ABN Amro

-

Additional tier ones have been left behind in a recent rally across European credit markets, leading some analysts to champion the asset class as a rare source of yield.

-

Royal Bam group, the Dutch construction company, has negotiated a waiver on its loan covenants before they were due to be tested this week. Some loans bankers say that similar agreements are expected to be made across multiple industries for the rest of the year.

-

The coronavirus crisis has reshaped many aspects of finance, but not the line-up of top investment banks. It does appear to have pressed some firms into sharp decisions, though.

-

ABN Amro plans to quit corporate banking outside Europe, except for clearing, and also exit trade and commodity finance in a shake-out of its corporate and investment banking activities.

-

A burst of additional tier one (AT1) supply this week showed that financial institutions will be keen to take advantage of every funding window available this summer, despite having made substantial progress on their annual issuance plans.

-

Reports that the European Central Bank (ECB) could ask banks to suspend dividend payments until the end of 2020 sent subordinated debt higher and stocks lower this week.

-

Iberdrola and Copenhagen Infrastructure Partners signed separate loans to develop renewable energy projects in Spain, as analysts say renewable energies are now cheaper for consumers than their fossil fuel counterparts in major markets.

-

De Volksbank said that ambitious sustainability targets played a big role in helping it to attract investor attention this week. The Dutch lender became the first European bank to sell a tier two bond in green format, hot on the heels of the first green additional tier one transaction.

-

Market participants said that de Volksbank was close to sailing through fair value with the pricing on its new tier two on Wednesday, the first such deal in green format from a European bank.

-

Copenhagen Infrastructure Partners, the Danish renewable energy investor, has signed a €380m green loan to finance a wind farm in Spain, as analysts say renewable energies are now cheaper for consumers than their fossil fuel counterparts in major markets.

-

De Volksbank is set to become the first European bank to issue tier two capital in a green bond format.

-

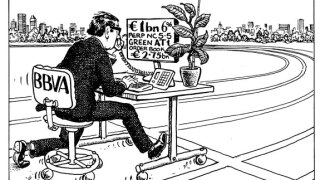

BBVA has become the first bank to print a green additional tier one (AT1) deal. When it was issued this week, it proved that the demand for socially responsible investments (SRI) extends to the riskiest of asset classes, meaning other banks are certain to bring out their own versions of the trade, writes David Freitas.