Web retailer JD.com’s $1.5bn initial public offering (IPO) on May 14 in New York was arranged by market stalwarts such as Bank of America Merrill Lynch, UBS and Barclays. Sitting alongside them was the lesser-known China Renaissance.

While the merchant bank doesn’t carry the same name recognition as its bookrunner peers, it’s arguably China’s biggest entrepreneurial success story in investment banking.

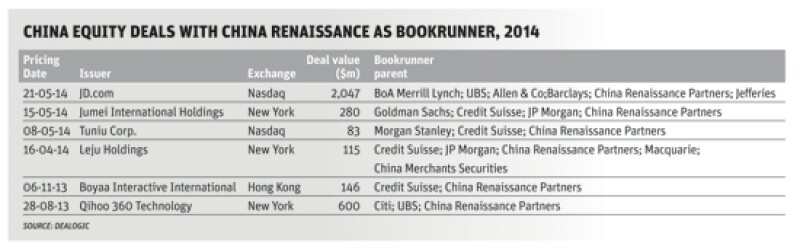

China Renaissance has more than 100 employees at offices in Beijing, Hong Kong, Shanghai and New York, who have been accumulating bookrunner and co-manager statuses on telecomunications, media and technology (TMT) deals for several years. They've done so well that China Renaissance stood as the second-largest bookrunner for Chinese listings in the US as of late July, according to Dealogic.

That’s not bad going, considering just 10 years ago the firm consisted of a rented office, a borrowed desk, and one man – Fan Bao.

Senior international bankers describe the China Renaissance founder as one of the country’s most charismatic and astute financiers. A Hong Kong-based venture-capital executive says that Fan has the rare ability to make both sides to a transaction feel like they have extracted a good price. He’s certainly ambitious, looking to open a San Francisco office and expand into asset management.

The goal? For China Renaissance to become the financial adviser to many of China’s new-economy entrepreneurs.

Attracted to entrepreneurs

The creation of China Renaissance is a product of Fan’s interest in China’s entrepreneurs.

He joined Morgan Stanley’s TMT team in Hong Kong in 1998, meeting the mainland’s burgeoning class of technology entrepreneurs.

“I was blown away,” he tells Asiamoney. “Until then I had been working with state-owned enterprises (SOEs), but Chinese tech entrepreneurs were intellectually interesting. Many were returnees with a Silicon Valley culture.”

This interest led him in 2000 to join Asiainfo, a mainland telecoms and software firm on whose Nasdaq listing he had worked. His four-year tenure there broadly coincided with the “nuclear winter” that followed the global dot-com crash. Yet during this fallow period Fan met many tech entrepreneurs, realising their fledgling companies needed funding but had not yet attracted big investors.

“I saw this opportunity to engage with them early and grow with them. And I saw that if you picked the right guy, they would grow very quickly,” says Fan.

To meet this need, he decided to start his own Beijing-based advisory outfit cum investment bank, despite being unsure of success. “I didn’t know if there would be any business, but a friend gave me an office with one desk,” he says. “My assistant and I didn’t have any meeting rooms, but our office was next to the St. Regis Hotel, so I held meetings in the hotel lobby.”

It was a smart move. By holding court in Beijing’s first six-star hotel, Fan’s first clients thought he was already successful. Plus “our timing was also pretty fortunate,” says Fan, noting that China’s VC industry took off in 2005.

Within months, Fan was joined by two former Credit Suisse colleagues, Kevin Xie and Krzysztof Werkun. Together they first focused on ‘private placements’, helping entrepreneurs raise capital from local venture-capital firms. By 2006 the company had worked on dozens of deals, totalling about $500m, including a notable series C round for ecommerce company and online bookseller Dang Dang.

China Renaissance’s first M&A role was as exclusive adviser to U.S.-based Amdocs, which acquired Longshine, a mainland developer of billing software, for $30m in 2005. In 2012 China Renaissance expanded into the securities business, by which time its name was synonymous with TMT transactions in China.

Fan admits his company didn’t always get it right. Ironically, JD.com approached him to advise on fund-raising in 2007 but he passed on both its series B and series C rounds. Still, Fan learned from the mistake and participated in the series D round, having realised the potential. “We got the relationship back,” he says.

