We’re all familiar with the zealots. Cryptocurrency in particular has attracted far more than its fair share. Bitcoin maximalists — those who hope and even expect to live in a world where bitcoin has replaced the dollar, euro and all other currencies — are perhaps the worst offenders, but almost every technological innovation in finance has a flock of adherents who hail it as the most significant advancement since the IOU.

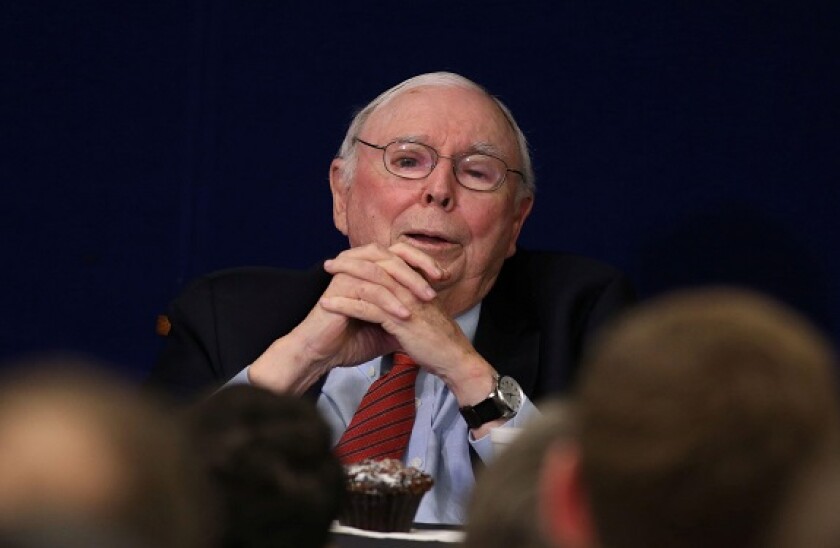

But the cynics are almost as bad. Charlie Munger described bitcoin as “disgusting and contrary to the interest of civilisation” during Berkshire Hathaway's annual shareholder meeting in May. His distaste for financial market disruptors even led him, during a recent interview with CNBC, to praise the Chinese Communist Party for its handling of Jack Ma, founder of Alibaba, when it quashed plans for his company Ant Group’s initial public offering. The commission-free trading app Robinhood, meanwhile, is "beneath contempt".

Although not a cryptocurrency player, Ant’s Alipay has provided digital payments services for 1bn users, many of whom were previously unbanked. It is understandable that the Chinese government might be keen to retain state control over its banking sector, but less clear why Munger is so sympathetic with this aim.

His support for the actions of the Chinese state against a financial innovator and his revulsion towards cryptocurrencies smack of obstinate, blind support for the status quo — the very flaw that technology zealots love to attribute to their opponents.

There are, of course, numerous good reasons to be concerned about the impact of cryptocurrencies and sceptical of the promises of fintech evangelists. For every genuinely revolutionary development, there will be several thousand frauds, failures and things that turned out just not to be that important.

This should not be overlooked, particularly when the zealots have secured so much control over the agenda that what should be mundane questions of database architecture are, thanks to the “blockchain revolution”, deemed to be matters to bring to the attention of senior management.

But it is just as damaging to follow Munger’s lead and treat any disruptive developments, whatever the benefits they may bring, as a threat to civilisation, to be stifled or eradicated at first sight.