First the good news: most DCM heads expect not to have to cut staff this year, with Western Europe the most likely place to hire. However, DCM teams will not grow sharply and if seats need to be filled, banks will move people from other teams. Headhunters will be disappointed to hear this, but DCM bankers will be relieved, after a 2015 that brought a lot of job losses, especially in the ailing emerging market sector. This year, the knives will be aimed at FICC rather than capital markets.

HIRING AND FIRING

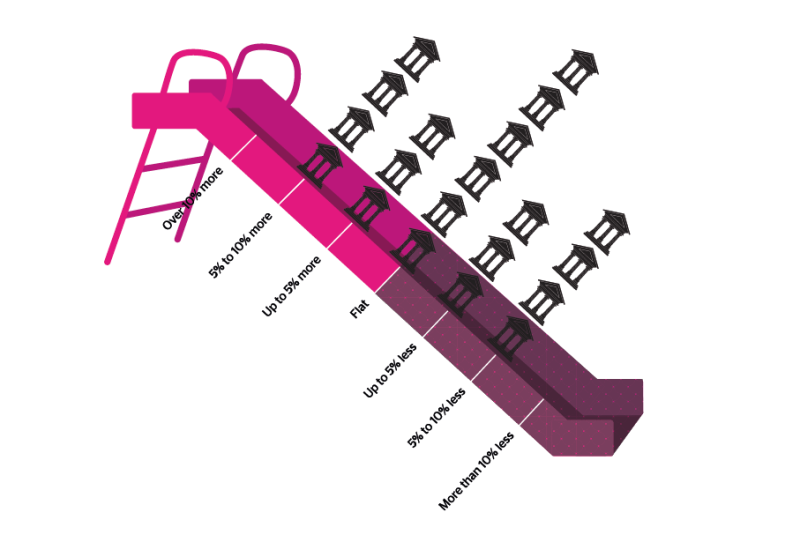

Overall, will there be more or fewer people working for you in 2016?

Which countries or regions will you be hiring or firing in?

Which sectors will you be hiring or firing in?

Within DCM, sovereign, supranational agency teams will bear the brunt of any cuts. SSA bankers dextrous enough to persuade their line managers that they are equally adept at financial institution (FIG), investment grade corporates, high yield, emerging markets and private placements will be pushing an open door. FIG is likely to be the sector with biggest increase in headcount.

VOLUMES FEES AND SPREADS

Which countries or regions will you be hiring or firing in?

Optimism is a human habit that is particularly prevalent in the debt capital markets. You can hardly blame bankers for it, especially after such a dispiriting 2015. So it is worth pointing out that when most people said 2016 would be mildly better than 2015 for bond issuance, they in fact meant it couldn’t get any worse. Of course, some gloom-mongers (20%) think it might still get worse, worried no doubt about the impact of a slowing Chinese economy, a moribund European economy, sinking emerging markets and the US poised to raise rates again. SSAs, after a bumper few years since the crisis, will also begin to reduce their funding needs. Twenty percent of DCM heads think bond volumes will in fact be much better than 2015, spurred by the hope that Europe finally begins to pick up and the M&A boom finally arrives, requiring lots of jumbo bonds to take out bridge facilities.

What is your prediction for fees for 2016?

DCM heads are not quite as optimistic about fees. While many (40%) think they will be mildly better than in 2015, 35% say flat and 25% forecast them to be slightly worse. The hope comes mainly because of the expectation that FIG capital deals will proliferate as total loss-absorbing capital (TLAC) regulations become clearer — these deals tend to pay decent fees. However, competition shows no sign of abating in European bonds, so banks will have to continue to share the spoils. Five or six banks on an investment grade corporate mandate has become common, and this might well become the case on FIG deals, too. With SSA volumes falling, fee pressure in that sector is only likely to be downward.

What is your prediction for spreads for 2016?

As for spreads, most expect them to widen slightly on account of volatility over interest rate rises in the US and UK, global economic growth fears and conflict in the Gulf and Ukraine. This might make it easier to sell bonds, of course. But with the European Central Bank’s quantitative easing in full swing, which will keep a lid on European bonds’ secondary prices, spreads should not get carried away. Barring disaster, bonds are going to remain tight.

Which sectors are you most optimistic about in 2016?

