Danske Bank

-

Danske Bank has added two new members to its FIG origination team in Copenhagen.

-

Swedbank has grown its DCM syndicate team after hiring an SSA and FIG focused banker from a Nordic rival.

-

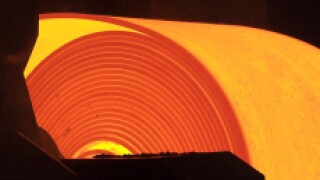

Sweden’s SSAB has ramped up the size of its euro denominated revolving credit facility to €600m, as the high strength steelmaker becomes the latest beneficiary of the liquidity flooding the loan markets.

-

DLR Kredit has become the first bank to convert senior debt that has been contractually subordinated into bonds that are subordinated by law, cementing the insolvency status of its creditors and paving the way for other firms to follow suit.

-

Danske Bank’s additional tier one note struggled to remain above water in the secondary market on Thursday as subordinated financials debt across Europe sold off. Other banks with plans to issue the instrument will be watching the market closely.

-

Danske Bank and CNP Assurances both looked set to execute benchmark deals in the most risky form of debt they could respectively offer on Wednesday, as financial institutions look to clear out a backlog of deals in a shaky market.

-

Cloetta, the Swedish confectionery company, has amended and extended its euro and krona loans in an entirely Nordic banking affair, and also launched a commercial paper programme.

-

Sweden’s Lundin Petroleum has slashed 90bp off the margin of its $5bn reserves-based lending facility, as borrowers continue to heap pressure on lenders over pricing.

-

Danske Bank entered the market on Tuesday, selling $1.75bn of senior non-preferred debt across three tranches, in its third transaction in the format in the space of less than a month.

-

The world’s largest salmon producer, Marine Harvest, sold the Nordic fish farming industry’s first bond for five years last week and as the industry scales up sources say a wave of issuance from the sector could be on the way.

-

Telecoms company TDC fired the opening shot of a multi-billion funding package for its leveraged buyout this week, with some investors showing mixed feelings about such deals.

-

Danske Bank is looking to issue two tranches of senior non-preferred debt in Swedish kronor, fresh from issuing its first such instrument in euros this week. It had been expected to issue several weeks ago but pulled back from the market.