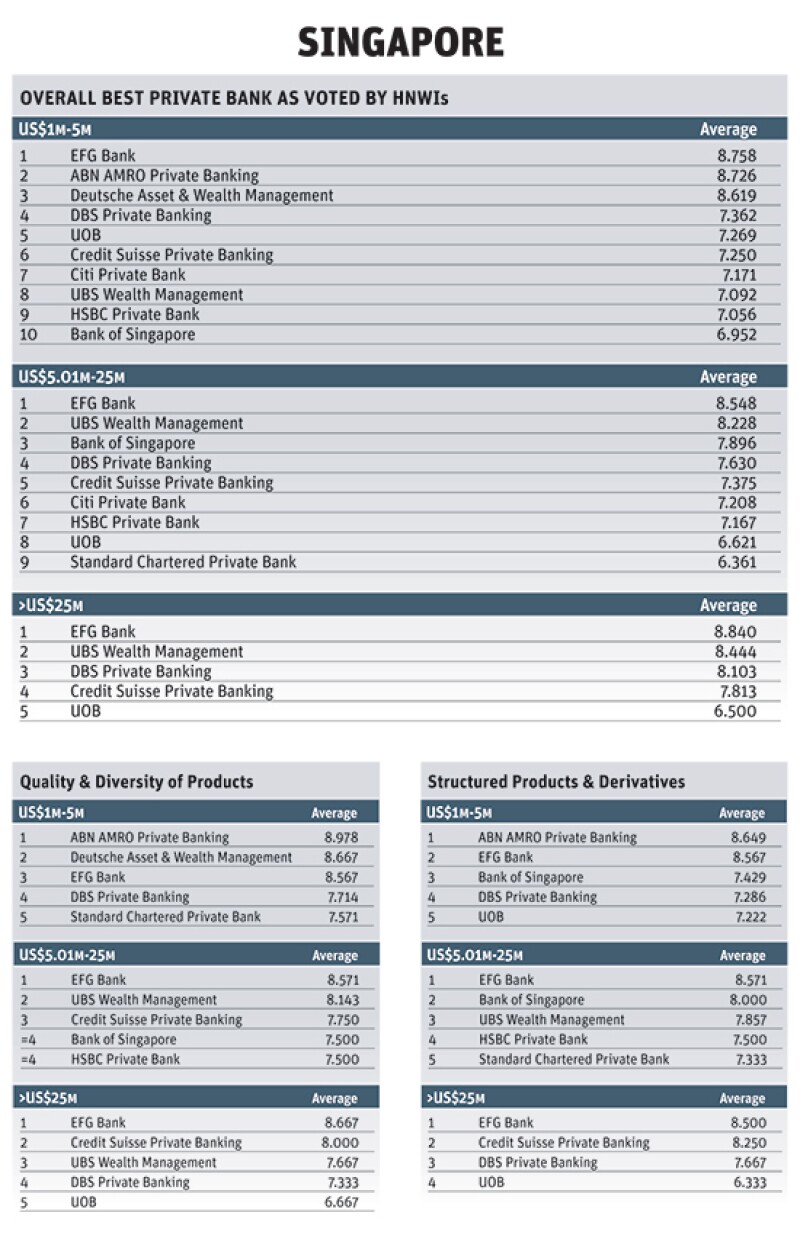

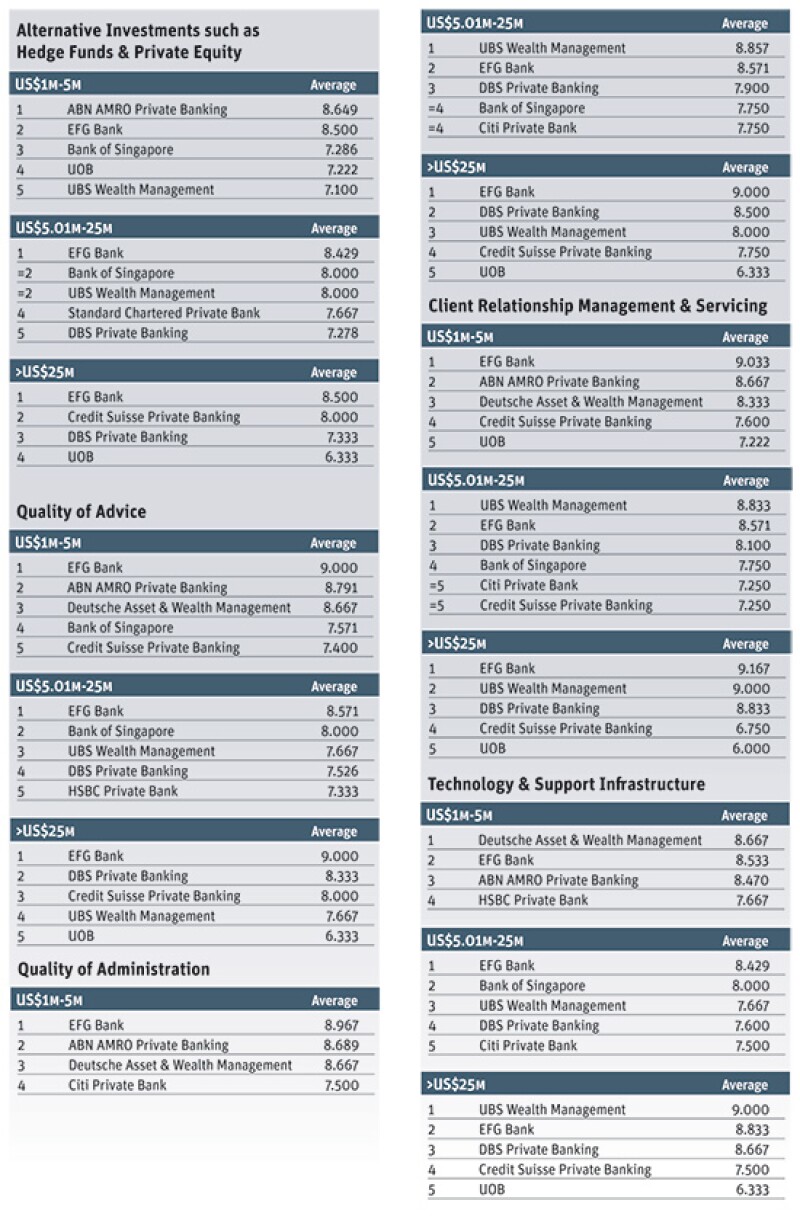

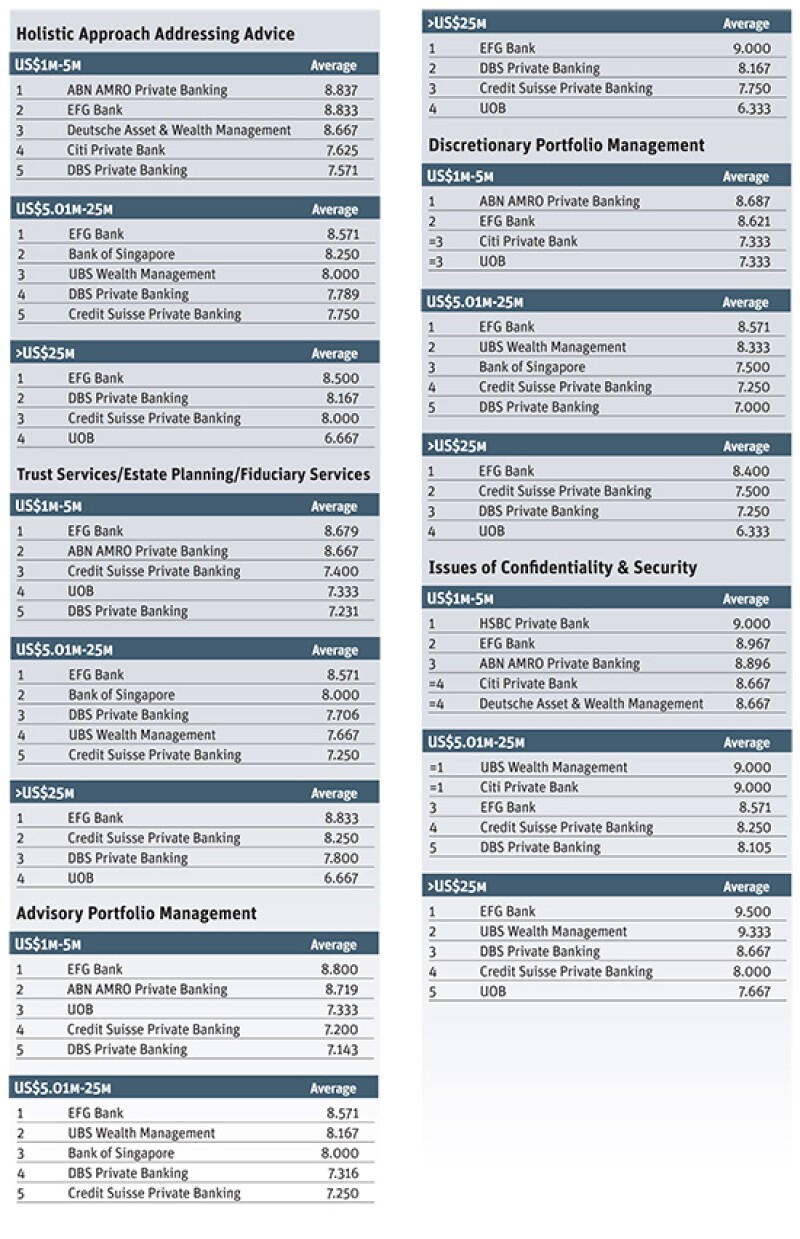

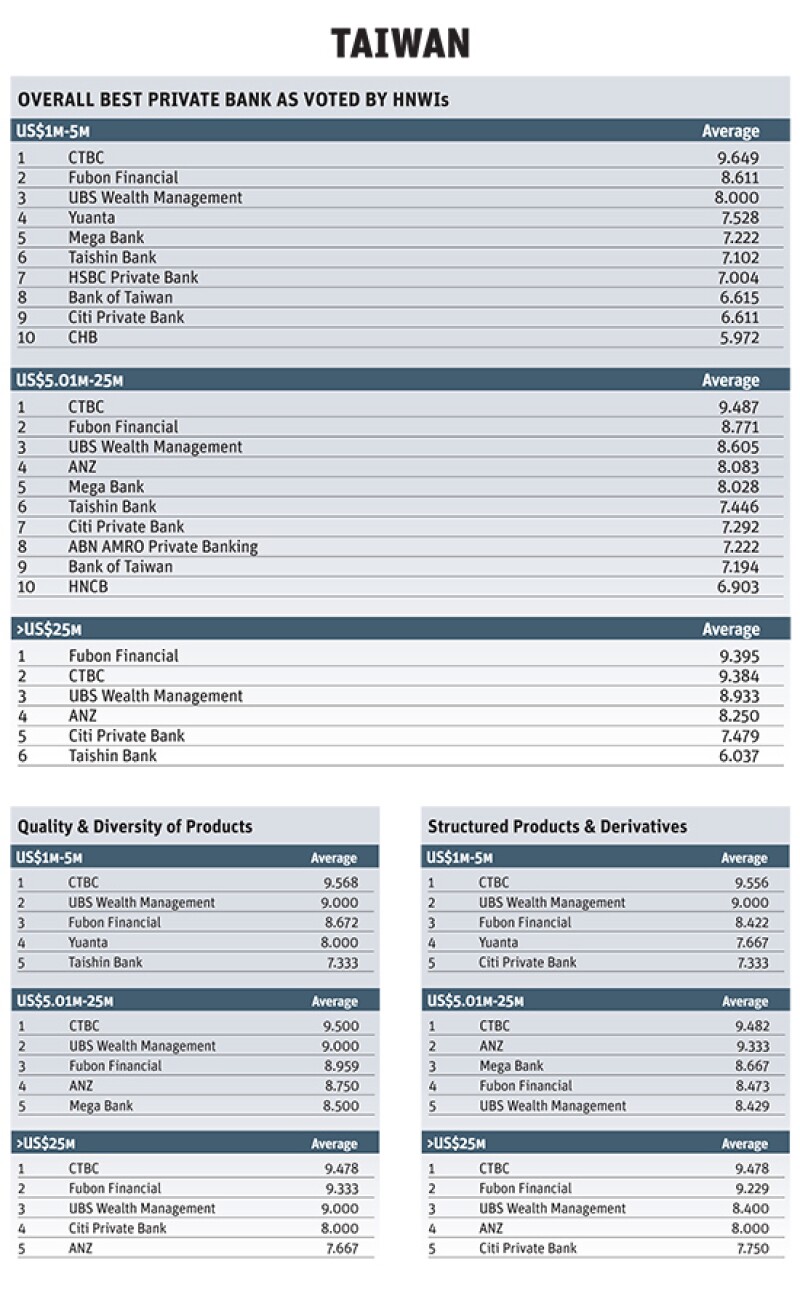

