HSBC has claimed the top spot in Asiamoney’s Offshore RMB poll for the fifth year in a row in a result that saw it extend its lead over its rivals.

This year’s poll was the largest and most competitive with Asiamoney receiving 2,009 valid responses from corporates, financial institutions and investors, a massive 57% increase from last year.

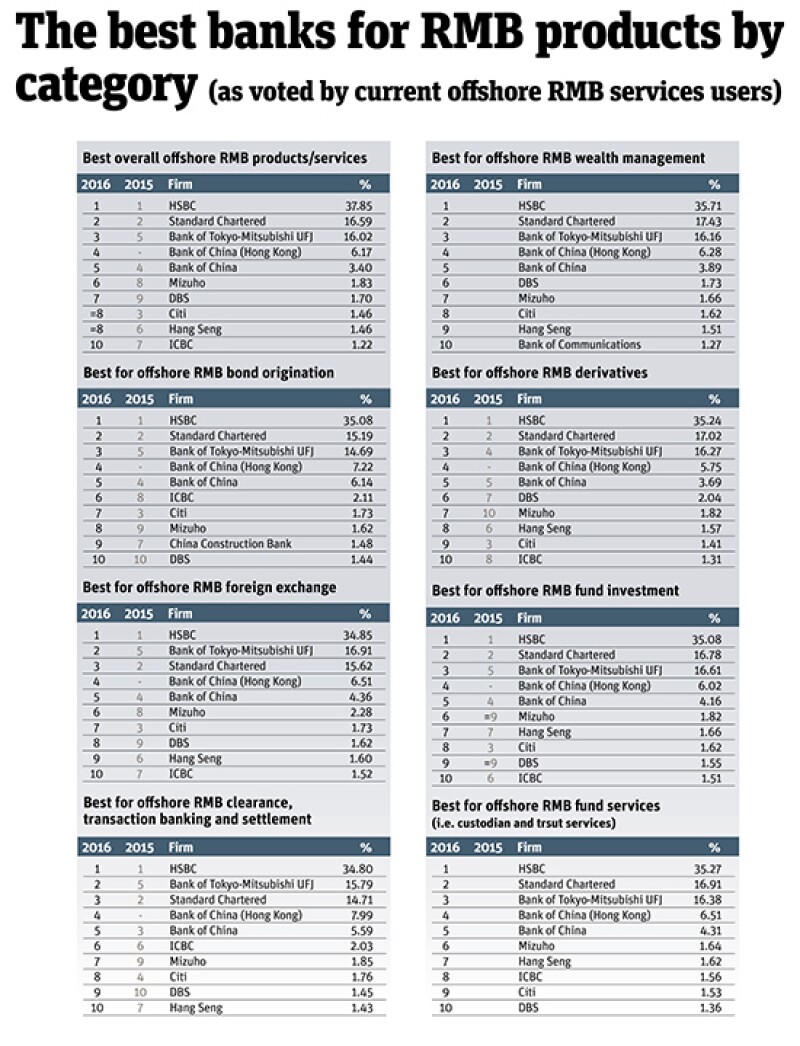

While HSBC managed to win with an impressive margin, the competition for second place was a close run battle (see full poll result). Standard Chartered managed to hold off challengers to retain its second place. Meanwhile, Bank of Tokyo-Mitsubishi UFJ, the banking arm of MUFG, put in an impressive performance to move two places up the rankings into third positon, its highest since the poll began in 2012. HSBC is certainly not resting on its laurels. The internationalisation of the renminbi was highlighted as one of the bank’s key business areas in its June 2015 strategic review and it is targeting to generate income of $2.5bn from it by 2017. For Candy Ho, global head of RMB business development at HSBC, the bank’s success has been making sure clients have the tools they need to deal with unexpected events including the surprise plunge of the renminbi in August.

“The August 11 depreciation of the currency was a major game changing event and although we could not predict the date, as a house we had been calling for deprecation for some time,” she said.

“We have been educating and informing clients on that view and putting in place hedging strategies for them so when the depreciation took place I think a lot of clients were quite grateful for the advice we had given them.

“We act as a bridge between what China’s policies mean and what are the implications for our customers and I think clients are appreciative of that.”

For Standard Chartered, this link between clients and China is also key to its offering.

“One of the important things is how to navigate the changing regulatory environment in China and thanks to our long history in China we are very close to the regulator and so we can make sure we are conveying the right message to clients,” said Carmen Ling, managing director and head, RMB solutions at StanChart.

“This is not an easy time to be managing FX volatility and trapped cash. Clients don’t just look for information on renminbi, they want to know about how what is happening in China relates to their business.”

