Green bonds is a growing sector of the market without doubt. Interest in it is rising at a rapid rate. Banks want to advise on issuers’ green bond frameworks and investors want to publicise their green bond funds or what percentage of their funds are invested in such instruments.

You may believe that these institutions really care about the global environment, our impact on it, and ensuring a better future for it. Green bonds certainly tick those boxes.

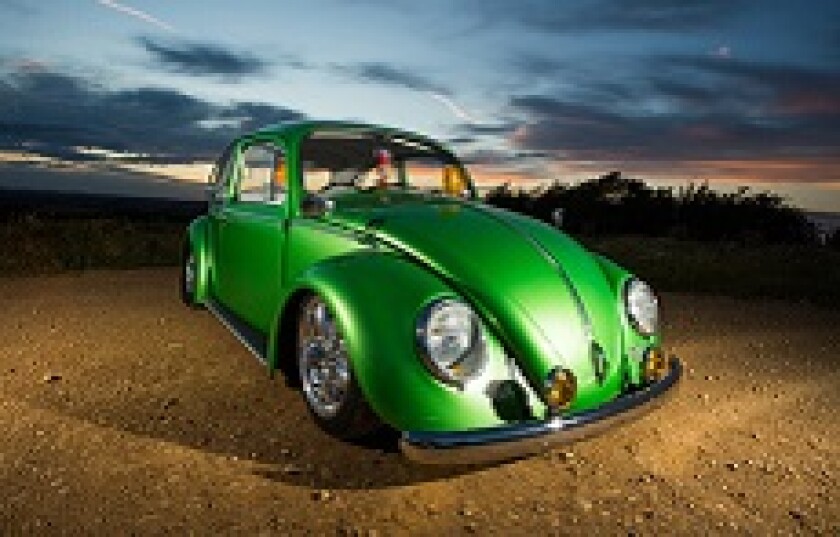

But look beyond the green sector, and which issuer has issued the largest volume of corporate bonds in euros in 2017? Volkswagen. This week the diesel data dodger extended its lead at the top of that league table, having issued €17.25bn of bonds after an 18 month issuance break following the emissions scandal involving its cars.

To put VW’s issuance in context, General Electric and AT&T are the next highest issuers with €8bn and €7bn. After that come BMW, Daimler and Renault, who, when added to VW’s total, push car company bond sales to nearly €35bn in 2017.

Maybe green bonds are the bond market’s equivalent of carbon offsetting for air travel. Buy green bonds to lift your guilt at buying several times more auto bonds.