During the ECB’s monetary policy meeting on Thursday, its president Christine Lagarde made the point many times that its policy decisions were data-driven. The message was clear: it doesn't decide based on personal views but on cold, hard facts.

It was baffling then, that Lagarde could also be opaque about what appear to be obvious facts. She insisted that there was no acceleration of monetary policy tightening underway, right after she said that the bank was planning to end net buying for its Asset Purchase Programme in June, rather than continuing all year as it had flagged a month ago.

The difference between carrying out the February plans to their fullest, or ending the APP net purchases in June, is €180bn. If the ECB doesn't think that counts as accelerated tightening, then it would be fascinating to know what its definition is.

Lagarde has form here. Last month she rejected the idea that spreads had widened significantly, while the BTP-Bund spread was doing exactly that.

And therein lies the problem. By muddling clear facts with semantics, the ECB is making its own messaging opaque.

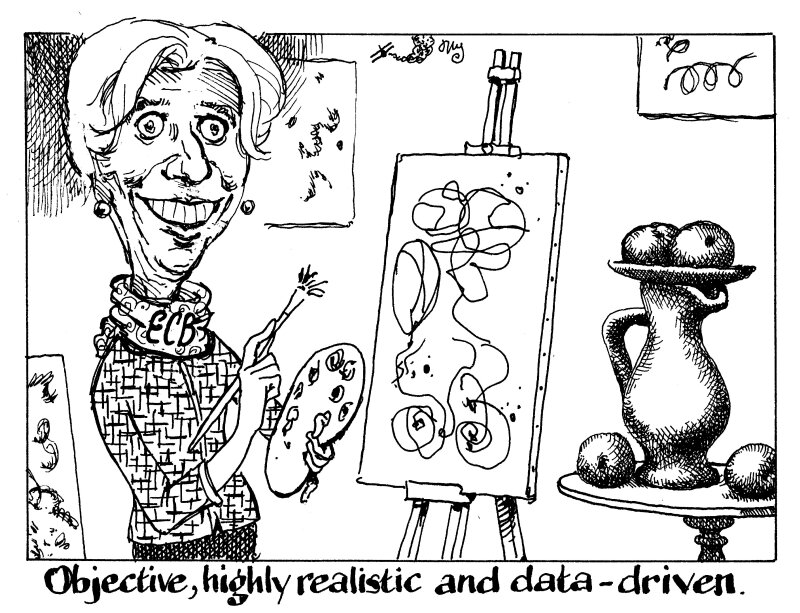

This hurts the market because if the ECB cannot be clear on provable data points then why should anyone take any of its guidance seriously? Guidance is there to guide, not to paint an interpretation of reality that the artist wants the audience to see.

How can a market built on sentiment and trust be expected to function well when its most important institution is engaging in doublespeak?

It is a shame, because the ECB is otherwise doing a sensible job in an almost impossible situation — one where inflation is soaring amid pandemic and war. It could do a better job if it didn’t keep trying to tell us that the sun is shining when we're getting drenched in a downpour.