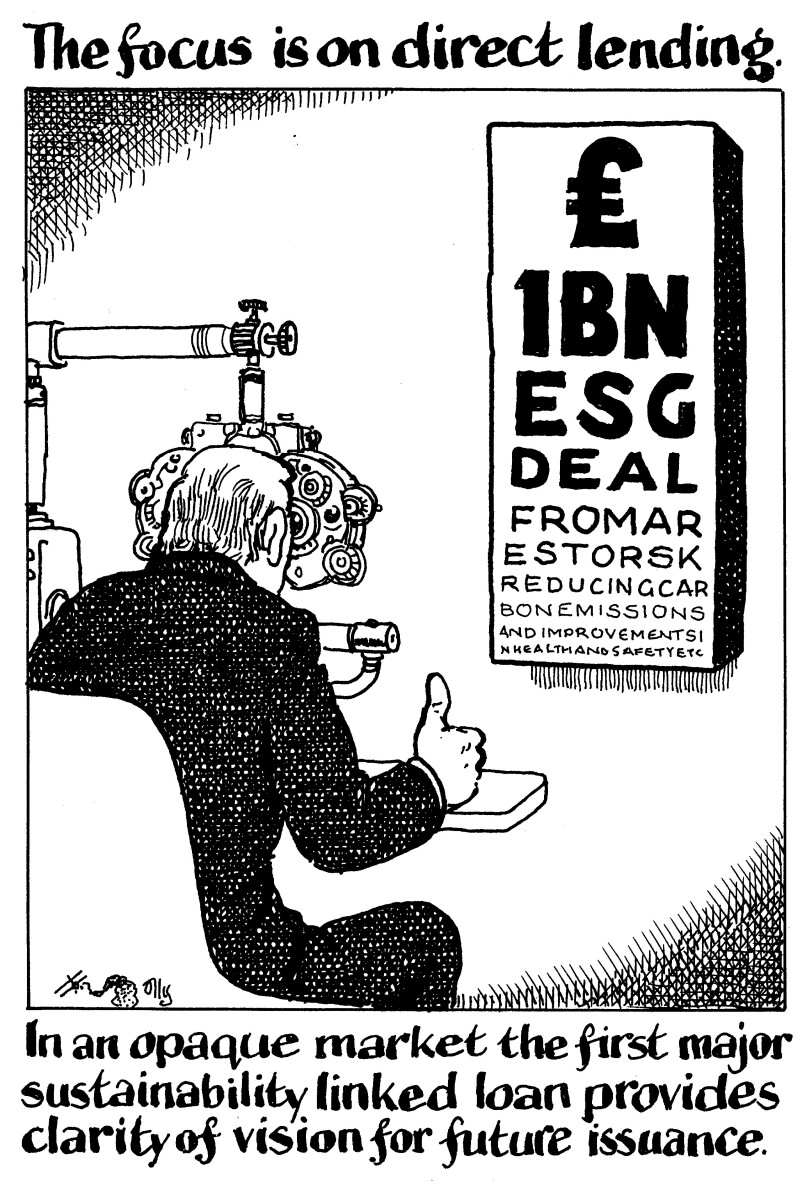

US alternative asset manager Ares has provided UK environmental services group RSK with £1bn in what is the largest sustainability-linked deal yet to hit the global direct lending market. While many believe this is a starting gun for further sustainability-linked issuance, market participants say standards need to evolve to avoid the pitfalls of greenwashing.

Ares is one of the largest direct lenders in Europe, with $42bn of assets under management. Earlier this year, it raised a whopping €11bn for a new European direct lending fund — with €4bn of leverage on top. Its influence on the market is therefore significant, and the £1bn sustainability-linked transaction with RSK may spur follow-on trades from other direct lenders.

“This was a collaborative effort and milestone for both Ares and RSK, as well as the broader private credit industry," said Mike Dennis, co-head of European Credit at Ares Management. "We hope that this financing will serve as a model for others in the industry and we look forward to seeing increased penetration for sustainability-linked financings in our corner of the market. With an ambitious ESG vision, we will continue to seek creative ways to support meaningful progress in our portfolio companies’ sustainability programs.”

Similar to the majority of sustainability-linked loans or bonds, the margins on RSK’s debt will be adjusted up or down based upon the company’s performance on certain key performance indicators.

“The KPIs were developed in partnership with Ares and focus on three broad areas: reductions in carbon intensity and continual improvements in the areas of health and safety and ethics,” Alan Ryder, chief executive of RSK, told GlobalCapital. “RSK has a very well-developed sustainability strategy and a few years ago, we developed a corporate responsibility and sustainability route map to capture our long-term goals and planned actions up to 2025. The route map was the foundation for our discussion on KPIs. It’s based around the UN Sustainable Development Goals and forms a holistic strategy around five pillars which we consider critical to our success.”

