Like many countries recovering from the eurozone sovereign debt crisis, Italy is enjoying a resurgence in investor appetite. A return to the dollar market in 2018 — for the first time since September 2010 — should confirm the sovereign’s impressive recent progress, says Maria Cannata, director-general, public debt at the Italian Ministry of Economy and Finance in Rome.

“We have concluded the legal framework on our [credit support annex] agreements for cross-currency swaps with our counterparties,” says Cannata, who had been working on those agreements for some time. “We want to rebuild our dollar curve as we have only two bonds outstanding, one redeeming in 2023 and the other in 2033. After that we can look at other currencies. The second we would consider could be yen, although that would not be for 2018 but the following year.

“Our dollar deal in 2018 will let us reach other investors. We have had some modest inflows from Latin America and the Middle East that had been completely absent until a couple of years ago. This buying action has been in euros but will be greater in dollars.”

Those potential names will add to a list that has grown since last September, with Cannata pointing to “some noticeable new inflow from Asian investors, in particular from Japan but also Korea and other areas in the Far East”.

She adds: “We have continued to see a large presence of the usual UK, US, European and Nordic investors. What is fairly new is the inclusion of Spanish investors and banks. There’s quite a lot of interest now in cross-investing between Spain and Italy.

“First of all there is a regional link, with Spanish banks wanting fewer Bonos and more BTPs. This has also helped institutional investors like insurance companies or asset managers to increase their knowledge of our market, so we are also seeing investment from those sectors. This is because we have similar levels of yields and ratings as Spain so we are a natural alternative of national investment.”

Those additional investors were welcome in 2017, a year when Italy faced a near record level of distributions, including some lumpy periods of big bonds redeeming, such as in November. But 2018 will be smoother.

“We sold a €7.3bn BTP Italia in late November that left us with a strong cash position,” says Cannata. “We didn’t allow a larger placement because we didn’t want to finish the year too abundant in cash. That’s also because 2018 will be less heavy in redemptions than 2017. We also in 2017 reduced the volume of T-bills outstanding, so those redemptions will be lower in 2018 too.

“Apart from finding funds for the intervention in the Italian banking sector, there will be a reduction in net borrowing in 2018. That means 2018 is not a concern in terms of the borrowing requirement.”

Bringing the ratio down

The desire to avoid holding too much cash at year end comes from an effort by Italy to reduce its debt to GDP ratio — at about 130%, one of the highest in the world.

“We are committed to reducing our debt to GDP ratio, so we didn’t want to grow our issuance,” says Cannata. “Instead, we have held buyback and exchange transactions and we are waiting for January for any large, new issuance.”

The increasing interest in Italian sovereign debt has been helped in no small part by the country’s improved economic outlook, even though it still trails some of its peers in Europe.

“Over the course of 2017 there were some positive surprises in terms of growth for Italy, which goes along with the picture we have seen for the eurozone in general,” says Luca Cazzulani, deputy-head of fixed income strategy research at UniCredit in Milan. “We expect the growth environment to remain strong in 2018.”

In September, the Italian Treasury raised its GDP growth estimate for 2017 to 1.5%, up from 1.1% in April, and also increased its 2018 projection to 1.5%, up from 1.0%.

Work to be done

On top of the GDP figures, investors have keenly watched the Italian government’s reform agenda — and seem pleased with the results so far.

“Italy has reformed employment law in the past couple of years,” says Antonio Cavarero, co-head of fixed income at Generali Investments in Milan.

“You could argue whether the government could have done more or reformed in a better way, but things have been improved here and there. Still, there are several outstanding reforms: making the justice mechanism quicker and more efficient; improving energy and transportation; taxes; public administration — there are plenty of angles.”

Some in the Italian market are concerned that the improving economic outlook could take some of the pressure off politicians to finish that remaining work.

“There was some fairly good progress on reforms in 2017,” says UniCredit’s Cazzulani. “Reforms are always an important factor: the more, the better. But one needs to take into account that, given the robust growth environment, the pressure to reform is reduced.”

Much of the reform work could of course be undertaken by a new government, with Italy’s parliament required to hold a general election by no later than May 20 this year, although reports suggest the vote could happen as soon as early March.

Polling in late January 2018 suggested that the centre-right coalition, led by Forza Italia, was ahead on 37%-39%, with the ruling centre-left grouping — with the Democratic Party its main member — behind on 28%-29%. The Five Star Movement, an anti-establishment party formed just a few years ago, was performing best when looking at single parties, on 26%-27%, but is unlikely to gain power on these figures, given that it has no coalition partners.