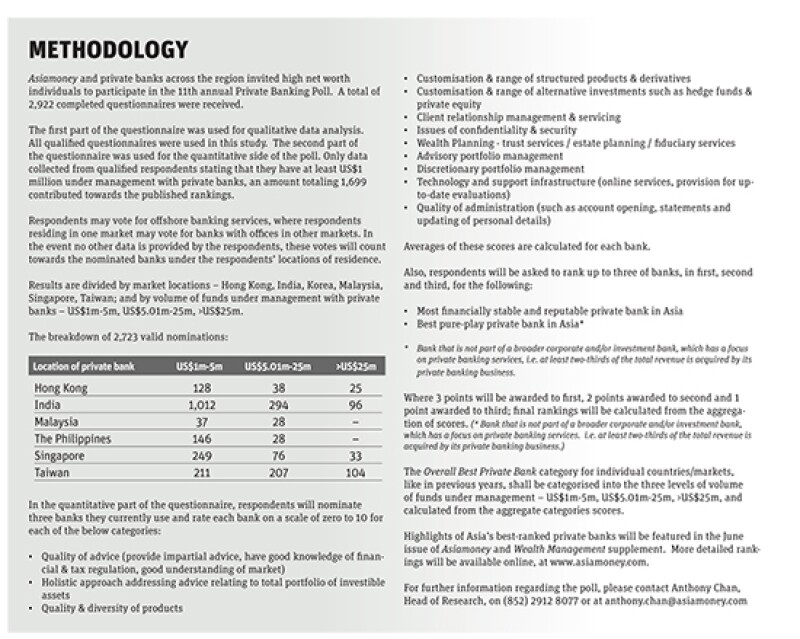

Coming out on top in this year’s Asiamoney Private Banking Poll were EFG Bank and UBS Wealth Management. We received 2,922 responses from high net worth individuals in the region between February and April. Respondents were divided into three categories: HNWIs with $1m-$5m in assets under management, those with $5.01m-$25m and ultra high net worth individuals with more than $25m in assets.

