Ireland

-

The European covered bond market kept up its momentum on Tuesday as four euro-denominated deals hit the screens and books were opened on another denominated in Australian dollars. The euro deals all offered a new issue concession of around 5bp and were comfortably oversubscribed.

-

Standard & Poor's upgraded the Ireland-based but German-owned Depfa Bank PLC to 'A-' from 'BBB' with a stable outlook on Monday. The state-owned bank can soon be considered a Government Related Entity (GRE) and will benefit from increased state support following a transfer of its ownership.

-

Covered bonds issuers in core and peripheral Europe will be aiming to finalise their 2014 funding needs in the next two weeks and others may be considering bringing forward their 2015 funding. As Irish and Belgian banks have been less active so far this year, there is a fair chance of supply from these regions. Covered bond research analysts have also recently reported on these markets.

-

Standard and Poor’s positive rating action on Depfa plc on Monday, and an expected rating upgrade from Moody’s that has yet to materialise, have had barely any impact on the issuer’s Irish covered bond spreads. The outlook should become clearer when further details of its ownership structure have emerged, bankers told The Cover on Tuesday.

-

Depfa Bank plc will not be sold to an unrated entity, but will be transferred to the German government’s wind-down institution for Hypo Real Estate Holding, FMS Wertmanagement (FMSW). The issuer’s covered bonds tightened by around 60bp on Wednesday from Tuesday’s open as uncertainty over its future was removed.

-

Depfa ACS covered bonds were unchanged on Thursday as the names of the failed bank’s preferred bidders emerged. The buyer’s strong rating suggests the covered bond rating is safe, and even if a sale is not agreed, the German government’s continued ownership means the rating is protected. As such, the covered bonds which have the highest rating in Ireland, should be trading tighter than all other Irish deals.

-

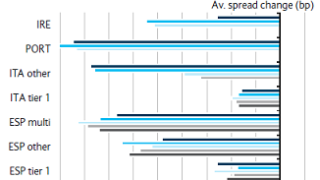

The more modest year-to-date tightening of Irish covered bonds relative to other peripheral jurisdictions has created a value opportunity, says Barclays research, which recommended buying Irish covered bonds versus Irish government bonds. However, traders say limited liquidity in the secondary market for peripheral names means that the trade idea will be difficult to executive in practice.

-

This week’s suite of covered bond deals have performed well and underscore that the market is receptive. AIB Mortgage Bank’s transaction was clearly the star of the show with its bond trading 10bp inside reoffer and its whole curve 3bp to 4bp tighter on Thursday paying little heed to bearish overnight comments from the Federal Reserve’s chair, Janet Yellen.

-

AIB Mortgage Bank enjoyed a stellar response for its first covered bond this year. The deal attracted the most demand for any Irish covered bond since the Irish government’s bail-out of its banks.

-

AIB Mortgage Bank has mandated leads for a seven year covered bond to be launched on Wednesday, subject to market conditions. Meanwhile, Aktia Bank has picked leads for a covered bond roadshow starting next week.

-

Moody’s upgrade of Irish covered bonds will expand the universe of demand. The rating action should underpin the Irish ACS market’s recent outperformance, that has been led by the Bank of Ireland’s recent five year. However, despite the real estate market stabilising, two Irish banks were downgraded due to persistent asset quality challenges.

-

Bank of Ireland returned to the covered bond market on Tuesday to issue its fifth deal since November 2012, when it returned after the Irish sovereign debt crisis. It was well oversubscribed with plenty of orders, but less spectacularly so than on previous issues.