“The risk from the election is that we have a very long transition before a government is formed,” says Italy’s Cannata. “But this government has performed very well in terms of its implementations over the past year, so the risk may not be so great as this government can continue normally while a new executive forms.”

Investors also believe the risk of a populist party such as the Five Star Movement gaining power has been diminished, thanks in part to an electoral law enacted in October that means those parties that form pre-election coalitions — something Five Star lacks — have a higher chance of victory.

“The elections scheduled for the spring will no doubt be a focus for investors,” says Andrea Iannelli, investment director at Fidelity International in London. “But while the support for populist parties in Italy remains elevated, the recent change to the electoral law should prevent them from gaining substantial power in parliament, even if they receive a large number of votes.

“The market expects some sort of coalition of centrist parties that will diminish the impact the populist members may have. This reduced political risk has contributed towards a more positive tone for Italian assets and risks — bearing in mind the meaningful impact the European Central Bank has had on Italian government bonds and elsewhere.”

Cash cut

That “meaningful” impact from the ECB’s buying programme is likely to change in form in 2018, with its annual purchases halving in January to €30bn and running until at least September.

But, as with the election, investors are confident that Italy will be able to ride out the change in demand.

“Overall there will be less support on aggregate from the ECB in 2018, but the net impact will be less substantial than the headline number because of the reinvestment of redemptions,” says Iannelli. “In 2018, net issuance for Italy is likely to be positive, even when accounting for ECB reinvestments. This contrasts with 2017, when we had negative net issuance, thanks to the ECB purchases.

“Spreads should remain in check — particularly if the current environment of strong economics and minimal political risk persists.”

But the mix of a strong expectation of economic improvement in Italy and the eurozone, the reduction in ECB support and the general election could create some interesting dynamics for Italy’s curve in 2018, says UniCredit’s Cazzulani.

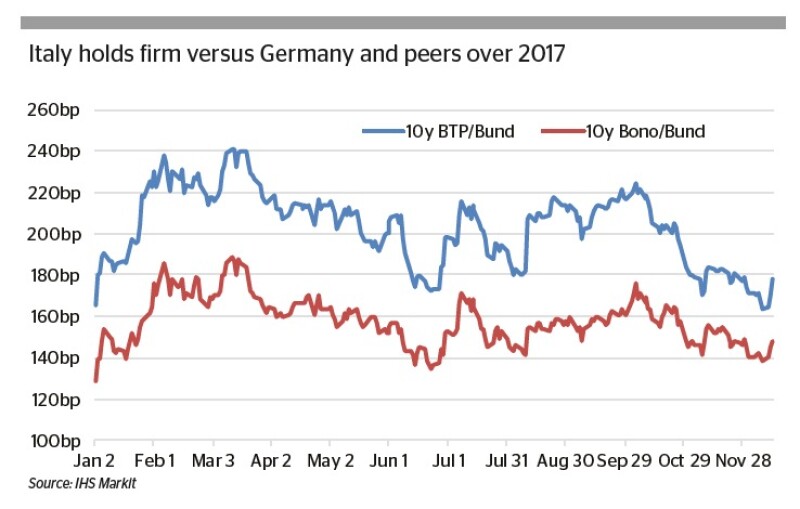

“The behaviour of the BTP curve will be a mix of the credit spread and the performance of the German curve,” he says. “The risk-free curve, the Bund spread, might steepen a bit in the first part of the year then, as we approach the end of 2018 and ECB rate hikes come into focus, we will start to see a bit of bear flattening.”

Rate hikes will start to appear on investors’ radars near the end of the year if the economic improvement holds and the ECB is ready to end quantitative easing and turn its focus to tightening.

BTP yields are likely to move in line with the German curve at the two to three year part of the curve, says Cazzulani, as the spread is “already fairly tight”.

“But the long end of the BTP/Bund spread in particular has room to adjust,” he adds. “Looking at the 10 year, the picture is a little bit complicated because there are two opposing forces in the first quarter. One is the propensity to enter carry trades, which should help compress spreads. On the other hand, as it’s highly likely the Italian general election will be late in the first quarter or very early in the second, the potential volatility could create headwinds for spread tightening, particularly those at already tight levels.

“I would expect spreads to recover in the second and third quarter, then afterwards we will have the issue of how to deal with the post-QE environment.”