INCOME AND COMP

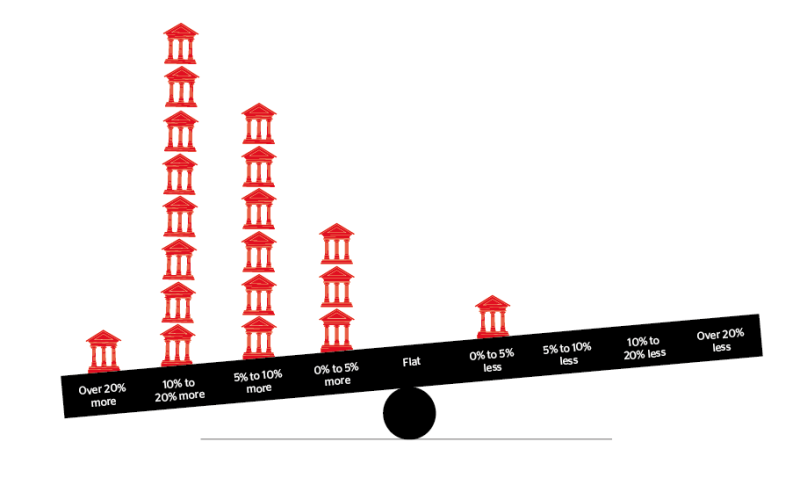

Do you expect your business to make more or less money than in 2015?

When it comes to actually making money, 2016 looks like it is going to be a great year. Almost 75% of respondents expect their businesses to make either 5%-10% or 10%-20% more this year. This bullishness jars somewhat with the volume and fee expectations (see above). But DCM bankers are pinning their hopes on the right kind of deals: lots of high paying FIG and investment grade corporate deals, and, crucially, lots of M&A finance. The latter is of course notoriously hard to predict. However, the US had a great year for M&A in 2015, and many believe 2016 will be the turn of Europe. After an exceptionally volatile first week, few CEOs have felt confident enough to pull the M&A trigger, although bankers will hope Shire’s $32bn takeover of Baxalta is the first of many.

Do you expect your MDs and directors to be paid more or less than in 2015?

With all but one of our respondents expecting their businesses to make more money than last year, DCM worker bees will be tempted into thinking 2016 will be a better year for bonuses, after recent yearse of decline. Sadly, it doesn’t quite work like that. While four banks expect to raise compensation by 5%-10% and three to lift it by up to 5%, the rest think comp will be either flat or down. Unfortunately, being paid less for doing more is one the perks of the job nowadays. As long as banks are under severe pressure to meet capital targets or still have work to do to repair their reputations with the public, shrinking bonuses will be a fact of capital markets life. And no, we won’t reveal which banks are set to raise pay and which to cut it.

GOVERNMENT BOND MARKET

How many more banks do you think will quit government bond primary dealerships in 2016?

Credit Suisse’s decision to quit government bonds last November might have shocked a few sovereign funding departments, but the Swiss bank was only doing what an increasing number of banks are thinking. Before the crisis, primary dealers were happy to load up on govvies and provide liquidity. But in the new world of Basel III capital and leverage laws and the Eye of Sauron-like focus on costs, banks are no longer comfortable being warehousers of risk but distributers and recyclers. Unfortunately, European government bond markets rely on banks to be just that — an unsustainable anachronism. No surprise then that every head of DCM expects more banks to quit the business this year. Most predict two will make complete exits.

BOND MARKET LIQUIDITY

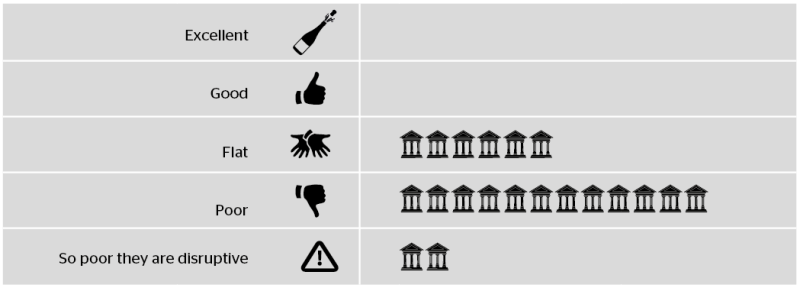

How would you rate secondary bond markets?

How damaging are liquidity levels to primary markets?

Poor liquidity has become an unavoidable feature of the bond markets over the last three years. According to our poll, most people class it as poor, with six saying it was flat with 2014 (not a vintage year, it has to be said) and two saying it is so poor it is disruptive. The main cause — capital constraints for banks’ trading books — will remain in place for the foreseeable future, meaning liquidity will continue to be poor, or get worse as regulations bite deeper.

But for all the moaning about liquidity, it has become easier than ever to do big bond deals. Three of the five largest were in 2015 — all US acquisition financings. Whatever problems the bond market has, it is not appetite for bonds in primary. The real headaches will come when there is a market crash and there is no liquidity to cushion the fall. “Liquidity’s poor, yes,” says one banker. “But is it really an issue? Not until we have a market crash, and then it will be devastatingly destructive.” will be devastatingly destructive.”