And despite the renminbi internationalisation project being around for a number of years, client demand for information remains as high as ever, says Xuping Yang, general manager and head of the Greater China marketing Group at BTMU.

“Customer education is still a very important part of our initiatives and we are definitely seeing the pay-off for our efforts over the long term,” he said

Toshihide Motoshita, BTMU’s executive officer and regional head for Hong Kong, added: “We have over 1200 offices outside of Japan and in key areas like New York, Brazil, London and Singapore, we have appointed experts who are responsible for staying close to what is happening in China and Hong Kong. They provide local support to the other relationship managers. We make sure there is local expertise as relationship managers cannot always call Hong Kong and China.”

Lower down the poll there was also plenty of change. Risers included Mizuho, which moved up two places to sixth place. DBS also gained, rising from ninth to seventh. Meanwhile, Citi slipped from third to joint eighth with Hang Seng Bank. In addition, Bank of China (Hong Kong) and Bank of China were counted as separate entities for the first time. Both still ranked highly, coming in at fourth and fifth place respectively.

Changing gear

Despite the uncertainty and turmoil caused by concerns over Chinese economic growth as well as the fallout from last year’s sharp fall in the currency, banks are not reporting any reduction in interest for renminbi services.

However, there is a recognition that the pace of reform has slowed and that this may remain the case until there is an ongoing period of stabilisation. This should not be a cause for surprise or alarm, says StanChart’s Ling. “When you’re driving a car and the road is smooth, you can drive at full speed, but when the road is bumpy you need to stabilise the car before going ahead at full speed again,” she said.

But even if renminbi reform takes place in third gear rather than fifth, market observers are still expecting plenty of crucial developments to take place this year.

One important change will be a greater focus by Chinese authorities on capital markets.

“If we go back to the roadmap, the plan is to have renminbi used as a trading currency, an investment currency and a reserve currency,” said Ling. “Use of renminbi as trade and reserve currency are pretty much set, especially now that renminbi will join the SDR later this year, so the one that’s missing is investment. Renminbi now needs to be a financing currency. ”

The rise of renminbi as investment currency is also important for HSBC’s Ho who terms it the integration of China’s capital markets. She points out there is already evidence of this happening such the announcement in February that the China interbank bond market is now open to long-only institutional foreign investors. Other initiatives include allowing more foreign participation in the onshore FX market. Getting the equity trading link between Shenzhen and Hong Kong up and running, to add to the one between Shanghai and Hong Kong, is another important milestone.

“Another big step for integration would be the inclusion of A-shares in MSCI indices. But one big hurdle to that happening is Shenzhen-Hong Kong Stock Connect,” said Ho.

“Typically MSCI reviews its indices mid-year so while there might not be enough time to launch the Shenzhen connect before then, we are expecting some formal guidelines and timing to be announced this year.”

Ho says there is a recognition by the Chinese authorities that opening up its capital markets will bring help bring about some of the much needed stability.

“I think they realise that if you want the renminbi to be an international currency, you need it to be more accessible to the international market and that these initiatives will help stabilise and neutralise capital outflows. That is the kind of polices we expect to see this year.”

The Americans are coming

Of course the biggest confirmed event taking place in 2016 is the renminbi’s inclusion in the IMF’s Special Drawing Rights basket in October. The entry is expected to increase demand for renminbi assets, with BTMU predicting $220bn additional buying over the next five years or so.

“With the renminbi joining the SDR basket we're expecting more foreign investors to demand renminbi bonds if the currency is stable. I think this stabilisation is now what we are gradually seeing,” said Kennis Wong, executive director and head of Greater China debt capital markets at the securities arm of MUFG.

China’s Belt and Road project is also stepping up and should provide huge opportunities for renminbi financing due to its emphasis on infrastructure projects. Panda bonds, onshore renminbi debt sold by foreign issuers, is also attracting plenty of attention although it too suffers from the ambiguity around some of the rules. “We certainly see a lot of interest in the Panda bond market from our foreign clients. We have done a roadshow providing up-to-date information on the market and the regulations are still not very clear right now but we think this will come soon,” said MUFG’s Wong.

More unexpectedly, one of Ho’s predictions for this year is for the United States to be the country to watch in terms of offshore renminbi development. While there has always been some participation by the corporate sector in terms of using the currency for trade, more generally American institutions have been wary. In part this is because the renminbi is a sensitive political issue in the US where China has regularly been called a currency manipulator. But that could be about to change.

“The institutional investor space is where it was lacking because fund managers in the US don’t have RQFII quotas. But now with the CIBM opening up and discussions by the index providers about adding Chinese bonds I think big US money market funds will start to look at accessing China’s onshore bond market,” she said.