Spanish Sovereign

-

Austria, Belgium, Finland and the UK were among the European sovereigns to add to their funding totals with benchmark deals this month.

-

Spain has gorged on the after effects of the US Federal Reserve’s surprise decision to put quantitative easing tapering on hold, auctioning three year debt at its lowest yield in nearly four years and finding healthy demand for a 15 year tap on Thursday.

-

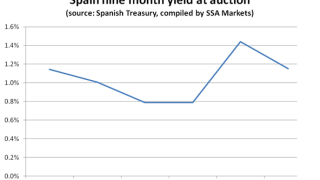

Spain’s short term borrowing costs crept up and demand for its 12 month paper fell at auction on Tuesday, ahead of a sale of long dated debt later this week. But the sovereign was able to overshoot its maximum €4.5bn target, raising €4.563m.

-

Spain’s flirtation with the private placement market led to mixed reactions from dealers, as some felt it might struggle to match Italy’s ultra long dated efforts this year while others said it should be able to equal its peripheral peer.

-

Italy found demand at the ultra long part of the curve and Spain scored its lowest 10 year borrowing cost in three years mid-week, as fears over potential military action in Syria and a reduction in US central bank liquidity support failed to derail the eurozone periphery’s journey back to capital market normalcy.

-

Italy made a solid start to three days of auctions on Tuesday, as yields and demand for its two year zero coupon bonds remained steady despite the latest round of political turbulence from the country.

-

As European sovereigns gear up for a busy period of auctions in late August and September, here are the latest funding figures for selected issuers.

-

Germany’s 10 year borrowing costs rose to their highest level in 18 months at an auction on Wednesday, as better than expected economic data gave investors to switch out of the eurozone’s safest assets and into the periphery.

-

Italy’s 12 month borrowing costs dropped for the first time since May at an auction on Monday, as redemption flow of €8.2bn helped the sovereign comfortably place €7.5bn of debt.

-

Spain auctioned medium term debt at its lowest yield since May on Thursday, despite a volatile political background which saw the country’s prime minister appear before parliament to deny any connection to a recent slush fund scandal.

-

Spain’s short term borrowing costs fell at auction for the first time since May on Tuesday, despite its secondary yields rising over the course of the day.

-

France, Germany and Spain held well received auctions of medium to long term debt this week. Here is a round-up of key European sovereigns' funding figures.