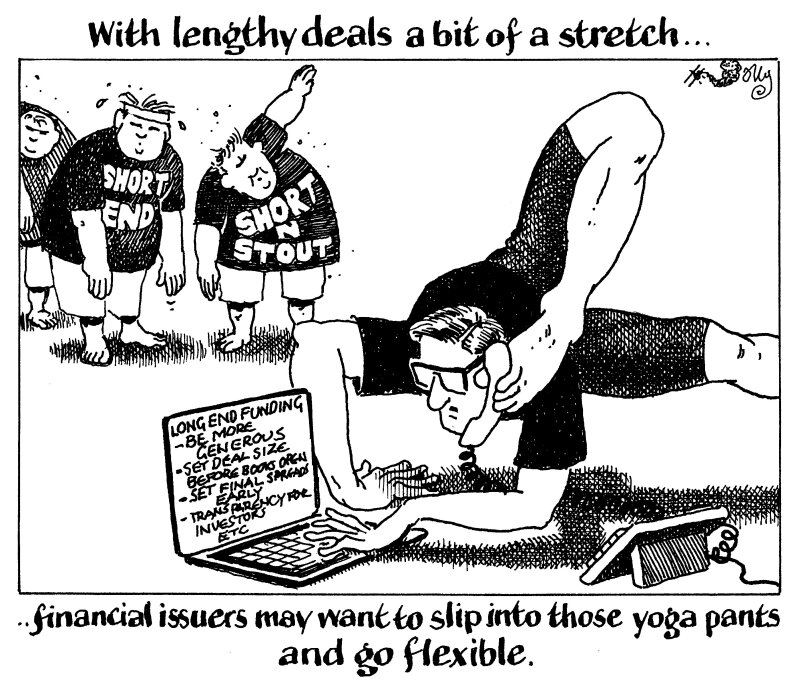

There have been some standout covered bonds issued in the seven year sector and beyond this year, but few banks have thought execution risk was low enough for them to follow.

In the past year yields have risen more than 3.5% in the short end, the curve has inverted sharply and, for the time being, there is no sign of that changing.

Most issuers have therefore met investors’ desire for juicier short dated bonds. But these are a poor match for the long dated assets they fund and not what covered bonds were designed to do.

Overreliance on short dated funding, including deposits, risks creating an asset and liability mismatch — something that contributed to the demise of Silicon Valley Bank.

Small and medium-sized European banks are better regulated than those in the US, but many are complacent about their reliance on deposits.

Eurozone banks pay paltry interest to their depositors, which should worry them following February’s record €71.4bn deposit flight.

Many bankers hope next week’s European Central Bank meeting will deliver visibility on the direction of inflation and rates, paving the way for longer duration covered bond issuance.

But Thursday’s unexpected rise in the US first quarter personal consumption expenditures index, the Federal Reserve’s preferred measure of inflation, rose by more than expected. Who can say European inflation will not follow?

And given the mountain of global central bank liquidity being withdrawn from bank balance sheets, recession may be looming — hardly conducive for credit conditions.

Issuers can mitigate execution risk on long dated bonds by offering early certainty on size and spread early during syndication. That may deny them some pricing power now but they will have reduced funding uncertainty.

There may never be a perfect time to go long. Waiting for a market as conducive to long dated issuance as that of a couple of years ago betrays a fundamental misunderstanding. The world has changed. Issuers must not let perfection become the enemy of good.