Treasury officials at European borrowers can probably pack away their passports this year. With euro bond yields at record lows, abundant liquidity and the ability to get ultra-long dated funding at rock bottom prices, there is little need for them to trawl Asia’s financial capitals to drum up investor interest in their bonds.

This marks an important shift from the strategy of recent years, which had seen European credits become more frequent visitors to Asia. While diversification has always been a key pillar of an established borrower’s funding strategy, before the global financial crisis it was mainly SSAs that came to Asia, along with the odd multi-national conglomerate. But since the events of 2008, a broad mix of issuers has recognised the need to tap into different pockets of liquidity. Asian funds have become a key investor base and have been more actively sought out by European borrowers in recent years.

The private bank bid has been particularly strong from the region, snapping up European corporate hybrids that met their requirements for both diversification and yield. The market has also seen banks and corporates come to Asia to sell straight bonds. Asian central banks, bank treasuries and some institutional names have also been keen to get their hands on European assets.

But that has already started to change. One of the consequences of the quantitative easing programme unleashed by the European Central Bank is that, for now, diversification is taking a bit of a back seat. When ECB president Mario Draghi announced in January that the central bank would start an asset purchase programme it was clear that the continent’s bond issuers would be the big winners.

Draghi’s plan to buy assets at a rate of €60bn ($65bn) per month until at least 2016 caused euro bond yields to tumble and has been followed by a torrent of issuance as borrowers from around the world take advantage of the low prices and abundant liquidity in Europe.

Not that this is creating much opportunity for Asian investors. Some are buying, but the region’s accounts are largely sitting on the sidelines as the post-QE deals look too expensive from their point of view compared to the yields on offer in Asia.

"Historically we’ve had a bit of euro buying in Asia, notably from central banks”, says Yves Jacob, head of debt capital markets for Asia Pacific at Société Générale. “What we are seeing now is some additional interest from Asian investors looking to buy Asian names in euro currency. They are often attracted by the additional pick-up, along with the fact these are names they are familiar with."

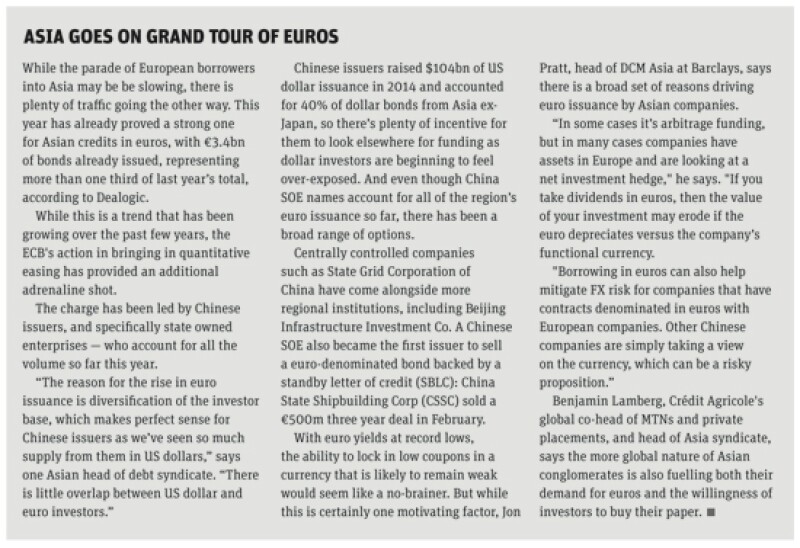

Indeed, Asian credits selling euro bonds has been one of the key themes so far in 2015 (see box on following page), but there is certainly less incentive for European issuers to ply their trade in Asia.

Basel III bonanza

Yet while policy action is keeping European borrowers away from the Asia investor base, another set of regulations is driving one issuer segment to the region in large numbers for the first time to access a very specific liquidity pool. This year has seen the first Basel III bonds in offshore renminbi (CNH) by European banks.

The first non-Chinese bank to sell renminbi Basel III debt was not European, however. Australia and New Zealand Banking Group took that honour in January when it issued a Rmb2.5bn ($410m) 10 year non-call five trade. But Europe’s banks, particularly French names, have been quick to take advantage of the opportunity. BNP Paribas was first, with a Rmb1.5bn 5.1% 10 year non call five at the start of March, and was followed a few weeks later by BPCE issuing Rmb750m with the same structure.

“What we have been seeing is an increasing number of banks coming to Asia to issue subordinated debt capital,” says one Asia Pacific head of debt capital markets. “That has been driven by Basel III regulation, with the latest development being TLAC, although we are still waiting for the final draft.”

Hailed as the solution to the problem posed by “too big to fail” banks, total loss absorbing capacity (TLAC) is championed by the G20 countries and was put forward by the Financial Stability Board (FSB). TLAC proposes that globally systemic important banks (G-SIBs) hold capital equivalent to at least 16%-20% of risk weighted assets — nearly twice the current Basel III leverage ratio. The new rules are unlikely to be imposed until 2019 but banks are already preparing for the change.

The proposed requirements could have a big effect on the market. European issuers need to find a whole heap more capital and also face increased competition for their paper from rivals that are trying to meet their own obligations. This is one reason why branching out into renminbi is proving an attractive prospect. In addition, the renminbi investor base does not overlap with euro or dollar investors, so the sector is genuinely providing a new source of liquidity — even if the deal sizes remain small.