Merchant-banking model

Fan credits three factors for China Renaissance’s rise from bit-part player to leading TMT adviser and bookrunner.

First is its merchant-banking model. China Renaissance invests in the companies it advises. “We see them as partners, and they see us as partners,” says Fan. “Investing your capital alongside your client means people view you differently.

It also invests much earlier than typical bulge-bracket firms. “In the technology world, you need to cover companies early to understand the technology and what will happen in the future. By going early stage, you get to see the disruptors; it also allows us to produce a very differentiated research.”

Secondly, Fan believes that focusing more than 100 staff on new-economy technologies and companies gives it a big advantage when pursuing business in this space.

Finally, he heralds China Renaissance’s culture. “My experience helps me evaluate people,” argues Fan. “How many bankers have been entrepreneurs? Very few. When I sit down with these CEOs, our conversations aren’t the same as the usual ones between a banker and client; they’re a lot deeper and more strategic.”

China Renaissance also boasts local connections that international banks cannot emulate.

“[Foreign banks] have a lot of strength in cross-border activity. But in terms of local business, it will be increasingly difficult for them to compete with local firms, possibly with the exception of one or two who may successfully localise their businesses,” says Fan.

“Our equity distribution is quite different. We focus on emerging managers, especially those with Chinese backgrounds. These groups of people are playing an increasingly important role in the IPO game.”

He points to China Renaissance’s growing links with hedge funds, long-only funds and specialist China TMT funds, many based in Hong Kong.

Domestic rivalry

China’s domestic securities houses pose a more plausible threat if they choose to focus on private technology companies.

But Fan believes only some can succeed. “They are very much traditional economy firms, but everything is moving toward the new economy,” he says. “In the old economy, a lot of financing comes from commercial banks; in the new economy, it comes from VC and angel investors. Everything is different, and I don’t know how quickly they can adapt.”

Still, Fan expects that China Renaissance’s early-mover advantage will not last indefinitely. “Our success is going to inspire others... I won’t be surprised if you see a lot of China Renaissance wannabees.”

For now, though, Fan sees the likes of investment bank CICC as partners rather than competitors, in their role as generalists that mostly advise the buy side. He compares China Renaissance to US boutique investment bank Allen & Co. (a fellow bookrunner on the JD.com IPO), offering expertise rather than financial firepower.

“We never fight for the top position, for the top left; we are happy to be a senior co-manager or a junior book-runner in a syndicate,” he adds.

However, Fan’s ambitions for China Renaissance mean it will encroach on the banks’ traditional hunting grounds. He believes China will become a global financial centre in the next decade, requiring its own first-class investment banks. “Our long-term plan is to be one of them,” he says.

Reform required

However, Fan admits China needs fundamental financial reform to become such a centre. Right now its stock markets lack the credibility of their foreign peers, reducing their appeal to China’s biggest new-technology companies.

Fan is hopeful this will change but he says structural reform is needed for the country’s financial markets to reach their potential. This includes liberalising a broad range of financial licences to allow private-sector participation in securities asset management and advisory businesses.

“Right now 80% of capital is still allocated through the commercial banking system. I think that long-term the figure should be 30%, and there should be people trying to grab the other 70%,” says Fan.

Fan plans to grow China Renaissance organically, although he is open to tie-ups in some markets. He wants to open a San Francisco office, cementing its presence in the world’s two largest technology and VC markets.

“That knowledge arbitrage is of immense value because innovation in each market spurs on the other. Very few firms know what’s happening in both markets,” says Fan.

China Renaissance is also expanding into asset management, having launched early-stage funds and one capital growth fund. And Fan wants to capitalise on the company’s links to freshly minted millionaires by building a wealth-management arm.

China Renaissance is also seeking to engage technology entrepreneurs across a wider range of businesses. It is bulking up its healthcare practice and seeking business in education and supply-chain management. The unifier is that client companies must be internet or new-technology driven.

Fan refuses to give specific business objectives, but says his plan is to “double business every year for the next few years”. That may seem overly ambitious, especially if the market cools, yet his success to date suggests it may not be impossible.

Still, Fan says he won’t pursue profits alone. He paraphrases former Chrysler chief Lee Iaccoca to describe his company’s ethos: “People, products and profits, in that order. If you are just going for the profits, it’s all wrong.”