Back in 2014, Taiwan’s bond market was a very different place. Volatility was relatively low – but then so were yields and trading volumes. The island nation’s leading life insurers – Cathay, Fubon, Nan Shan, Shin Kong – boasted assets valued cumulatively at around $600bn. Annual income on premiums had more than doubled from NT$1.2tr ($38.4bn) in 2003, to NT$2.7tr in 2013, according to data from the island’s financial regulator, the Financial Supervisory Commission (FSC).

Most insurers were focused on buying the nation’s outstanding sovereign bonds, and for good reason. Taiwan is stable and financially well run, boasting a generous current account surplus, and an economy roughly the size of Sweden’s. Standard & Poor’s rates it AA- with a stable outlook; Moody’s Investors Service rates the sovereign Aa3, also with a stable outlook.

Yet this stability masked cracks. Taiwan’s leading investors were forced to book yields of as low as 2% on the debt they bought, the majority of it issued in New Taiwan dollars. A longstanding regulatory cap prevented them from holding more than 45% of their total portfolios in debt printed by foreign corporations. This, many felt, was an unnecessary restrictive anachronism, designed long ago by regulators keen to ensure that capital generated in Taiwan was reinvested, wherever possible, at its source.

A simple tweak of the rules changed all that. In May 2014, the FSC removed onshore foreign currency bonds from life insurers’ investment ceilings. Under the new rules, insurance firms could count a bond listed in Taiwan but denominated in a foreign currency as a domestic investment, even if the issuer was based offshore and the security was cleared outside the island state.

This was designed to achieve three things. First, and very broadly, it would help to cultivate the development of Taiwan’s still somewhat parochial financial and capital markets. Second, it would allow Taiwan insurance majors to diversify their investment options, by permitting them to buy and profit from higher-yielding foreign debt. And finally, it would aim to put a rocket under the local debt market, in the hope that credible and higher-rated foreign firms would rush to Taipei to issue Formosa bonds.

Firm foundations

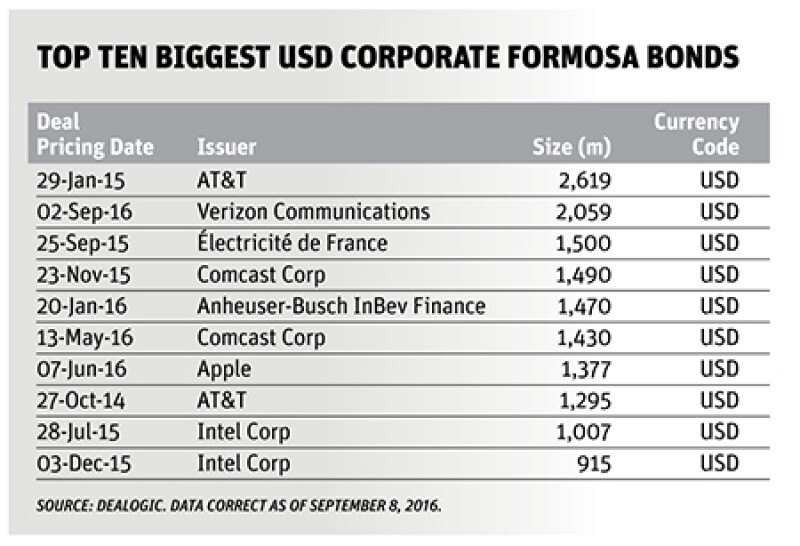

Global corporates were quick to spot the market’s potential as a source of additional funding. Within four months of the rule change, Verizon Communications became the first non-financial firm from the United States to tap the market, the New Jersey-based carrier issuing $870m worth of 4.8% 30 non-call one year notes. In February 2015, AT&T followed suit, selling a bumper $1.295bn, 4.7% 30 year bullet listed on the Taipei Exchange, formerly the GreTai Securities Market.

In May 2015, Reliance Industries, India’s largest overseas borrower, became the first south Asian corporate to tap the Formosa market, raising $200m. Five months on, it was the turn of Paris based utility Électricité de France, which sold $1.5bn of 30 year bonds at 4.75%, becoming the first non-financial European issuer to test the waters. HSBC was global co-ordinator on the sale, with Deutsche Bank joint bookrunner and Morgan Stanley structuring adviser.

To Stéphane Tortajada, group head of finance & investments at EDF, it was a surprisingly “easy transaction” to complete.

“In terms of documentation, it was quite light, certainly compared to 144A deals. The Formosa market offers long maturities of up to 30 years, and they are easy to swap, if that is what you are looking for [as an investor].”

There are other bonuses, too. One very obvious one is the benefit of selling debt into such a concentrated market.