IMPACT OF TECHNOLOGY

Just like turkeys rarely vote for Christmas, DCM bankers don’t want to say they are going to be replaced by robots. While a few admitted that the rise of technology in their business was “inevitable” and would eventually replace certain syndicate functions, especially for frequent borrowers, most said debt capital markets was a business where people were still needed, especially for origination and sectors where borrowers are infrequent or more complicated.

Will new technology make the new issue market better…

Less than 25% said technology would make the new issue market better for issuers but almost 75% said it would make life better for investors — at first glance an interesting divergence. But this is probably explained by DCM heads being closer to their issuers than investors, and therefore more protective of them and the fees they provide.

As for going totally electronic, again, the turkey impulse kicks in. However, this poll was conducted before news broke of the possible scandal in SSA bond trading. If wrongdoing is found to have happened, banks (and regulators) may decide to bring in technology earlier and into parts of the business that hitherto were thought safe from algorithms.

THE COMPETITION

US (and Canadian) banks are where the big competition is going to come from next year, according to the poll. No one is afraid of European banks. US banks took their medicine immediately after the crisis and are, for the most part, in better shape than their European rivals, which are still repairing and rebuilding after the European crisis and struggling with near-deflationary conditions.

From where do you expect more competition in 2016?

But European bankers also complain that they are structurally disadvantaged as well, blaming the leverage ratio (they typically have higher levels of low risk mortgages on their books), and believing the US has implemented a better post-crisis response.

Are European banks structurally disadvantaged compared with US banks?

Japanese banks, with their strong balance sheets, are also expected to provide more competition this year. But so too are the buy side and perhaps even the more frequent issuers. At the end of last year there was talk that some of the more frequent SSA issuers might bypass the banks altogether and link up with their investors directly to sell MTNs and that investors might do the same in reverse, cutting out the middle man.

UPSIDE WILDCARDS

M&A is the big hope of a surprise on the upside for European DCM in 2016. After missing out on the boom in 2015, because most of the M&A was all-share megadeals, bankers expect acquisitions by smaller companies to pick up sharply this year, and along with it, a sharp increase in lucrative acquisition facilities refinanced in the bond markets.

Upside wild cards for 2016

M&A dealflow will partly depend on stable equity markets — something missing so far this year. But many European companies, with lots of cheap debt available, thanks to the European Central Bank’s largesse, will be looking at debt-financed M&A as a way to expand and diversify in the absence of economic growth.

Some hope for a return of CEE and Russia business — let’s face it, an improvement would not be hard — based on a relaxation of EU and US sanctions. While this might be wishful thinking — Russia looks no closer to rejoining the international fold — the wild card of more issuance from the Middle East and Africa looks more likely, especially the former, given the falling oil price and its effect on deficits.

The prize for the most cynical suggestion? This surely goes to the person who was hoping for another global financial crisis because it might bring about higher volumes of bonds and reduce competition. Nice.

WORRIES

No surprises: China is bankers’ biggest fear for 2016 — and given the performance of the country’s stock market in early January, it looks well founded. Next comes asset price bubbles (unintended consequences of QE, anyone?), European growth, an overbearing ECB and, after the atrocities in Paris in November, ISIS actions.

What are your biggest fears for 2016?

The other big topic of conversation at the end of the year was US rate rises. With Fed chair Janet Yellen finally having pressed the button on December 16, the market is now fretting about the pace of rate rises. The bond markets want her to go slowly and steadily, but there is no fundamental economic reason why the Fed should do that — the events to which the Fed responds do not behave tidily.

Brexit and the US election are lower on the list, in part because both are still far away. However, a US presidential election is always a big event, and this time, with Donald Trump making George W Bush look sober and managerial, the risk of volatility is much higher than usual. Meanwhile, as the Scottish independence vote showed, the nearer the Brexit vote gets, the tighter it will become. For capital markets, the UK leaving Europe would be catastrophic.

What is going to be the most disruptive piece of legislation for DCM?

NEW PRODUCTS

2016 will not be a vintage year for new products in the capital markets, according to our bankers. Instead, it will be a year of sticking to tried and tested structures, rather than anything fancy. Innovation might be found in upgrading or evolving existing products such as green bonds (perhaps through more corporate or project finance green bonds). Banks will also be eager to apply securitization techniques to offload unwanted portfolios. But otherwise, it will be a year when DCM bankers stick to their knitting.

What new products will there be more of in 2016?

ATTITUDES TOWARDS GREEN BONDS

Just three years ago, the mere mention of green bonds prompted smirks and a rolling of eyes among many DCM bankers. It remains true that almost nothing that has been financed using green bonds could not have been financed by other means, including ordinary bonds. However, attitudes are changing. Most people believe the product has a valuable purpose, that it has become a proper asset class and a key part of the DCM arsenal. Only one banker believes it is nothing more than a marketing twist on regular debt. There is clearly a new-found green spirit flowing through today’s bond markets.

How important are green bonds?