The financial world is at a once-in-a-generation inflection point. A traditional US recession flag rose when the two year/10 year Treasury yield curve briefly inverted on Tuesday. The European Central Bank’s €1.85tr Pandemic Emergency Purchase Programme is finally ending, and where people think US and eurozone interest rates will be at the end of the year is heading higher almost every day.

Meanwhile, there’s a war on between two countries in eastern Europe that is a single mistake away from blowing up into a fully fledged battle between East and West.

Analysts, economists, bond bankers and even journalists are reaching for the textbooks to see what should happen now. Higher rates and then recession would be the classic answer. But that would be to ignore the extraordinary monetary policy conditions we have experienced over the past 10 years that have utterly warped financial markets.

Central banks have changed too. Having spent the past 10 years being socially conscious and printing money by the truckload to support employment and even generate inflation, they are now faced with something their current mindset is ill equipped to deal with. “The irony of still having Draghi’s signature on the bills in my wallet that are losing value by the day,” griped one German contact of GlobalCapital’s this week.

German inflation hit 7.3% year-on-year in March, the highest it has been since 1974, while US inflation hit a 30 year high of 7.9% in February. Supply chains have broken down because of coronavirus lockdowns, Europe’s gas supplier Russia is a pariah, thanks to its president’s reckless invasion of Ukraine, and double digit inflation now looks like a real possibility in the world’s largest economies.

Consider what the world looked like the last time the UK retail price index touched 8.2%, as it did in February. It is March 1991, The Clash are at number one in the music charts, Dances with Wolves inexplicably beat Goodfellas to best picture at the Oscars, and the Bank of England interest rate is 10.5%.

However, now, there is so much debt in the system, the prospect of lifting rates above 3% is enough to make a plethora of analysts warn of financial catastrophe. A rise to 10.5% to try and control inflation, amid a cost of living crisis thanks to the spiralling price of fuel and food, could lead to riots and chaos and prompt politicians to start meddling with hitherto independent central banks.

The link between interest rates and inflation has rarely looked weaker. Monetary policy might be tightening, but at the scale of increases expected over the coming months it will not make a difference to inflation. So, it is hard to see how we will avoid inflation of 10%, wages rising at 3%-5% if we are lucky, and some real pain affecting everyone.

Only if inflation gets seriously out of control over a sustained period will the next phase begin, when central banks will have to take off the velvet gloves and get medieval on interest rates.

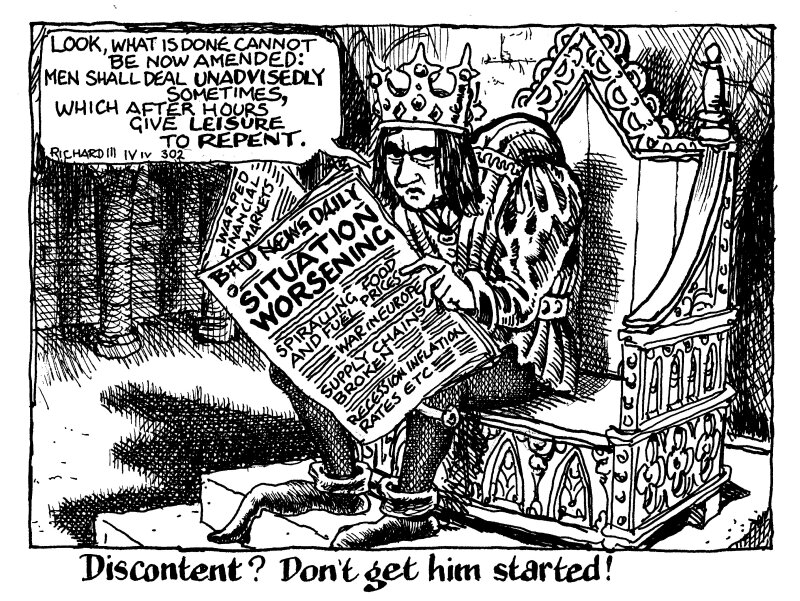

In the meantime, as one financial Richard III told us this week: before we have our Winter of Discontent we will have a Summer of Hate.

Additional reporting by Jon Hay