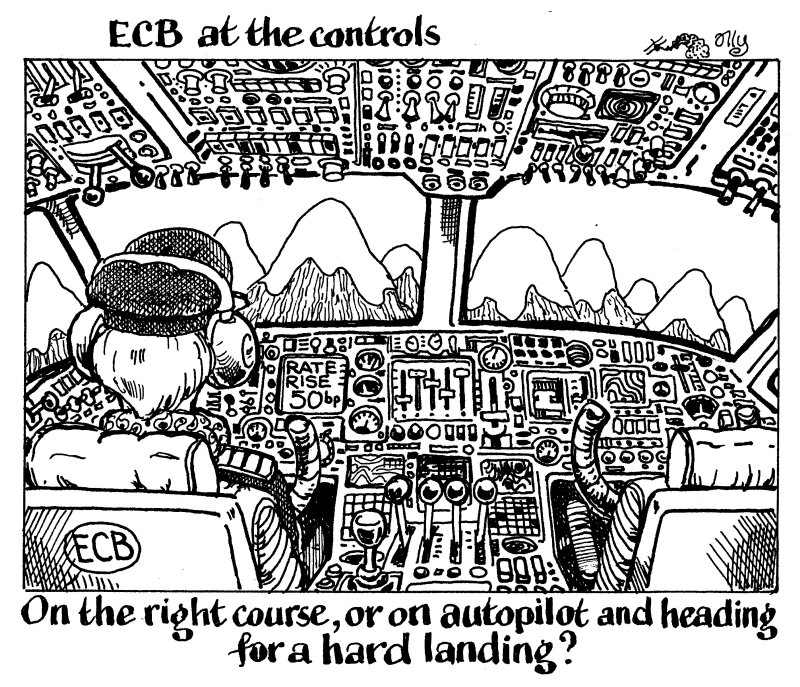

Inflation is projected to remain “too high for too long”, according to the opening statement accompanying Thursday’s 50bp European Central Bank rate rise.

After Silicon Valley Bank’s collapse and the rout in Credit Suisse this week, expectations — or perhaps hopes — for a 25bp move rose.

Detractors are right to point out possible similarities with the policy errors of Jean Claude Trichet, the ECB’s first president, in 2011, when rates were raised twice into the face of an ugly financial crisis.

The impact of additional quantitative tightening and a withdrawal of the Targeted Longer Term Refinancing Operations will not start to be felt until July.

But pandering to calls for a 25bp move could have just as easily inflamed financial stability, had the market interpreted that as an admission of weakness in the banking sector, simultaneously undercutting the ECB’s efforts to tame inflation.

In any case, with no forward guidance, the ECB has given itself plenty of flexibility to change course and adapt to incoming data.

More crucially, unlike 2011, it has a multitude of other policy instruments that are more closely tailored to alleviate financial stability risks, crucially aimed at freeing up liquidity bottlenecks.

Although this week’s events showed just how easily contagion and panic can set in, the European bank sector is, on the whole, better capitalised than that in the US.

It is also better placed to avoid the huge duration mismatch that beset SVB, with Moody’s pointing out this week that a third of European banks’ sovereign bond holdings mature in less than two years.

But ultimately only time will tell whether Thursday’s decision was the right one. If market tension endures and financial conditions tighten, the disinflationary impact of a hard landing will prove detractors right.

It therefore remains to be seen whether the move is founded on confidence in Europe’s financial stability, staying the inflation fighting course — and whether the ECB kept its head when all around it were losing theirs.

Or whether, as the churlish believe, it’s because the ECB is tone deaf, sluggish and on autopilot.