Ireland

-

Bank of Ireland priced a hugely successful €500m five year transaction on Friday, bringing its longest benchmark covered bond in over three years and radically repricing its curve relative to the Irish sovereign.

-

The Irish sovereign’s successful 10 year benchmark has paved the way for the country’s covered bond issuers to push out their curves and take advantage of investors’ thirst for yield, said syndicate bankers on Thursday.

-

Issuers looking for rehabilitation in the capital markets and wanting to wean themselves off central bank funding must be careful to ensure they issue strategic deals that have a high chance of performing. This should lower their long term cost of funding and enable greater market access.

-

Allied Irish Bank (AIB) has priced its first covered bond since the crisis. Vocal investors, who had demanded a wider spread were compelled to cave in to blistering demand and, rather than cut their orders, they were forced to inflate them.

-

Bank of Ireland has priced its first covered bond in three years, attracting a heavily oversubscribed book that was broad and granular. The deal, that many may have considered impossible only a few weeks ago, pays further testimony to the continued bid for higher yielding assets and represents a strong endorsement of covered bonds.

-

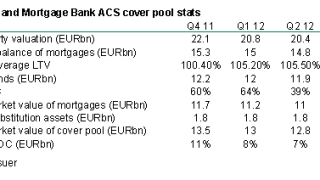

Bank of Ireland Mortgage Bank looks set to reopen the Irish covered bond market and has appointed joint leads for the first Asset Covered Security since the crisis. With Irish government bonds trading inside Spain’s and Italy’s, the deal should get more competitive funding.

-

Irish Finance Minister Michael Noonan has rejected a private members’ bill to adopt the Danish balance principle for covered bonds but he will investigate whether some elements of the bill could be rolled out.

-

SSA and corporate markets were busy on Tuesday, keeping the primary covered bond quiet. But issuance should improve this week as investors filter back from holiday, said bankers, though they warned that as spreads have tightened a long way in a short time the market may widen after the initial flurry of deals.

-

New Irish insolvency legislation will benefit covered bonds over the long term, according to Moody’s. But as the new law will provide debt forgiveness for mortgage borrowers with unsustainable loans, it could hit Irish cover pools that boast a high percentage of negative equity loans.

-

Europe’s peripheral covered bond markets are looking over their shoulders after Fitch downgraded Banco Popular Portugal’s covered bonds on Wednesday. This followed downgrades of Greek and Cypriot covered bonds which have left their issuers unable to access emergency ECB repo funding.

-

Rising unemployment in Spain could hit residential mortgage portfolios, JP Morgan analysts have warned. An increase in non-performing loans would affect Spanish cover pools, while a lack of adequate measures to deal with mortgage losses means subordinated bondholders could be called on to provide additional capital.

-

Standard and Poor’s brutal six notch downgrade of the Depfa ACS public sector backed covered bonds, from double A to triple B, matches the severity of downgrades that have been seen in several Spanish multi-Cédulas deals. But unlike those deals, this deal was issued by the Irish entity of a German parent bank.