Reports of the demise of dollar assets have been greatly exaggerated if this week is anything to go by.

On Wall Street, Nvidia broke new ground as the first company to hit a market capitalisaton of $4tr.

Goldman Sachs became the latest brokerage to raise its year-end target for the S&P 500 index, upping it to 6,600 from 6,100 (though detractors will jest that estate agents are also similarly bullish on their house price forecasts).

In the dollar bond market, the Inter-American Development Bank sold a $3bn 10 year deal that not only attracted large demand from investors, but at 6.93bp over US Treasuries achieved the tightest reoffer spread ever for a 10 year SSA bond.

These latest wins followed relief at the start of the month when a ‘revenge tax’ that would have introduced a supplementary charge on US assets held by foreign investors in certain countries was dropped from US president Donald Trump’s budget bill.

Could dedollaristation be over before it ever really began?

Not so, is the anecdotal view of many issuers, investors and capital markets bankers alike.

For one, Trump’s erratic behaviour, and questionable regard for the rule of law, is said to have led to “conversations” among investors, including global asset managers. Some are said to have “slower processes” and are still implementing changes in their allocations, meaning that impact is yet to come.

More agile appear to have been central banks and official institutions — as evidenced by their increased allocations in euro-denominated SSA bond syndications in recent weeks.

But forget Trump.

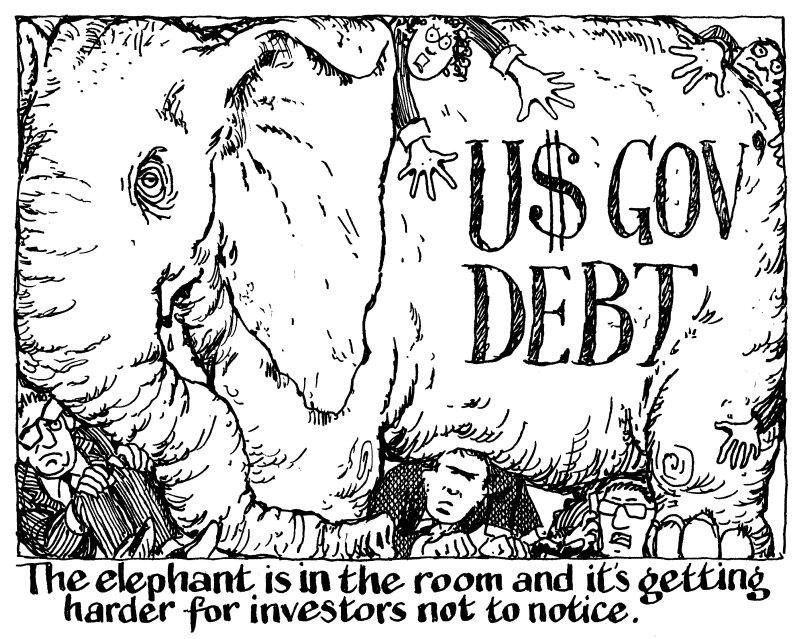

More worrying, is the structural shift that investors have woken up to — US government debt is 124% of GDP and rising in a country that remains heavily reliant on foreign buyers and its central bank.

Sooner or later, the dam might just break — possibly from an unpredictable political event or perhaps from the gradual leaking of confidence in the safety of dollar assets. Prudent investors are not willing to leave everything in dollars while they find out which it will be.