Credit Suisse

-

CSFB and Barclays banker was one of market’s most eminent figures

-

Owners of the bonds face a long route to a payout but have a precedent in sight

-

◆ Holders win write-down ruling but path to recovery uncertain ◆ StrideUp brings Islamic innovation to UK securitization ◆ Emerging market bonds have an off-week (almost)

-

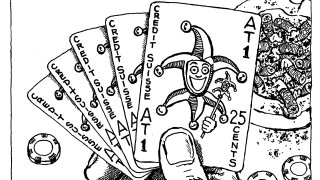

Credit Suisse AT1 bondholders should consider alternatives after this week's sharp repricing

-

Claims on Credit Suisse AT1 bonds shot up after a court ruling this week, though a long judicial process is anticipated

-

The Swiss bank has launched a new initiative that aims to transform how it serves wealth management clients with investment banking products

-

Career spans First Boston to UBS via Credit Suisse

-

Outgoing head of UBS Investment Bank has steered it through tumultuous times

-

Brent Johnson has retired after almost 27 years at the Swiss bank

-

Top dogs named as Swiss giant takes next step in Credit Suisse integration

-

In European mergers and acquisitions, UBS is enjoying its best run for years, especially in the UK, as bankers from the paired firms work together

-

Michael Klein’s attempted spin-off of Credit Suisse’s investment bank was complex and conflicted, but it could have reshaped the landscape in a way the UBS takeover does not