South America

-

Argentine oil and gas company YPF triggered a rally in its bonds this week by improving the terms of a proposed debt exchange that bondholders had initially rejected. Yet if the amendment was a sign of pragmatism from the government owned issuer, investors hardly saw it a reason for cheer, and yet another government related default is still on the cards.

-

Latin American development bank Corporación Andina de Fomento (CAF) offered the ideal combination of a safe haven on a volatile day and a positive yield in a low rates environment to notch its largest ever euro benchmark on Thursday.

-

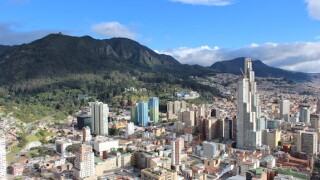

Colombian state-owned oil and gas company Ecopetrol said it would issue new debt and equity to fund a proposed takeover of the government’s 51.41% stake in conglomerate ISA (Interconexión Eléctria), should the finance ministry accept its offer.

-

Latin American development bank CAF (Corporación Andina de Fomento) will pick either a five or seven-year maturity this week as it prepares its first benchmark in euros since May 2020.

-

Argentine oil and gas company YPF’s bonds rallied on Tuesday as markets acknowledged several improvements to terms on the company’s attempt to exchange all of its $6.228bn international bonds for new notes. But analysts were still undecided as to whether the amended offer would be enough for YPF to meet the necessary acceptance thresholds.

-

Car rental company Movida is looking to become the third Brazilian company this year to issue sustainability-linked bonds (SLB), just two weeks after its parent company issued a similar instrument.

-

Brazilian waterway logistics services provider Hidrovias do Brasil will begin investor calls on Thursday as it looks to sell new bonds to finance a tender offer launched last week for existing bonds.

-

Three of the most active banks in financing oil exports from the Ecuadorian Amazon — an environmentally destructive industry with a long track record of trampling on indigenous people’s rights — have agreed to cease important parts of their financial support, after pressure from NGOs and a devastating oil spill in 2020.

-

Bond bankers said that Brazilian agribusiness company André Maggi (Amaggi) was the ideal credit for the market’s current tastes as the borrower notched a hefty oversubscription and tightening for a debut sustainability bond on Thursday. A tier two deal from Brazilian lender Banrisul confirmed that high yield appetite in Lat Am remained robust.

-

Emerging markets issuers across CEEMEA and Latin America once again triumphed in primary bond markets this week, with several sovereigns and corporates notching record low costs of funding. But there are signs that the direction of US rates is playing on investors’ minds, write Mariam Meskin and Oliver West.

-

Bond markets continue to offer Latin American sovereigns tight pricing down the dollar curve, with Panama and Paraguay on Wednesday becoming the latest pair to price dual tranche deals. But with rates curves having steepened this month amid the expectation of higher rates in the long term, bankers are sensing that the 10 year is becoming the sweet spot on the maturity curve.

-

Chile tapped bond markets for $4.25bn-equivalent of funding on Tuesday, starting with a 10 year green tap and new long-dated social bond in euros, and then following a similar playbook in US dollars.