“You have perhaps ten investors making up maybe 90% of the total demand” for a Formosa print, he noted. “So if you can convince those accounts that you can make the sale, it can be quite an easy market [to sell into].”

Tortajada noted that Taiwan investors are particularly keen on being able to see where a firm’s bonds are trading in the US secondary market. “They want to know they are paying a fair price for the [debt issued by a new] issuer,” he said. “That means it does help to have some debt outstanding in the US. Fortunately, we do, and that allowed us explain our story to investors [in Taiwan].”

Big Apple

This year, the market has barely paused for breath. In January, Anheuser-Busch InBev raised $1.47bn worth of 30 year debt from domestic investors. Four months later, Comcast Corporation printed $1.43bn in 30 year bonds at 4.05%, the second visit by the US mass media firm to the Formosa market since December. Then in June, Apple sold $1.38bn in 30 year notes — a deal that was upsized nearly 40% on heavy demand — marking its foray into a market that houses a number of its main equipment suppliers.

A total of four bonds worth $6.34bn and printed in US dollars were completed in Taiwan by foreign corporates in the year to September 8, against nine prints worth $6.66bn in the same period a year ago, according to data from Dealogic.

Overall, bankers and analysts say the rule change has proven to be a win-win for everyone. Global corporates, for their part, are more than happy to raise fresh debt in a market that offers strong regulatory support, deep wells of liquidity, and a sophisticated and mature investor base. Eric Lou, head of primary market business at Yuanta Financial Holding, has been heartened by the interest shown by major non-financial corporates such as Apple. “It’s a famous brand, well known both locally and globally. Apple’s decision to choose to issue dollar-denominated Formosa debt was a great fillip for the local bond market.

“Intel and AT&T, which chose to issue Formosa bonds as one of their funding options, [also helped] to boost the reputation and market confidence in Formosa bonds.”

Local investors, meanwhile, have been more than willing to play their part.

“Taiwanese investors are constantly seeking high yield investments within acceptable risk parameters,” noted Daniel Kim, head of financial institutions group, debt capital markets, Asia, at HSBC. “Due to abundant liquidity onshore, Taiwanese insurers are keen to look for long-dated US dollar-denominated investments. The Formosa format has provided issuers with an opportunity to complete sizable transactions with private placement-style execution.”

It’s all very impressive – but can it last? Will Formosa bonds prove to be a flash in the pan? Or will Taiwan become a regular pit stop for global corporates keen to top up their coffers, diversify their funding sources, or help to fund a major acquisition?

Here to stay

The market, to be sure, does have its limits. EDF’s Tortajada believes it’s hard to see many corporates raising more $2bn, at least at present. Yet in the short term, it’s difficult to see the lustre fading from the market, given that the main generators of demand for foreign-currency debt — namely, Taiwan’s insurance community — are so well-protected and flush with cash.

“Taiwan’s local insurers are looking for targets with higher yields — compared with the low returns of New Taiwan dollar-denominated bonds — and investment grade ratings,” said Yuanta’s Lou.

That liquidity can help in other ways, too. AB InBev’s January sale was a tiddler compared to the $46bn it raised in the United States the previous week. But it came at a key moment for the firm, as it sought to finalise a $100bn-plus takeover of a rival brewer, London-listed SABMiller. Debt capital market bankers will have taken note: expect Formosa bonds to become a major incremental source of funding for acquisitive corporates facing enormous fundraising targets.

For now, it seems, the Formosa format is here to stay. Global corporates are clearly fans of a market that offers a large pool of devoted institutional investors with deep reserves of untapped liquidity. It’s a nice diversification play, and it offers, as AB InBev showed, the chance for a major global corporate keen to top up their tanks prior to a takeover, to raise an extra slice of funding.

HSBC’s Kim said he was “positive about the further growth of the Formosa bond market, so long as it provides mutual benefit to both issuers and investors”.

Yuanta’s Lou said he expected previous Formosa bond sellers to “re-issue new bonds as they exercise call options”, and tipped the low funding rate to attract new issuers to come to market.

But he added: “The fact that this market has been booming [since 2014] can be attributed to abundant capital and, in particular, policy encouragement. If financial authorities tighten the investment cap or propose some restrictions, that may alter the market’s long-term outlook.”

To EDF’s Tortajada, the Formosa experience was definitely one that the France based corporate would be happy to repeat. “It’s a good market and an interesting market,” he said. “And it is one of the markets we are interested in issuing in again in the long term.

“We are monitoring it, and it’s much easier to revisit, as investors are already familiar with our credit. It’s the kind of market that it would be good to visit, maybe not regularly, but certainly once a year, or every two or three years.”