Arbitrage has also played a part, with banks picking offshore renminbi as a diversification play for their Basel III bonds. Some have reported savings of as much as 60bp compared to their dollar curve, although as always in the CNH market much depends on the specific dynamics of currency swaps at any particular moment in time.

“The CNH market can provide a nice USD funding arbitrage for issuers that have modest size requirements,” says Jon Pratt, head of DCM Asia for Barclays. “While CNH yields have moved higher since last year, USD swap rates have moved much more significantly, which provides a unique opportunity for nimble borrowers that can move quickly to capture end demand and lock in a favourable swap.”

It’s also a win for investors, who get exposure to a high rated European credit and a yield pick-up from the subordination and the higher rates on offer in the CNH market right now.

Frank Kwong, head of Asia Pacific bond syndicate at BNP Paribas, who worked on the bank’s own issuance in RMB — a Rmb1.5bn 10 year tier two that was sold in March 2015 — says the unified regulatory system in Europe gives lenders from the region some advantages, as their Basel III bonds have similar structures. But the French bank still needed to do plenty of work to educate investors in Asia.

“European banks are a bit more consistent with structure as they have the same regulator, but Asian investors don’t fully comprehend the different transactions given the relatively light supply,” he says.

“Investors are only open to strong banks, as the product is something that’s new to them. We did manage to convince investors that this is a consistent framework, and us being the largest bank in the eurozone gave them some comfort. We hope now to bring other issuers.”

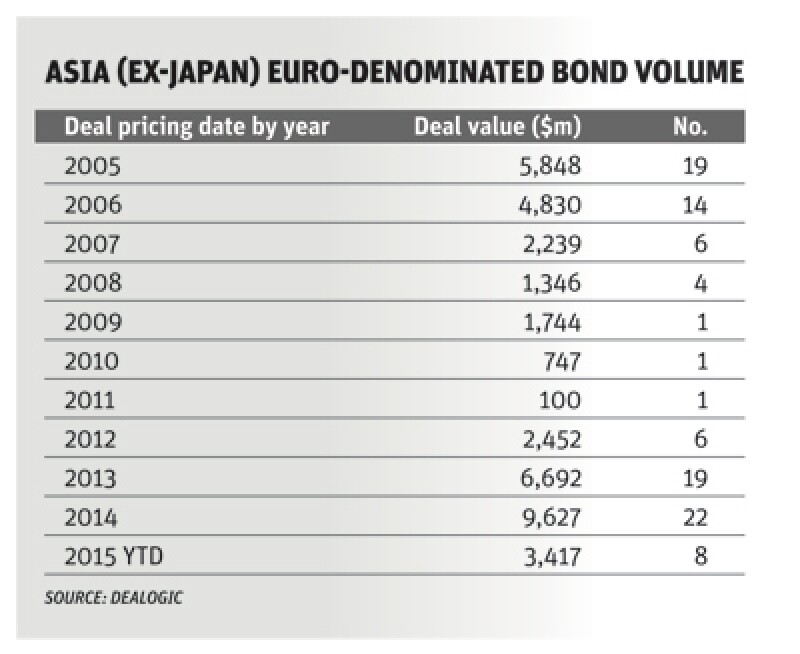

The European bank foray into CNH capital bonds is still nascent, although bankers are optimistic about the prospects. But it is not the only source of offshore renminbi liquidity that European banks have been targeting. A far more pervasive trend is that of offshore renminbi debt into Taiwan, in what are known as Formosa bonds.

Staying engaged

Taiwan’s offshore renminbi market has developed separately from elsewhere in the world where the currency is traded freely. This is because of the strict capital and investment controls Taiwan has in place.

As a result, issuers wanting to access the Taiwan insurance investor base — which is a big buyer of bonds — need to sell them directly into the country. One reason renminbi is a popular choice is because Taiwan insurers have plenty of renminbi to put to use due to the strong rise in RMB deposits in the country. Formosa bonds have proved irresistible to FIG issuers, with European names firmly in the mix though so far the trades have been limited to straight debt.

Of the Rmb44.3bn raised in Formosa bonds since the market started in February 2013, nearly 10% is from European financials, of which almost all were sold this year, according to GlobalRMB. Already this year Crédit Agricole, Deutsche Bank, Intesa Sanpaolo and Société Générale have issued Formosa bonds.

The market has also started getting the attention of Europe’s corporates, with Air Liquide Finance selling a Rmb500m seven year in January — the first international corporate in the Formosa market.

More generally the renminbi looks like it will emerge as one of the main ways for European issuers to connect with Asian accounts this year. European credits have long been be active in the currency since Unilever became the first name from the continent to sell a syndicated issuer in March 2011.

And already this year borrowers including Caisse d’Amortissement de la Dette Sociale (Cades) and KfW have sold dim sum bonds.

But while the prospects for broader issuance into Asia seem smaller this year, European issuers are unlikely to completely abandon the region — at least in the short term. They will need to continue to engage with investors if they want their support in the future.

“From a big picture perspective, issuers take the view that it makes sense for them to keep an eye on Asia and to stay engaged with Asia,” says one head of Asian debt syndicate. “Credit conditions change from time to time and when a market becomes hot borrowers want to be a credit that has some name recognition.”