EM Polls and Awards

-

-

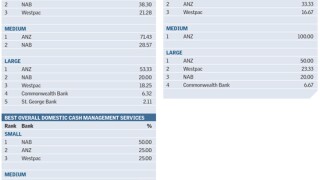

ASIAMONEY reveals the best foreign cash management providers in each country in the region, according to our corporate respondents.

-

ASIAMONEY reveals the best local cash management providers in each country in the region, according to our corporate respondents.

-

The US bank stood out in almost all rankings of our latest survey of Asia's providers of top FX services. Its rise forced HSBC, which was last year's most impressive bank according to financial institutions, into third place in that category. Meanwhile it remained the best service provider for corporates.

-

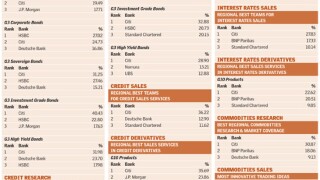

The region’s fixed income markets are growing on the back of rising investor demand, increasing debt volumes, and the desire to be protected from – or take advantage of – market volatility. ASIAMONEY’s first Fixed Income Poll reveals which banks in particular stand tall in this growing market.

-

US bank Citi continues to impress the most regional companies for its cash management services, while BNY Mellon emerges as the best firm according to medium and large financial institutions.

-

The extended results for China, Taiwan and Hong Kong in Asiamoney's inaugural Fixed Income poll featuring Citi, HSBC, ANZ, BNP Paribas and others.

-

The overall regional and domestic results for Asiamoney's inaugural fixed income poll featuring Citi, HSBC, Deutsche Bank, Standard Chartered and BNP Paribas and others.

-

The extended results for India, Indonesia, Korea, Malaysia, Singapore Thailand and the Philippines in Asiamoney's inaugural Fixed Income poll.

-

The US bank stood out from the competition when it comes to credit, interest rates and commodities, according to voters in our inaugural Fixed Income Poll. HSBC, Deutsche Bank, and BNP Paribas were also well-regarded.

-

The extended results from Asiamoney's 2011 Private Banking Poll, including category results for each country in the region.