South Korea

-

Industrial Bank of Korea is poised to reach out to offshore and onshore bond investors for Basel III additional tier one capital later this year.

-

Standard & Poor’s has upgraded South Korea’s long-term sovereign credit rating by one notch to AA from AA- with a stable outlook, in line with Moody’s Aa2 rating of the country.

-

South Korea’s Nonghyup Bank is looking to reach out to international investors for the first time this year, having hired banks to work on a 144A trade.

-

The South Korean regulator is looking to give securities firms a helping hand with their investment banking businesses, unveiling a series of measures on Tuesday.

-

Samsung Heavy Industries Co could be mulling a rights issue to raise as much as W1.7tr ($1.5bn) by the end of this month or early September, after posting higher than expected operating losses.

-

The scorching pace of Indian IPOs looks set to continue as Dilip Buildcon prepares to launch a Rp6.53bn ($97.5m) listing next week, with bankers expecting a solid response from investors.

-

Kookmin Bank opted for an unusual three year bond this week to diversify its funding avenues. The bond found strong interest from offshore accounts eager to get their hands on the new deal, allowing the lender to price inside fair value.

-

South Korea’s Kookmin Bank and Indian’s Glenmark Pharmaceuticals ventured out to the dollar debt market on Monday with their respective bonds.

-

KB Asset PE Fund has raised W90.5bn ($79.1m) from an overnight sale of shares in South Korea’s LIG Nex1, in a deal that saw investors piling in to take advantage of one of the last chances of a block in the stock.

-

A secondary sell-down in shares of South Korea’s LIG Nex1 is seeing a hot reception in the market, with the block expected to price at the top of the range to raise W90.5bn ($79.1m).

-

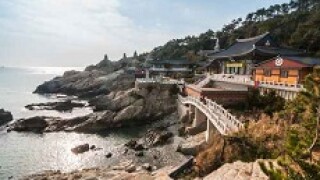

Investors turned up in large numbers to take advantage of Busan Bank’s offshore bank capital debut, with the robust demand set to encourage the rare South Korean issuer to become a more frequent name in the debt market.

-

South Korea’s Busan Bank is looking to tie up its first Basel III compliant transaction in the offshore bond market, opening books on Monday for a dollar tier two capped at $250m.