Fuelled by a growing consensus that the ECB’s terminal deposit rate will hit 3% with another 50bp rise in March, appetite for risk has gone from strength to strength with each passing week. This improvement has been felt across most sectors, but covered bonds have missed out.

The market’s renowned ability to provide long dated funding has been scuppered by the inversion of the yield curve and, accordingly, most of this year’s largest, tightest and most successful deals were in the three year sector, where euro swap yields are highest.

Fearful of a failed deal that could close the market, bankers have invariably guided their clients to seek a compromise with a duration slightly shorter than five years. But these deals typically fund a pool of 25 year mortgages, making this tenor far from ideal for borrowers.

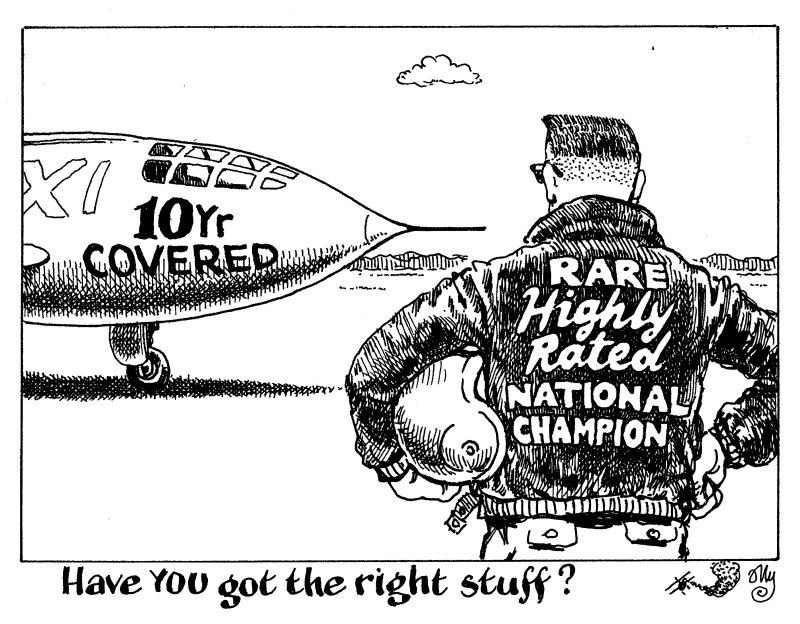

More crucially, the 44bp inversion between the two to five year points on the euro swap curve is more than six times higher than the 7bp inversion between the five and 10 year. In other words, the pain of extending from two to five years is much more than from five to 10 years, a gap that practical minded issuers can and should easily fill — if you are willing to push to five years, you may as well go to 10s.

Financial institutions with designs on the long end should be ready to think more like their supranational peers and compensate investors for the curve inversion. Buyers await those that do.

Tightly priced, small, labelled 10 year Pfandbriefe sold to captive buyers — of the sort a number of issuers have placed in private recently — are not a good guide. But sizeable 10 year bonds from Rabobank and BPCE and have indubitably shown the way forward.

With the path cleared, it is high time others stepped into the breach.