The deal will be used to refinance RSK's existing debt. Before the transaction, RSK had a seven year £350m unitranche loan from Ares. Alongside this fresh £1bn, its bank revolver with NatWest has grown from £25m to £40m.

Growing influence

There has been a quiet rise of sustainability-linked deals in direct lending, with firms like Barings and CVC beginning to sign sustainability-linked direct loans last year. However, there has been nothing like the groundswell of transactions seen in the public markets, and before RSK no marquee deals at £1bn plus.

French alternative asset manager Tikehau has some claim for drawing sustainability into private credit. “We pioneered sustainability-linked financing in private debt a while ago,” said Cécile Mayer-Lévi, head of private debt at Tikehau. “This year, it’s a feature we’ve introduced in all our 15 or 16 direct lending transactions. It’s great news that Ares arranged this very large transaction, and it shows the market is opening up sustainability-linked financing.”

Mayer-Lévi said that many companies had become engaged with sustainability because of the margin reduction they could receive if their performance is strong. “The sustainability-linked ratchet has helped trigger a difference in the way mid-market companies understand sustainability. Some perceived filling in all these ESG forms negatively, but now as there’s a reward it’s completely changed and companies have positively embraced this type of monitoring.”

Why the flow of deals has been less pronounced so far in direct lending compared with public bonds may be due to structural disadvantages. As lenders that finance the largely unrated middle market, funds have to conduct a lot of due diligence anyway — and ESG concerns are perhaps understandably lower down the agenda. Also there is little public disclosure of deal terms, which several lenders have said makes it hard to evolve ESG lending conventions.

Up until recently, middle market companies were not well acquainted with ESG issues, and so it was often up to the lender to educate them — which can be a Herculean task. “Sustainable finance is often a big ordeal,” said Mayer-Lévi. “You need to train not just the CEO and the CFO, but the HR departments — as there are several KPIs related to HR — and deal with the operations teams, for information on low carbon and plastics etc.”

However, several market participants have said they have witnessed a sea change among mid-market borrowers. They have noticed a concerted corporate effort to get up to speed with sustainable finance.

“[Borrowers] realise in five to 10 years it could become more challenging for them to borrow money without having a strong ESG record,” said Coralie De Maesschalck, head of CSR and ESG at Kartesia (pictured below). “Last year, I would have said we’d have to help portfolio companies — but today they are already learning by themselves.”

But that does not stop tracking performance being an arduous task. While certain KPIs like diversity in senior management are easy to chart the progress of, others are much trickier. “Our main concern is getting the data — which is often limited,” said De Maesschalck. “We often have limited access to management and as a lender and not a shareholder little influence. Some KPIs, like carbon footprints, are hard to track — most of our companies don’t assess their carbon footprints. Instead, we build up a model based on peer analysis to estimate carbon emissions. We do pro rata analysis based on size and sales, then aggregate at portfolio level and track versus indexes like MSCI.”

It is typically harder to develop standards in private markets. The opacity of each deal means that often participants are not fully aware of transactions they are not part of, while there are fewer industry bodies trumpeting ESG evolution and developing market standards.

Responsible lenders

Mayer-Lévi said direct lenders must therefore be on their guard to maintain standards themselves. The primary task is making sure companies put forward KPIs that are not too easy to achieve. “We’ve seen some KPIs which were too weak, like a criteria saying the company will become a PRI signatory — but they may have done that without the KPI. Some KPIs were kind of obvious. We had a transaction with a software company, where they proposed to have no plastic use cups to drink — we said no, that’s not serious. You need to be careful to make sure it’s pushing the company further otherwise it’s greenwashing and it doesn’t bring anything to the debate.”

However, this rigour that Mayer-Lévi believes the market needs may be challenging.

Floris Hovingh, managing director at Alvarez & Marsall, said: “Lenders are looking to win a deal and put money away with borrowers, and borrowers will go for lenders that offer the best terms. If other lenders don’t set the ESG bar high the other lenders will lose out. In a competitive environment where funds are trying to win business, how are you going to make sure people don’t chip away at the ESG terms?”

Hovingh said there must be some form of standardisation in the market. “Criteria needs to be transparent and easily measurable. Borrowers and lenders need to set ambitious KPI levels otherwise it’s a gimmick.” Others believe that ratchets need to have wider margin differences, and that would be a way for lenders and borrowers to take them seriously.

Heavy adoption

Many see direct lending as the next market to adopt sustainability. Several sources have said investors in direct lending funds have become more interested in ESG-compliant funds, and so naturally portfolio managers will look to position their funds in that direction. While there is broad agreement that sustainable finance will continue to grow in the asset class, some think that it will become more complex in its evolution.

"When we first saw ESG-linked deals they had one or two KPIs with a small discount," said De Maesschalck. "In the future, you can add sustainability improvement plans or you can donate part of the profits to charity. You can start building more complex KPIs. I expect some topics to become more important – like diversity and inclusion — and more impact funds dedicated to different endeavours."