DNB Bank

-

Ice Group, a Norwegian provider of wireless telecommunications, has begun pre-marketing for an IPO on the main board of the Oslo Stock Exchange.

-

The euro high yield market was giving signs that investor discrimination is back this week, as borrowers IDG and Victoria respectively marketed and postponed new issue bond deals.

-

Luminor Bank, an Estonian financial institution, was looking to place a small senior unsecured deal in the euro market on Wednesday, in spite of volatile market conditions. The transaction will be the issuer’s first step towards reducing its reliance on bank facilities as a means of funding.

-

Though neither DNB Bank nor Länsförsäkringar Bank (LF Bank) were flooded with orders for new five year senior bonds on Tuesday, the Nordic pair were able to place their deals in the market comfortably.

-

The Cover and GlobalCapital held the annual Covered Bond Awards Dinner on Thursday night at BMW Welt in Munich, celebrating the best performers in the market.

-

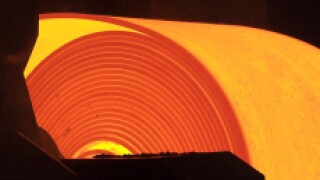

Sweden’s SSAB has ramped up the size of its euro denominated revolving credit facility to €600m, as the high strength steelmaker becomes the latest beneficiary of the liquidity flooding the loan markets.

-

Cloetta, the Swedish confectionery company, has amended and extended its euro and krona loans in an entirely Nordic banking affair, and also launched a commercial paper programme.

-

DNB Boligkreditt showed this week that borrowers have a very good incentive to consider issuing green covered bonds, especially now that the European Central Bank has signalled its intention to reduce net buying of assets under the Covered Bond Purchase Programme (CBPP3) to zero by December.

-

Sweden’s Lundin Petroleum has slashed 90bp off the margin of its $5bn reserves-based lending facility, as borrowers continue to heap pressure on lenders over pricing.

-

DNB Boligkreditt priced its inaugural green covered bond this week, paying a smaller new issue premium than core European names, but still attracting a large and granular order book in a short time frame.

-

Five Nordic banks have banded together for a Nordic Know Your Customer (KYC) venture that would cater to large and mid-sized Nordic corporates — an example of the kind of shared infrastructure project that banks need to bring their costs down.

-

The world’s largest salmon producer, Marine Harvest, sold the Nordic fish farming industry’s first bond for five years last week and as the industry scales up sources say a wave of issuance from the sector could be on the way.