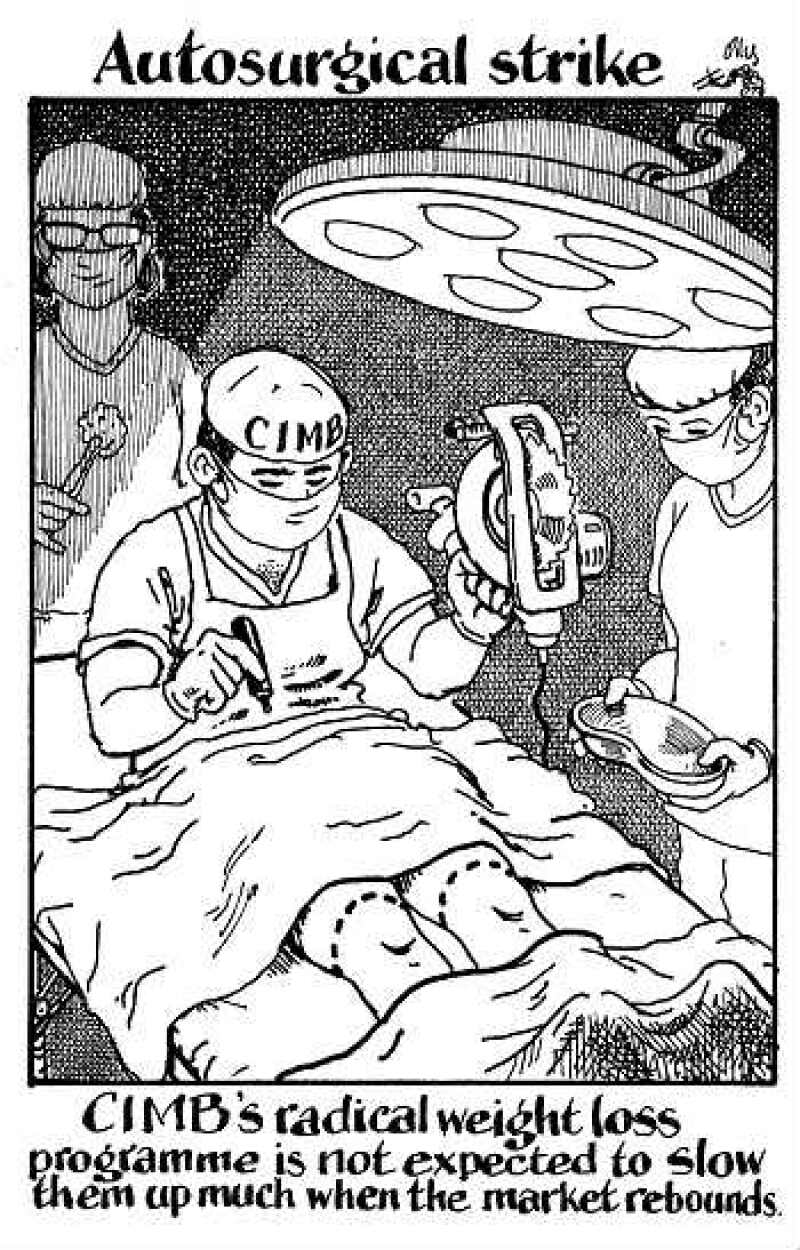

In an attempt to trim costs across its investment banking and equities franchise, CIMB is scaling back in Asia Pacific just three years after it bought the Asian and Australian investment banking assets of Royal Bank of Scotland.

The bank, Malaysia’s second largest by assets, has moved quickly, closing its offices in Sydney and Melbourne on Monday and making 103 jobs redundant. It will look to slash operating costs by about 30% this year, even as investment banking incomes have deteriorated.

These are hard facts to swallow, but CIMB is taking the bitter pill now. It is making cutbacks at a time when the Malaysian capital market undergoes a period of weakness due to the prolonged rout in oil prices — which have halved since the middle of 2014 — hurting the country’s oil-dependent economy.

Despite this, few other local banks are admitting they have a problem. Malaysian investment banks have generally kept their head down as markets get clobbered. In contrast, CIMB is tackling the issue head on.

It is easy to mark CIMB out as a case study for expanding too far, too fast, and having ambitions bigger than it can fulfil. That has proven true in some segments of its business such as Australia, where it has failed to make headway in an over-saturated market.

But the case remains strong for a bank with a regional reach. In 2012, when the opportunity came up for CIMB to buy the investment banking assets off a then-distressed RBS, many praised it as a sound acquisition. The purchase gave it immediate access to an established investment banking footprint across Asia Pacific, a reach that would not have been possible to develop organically in a short time.

This does not change just because of a down-market. In a good year its investment bank makes up 5%-10% of group income, showing the kind of value that CIMB can extract from the franchise. And these are not standalone profits, as the investment bank feeds and cross-sells into other divisions within the bank and across geographies.

CIMB is already highly integrated between its investment bank and non-investment bank segments, so the restructuring will give it extra heft when the market is poised for a rebound.

Its issues with cost are certainly stark. Investment banking overheads have risen 23% year-on-year to MR772m ($216.67m) during the nine months to September, an increase not matched by a growth in income. The investment bank consumed 13% of the group’s total overheads, while generating only 0.6% of group results.

These are the growing pains that accompany expansion. But CIMB has proved in the past that it buckle down in hard times — like in January 2014, when it raised MR3.55bn in new equity in an accelerated bookbuild to beef up its capital ratios.

Markets are volatile and that’s not about to change anytime soon. But having a diverse presence in more than one country means CIMB is better placed than its peers to ride out the current malaise. And that can only be a good thing when the market turns for the better.