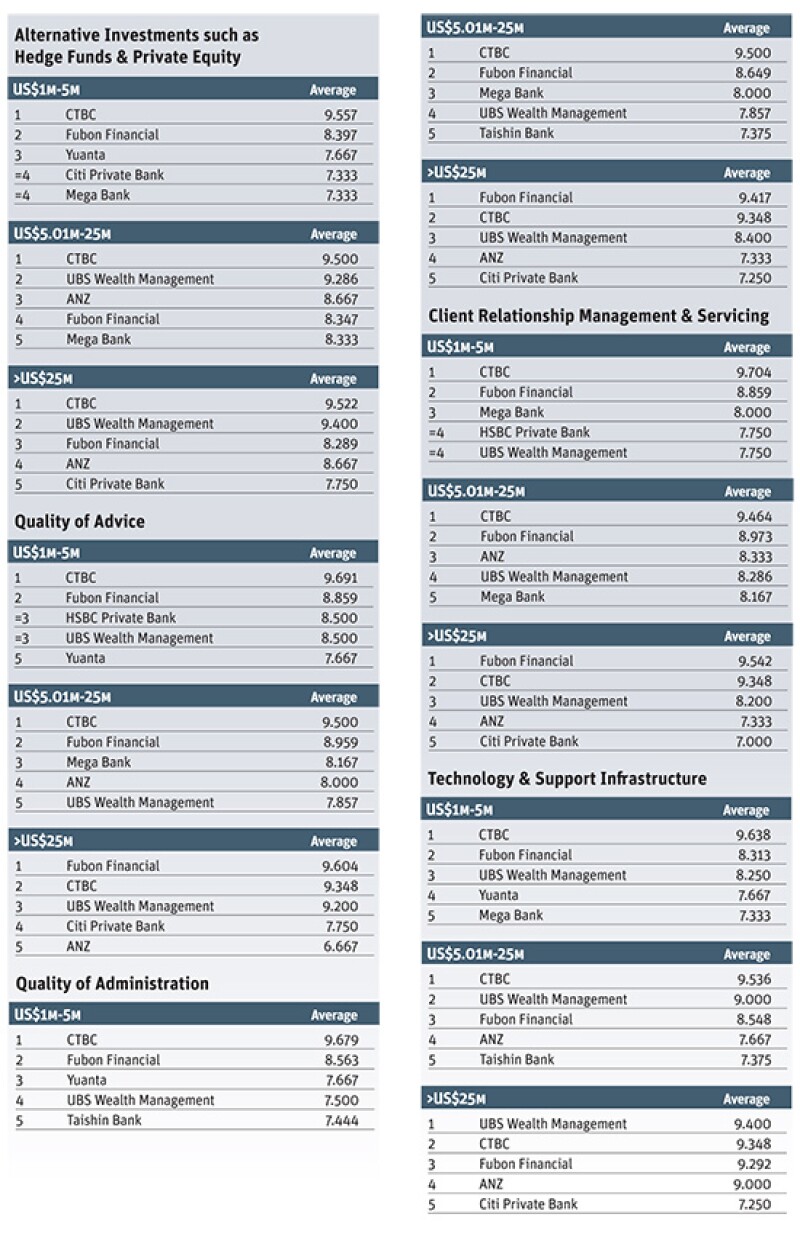

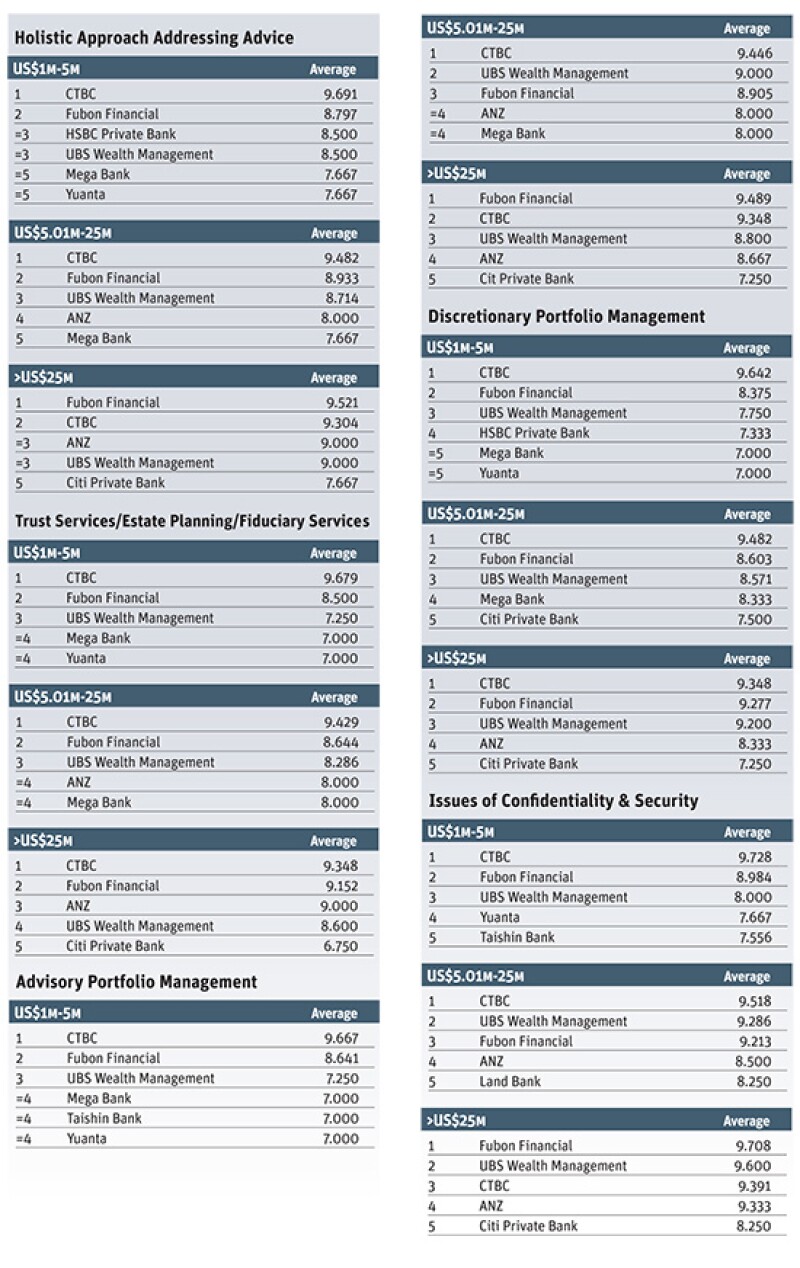

Participants rated banks on categories such as quality of advice, holistic approach, confidentiality, technology and support, using a scale of zero to ten. Participants were also asked to rank up to three banks for the title of best pure-play private bank in Asia, as well as the most financially stable and reputable private bank in Asia.

EFG plays up consistency

This year, as in 2014, EFG garnered top spots in the $1m to $5m and the $5.01m to $25m categories. Albert Chiu, chief executive of EFG Bank in Asia, attributes the bank’s success to its consistent focus on private banking as well as its stable of experienced private bankers who speak local languages and understand local cultures.

“Although we have a very strong Swiss heritage we are also quite Asian in a way," he says. "This is a huge advantage in understanding our clients.” Chiu notes that the bank hires mostly only career private bankers who have developed trust with clients, and then “we support them by providing best-in-class wealth solutions.”

EFG made several big hires last year, including Alvin Ma, the former head of private banking for Citic Private Bank, as its new head of emerging wealth. Based in Hong Kong, Ma has been tasked with growing the bank’s business in North Asia, particularly in China.

Chiu says he has growth in mind. Asia is currently about 20% to 25% of EFG Bank’s global business. He hopes to double that in the next three to five years to make Asia one of the most important areas for the bank.

Acquisitions are likely to be an important part of that growth plan. “There are lots of other private banks struggling,” he says, citing recent sales of Bank of America Merrill Lynch’s non-US private banking operations to Julius Baer, the sale of Société Générale’s Asia private banking arm to DBS and Royal Bank of Scotland’s decision to sell Coutts’ international operation to Union Bancaire Privée.

“I believe we have a very profitable business model and can be a good consolidator in the market,” he says. In particular, he sees an opportunity to acquire other banks or enter into strategic partnerships in high growth markets such as China. EFG bought the Hong Kong branch of Falcon Private Bank last year.

Ultra-wealthy embrace UBS

While EFG’s success comes from its pure-play strategy, others, such as UBS, have done well by leveraging their diverse businesses. UBS has this year again grabbed the top honours among ultra high-net worth clients with more than $25m in assets under management.

Francis Liu, regional market manager for Greater China ultra-high net worth at UBS Wealth Management, says the firm's integrated banking model makes it “well placed to cater not only to personal investment needs but also to work in the best interests of a client’s business and family wealth.”

Asia’s ultra-wealthy are increasingly looking for a one-stop shop that can serve business as well as personal wealth. “With SFr276bn ($298bn) of assets under management in Asia, we have economies of scale that are a clear commercial advantage,” says Liu.

Deutsche Asset & Wealth Management, which placed in the top five best private banks among ultra high net worth clients, argues that it can do very specialised deals involving collateral in multiple jurisdictions and syndicated deals with multiple lenders. It is widely accepted that large global banks have the upper hand over local or boutique firms in such transactions, and can also give clients favourable rates on other services because of their scale.

“The high levels of investment required to set up a wealth management infrastructure are a significant barrier to entry for our competitors,” says UBS’s Liu.

In addition to providing complex solutions, UBS also sees technology as a key area of focus. Liu noted that close to 40% of clients in Asia prefer digital to direct contact with their private banker. That might seem surprising given that high net worth clients are more likely to deal in complex financial deals that are arguably better dealt with face-to-face. But Liu says online information is an important means of putting clients in control.

“Asian clients like to be closely involved in determining portfolio strategy and be the final arbiter when making investments,” says Liu. Many equate hiring a private banker with losing control.

To help clients feel more comfortable with the idea of accepting investment advice and delegating control, UBS has launched a digital platform, UBS Advice, that helps ensure that client portfolios are in line with pre-defined investment objectives. The bank also launched Evolve – the UBS Centre for Design Thinking and Innovation in Singapore, a group focused on developing new products such as UBS Advice.

Growth ahead

Despite enormous growth potential in the region, private banks have grappled with high cost-income ratios because of fierce competition, a shallow talent pool, increasingly stringent regulatory requirements and a customer mindset that prefers to handle their own money. Asia’s cost-income ratio averages about 80%, according to a report by AT Kearney — a solid 10%-20% above the European average.

The report also found that most in the industry don’t think current cost-income ratios are sustainable. Industry insiders anticipate more consolidation to come and for those who stay on will need to streamline costs, work on differentiating and provide solid returns and improved transparency.

“It’s become a hugely competitive market — that drives costs up," says EFG's Chiu. "At the same time regulators are very serious in Asia. They want to make sure investments are being protected. It all adds to costs and that’s why margins are coming down. It’s not easy."

In EFG’s case, being an early mover has been an advantage. The bank has been profitable and uses its earnings to invest in people and its investment platform.

Deutsche says its wealth managers typically have 20 to 25 clients, far below the typical 30 to 80, helping to lower its cost-income ratio. The bank is also reducing costs by consolidating back office operations.

Sticking to a consistent strategy is another advantage, the bank argues. “We’ve been very focused on what we’re good at and not being distracted by or tempted to deal in areas that we do not believe we have the scale or platform to deliver efficiently in that market,” says Mark Smallwood, head of franchise development and strategic initiatives at Deutsche.

As EFG's Chiu points out, that is tougher than it sounds. “It’s never easy. [Some banks may have] underestimated the market or just looked at the headline growth, and think it’s a gold mine."