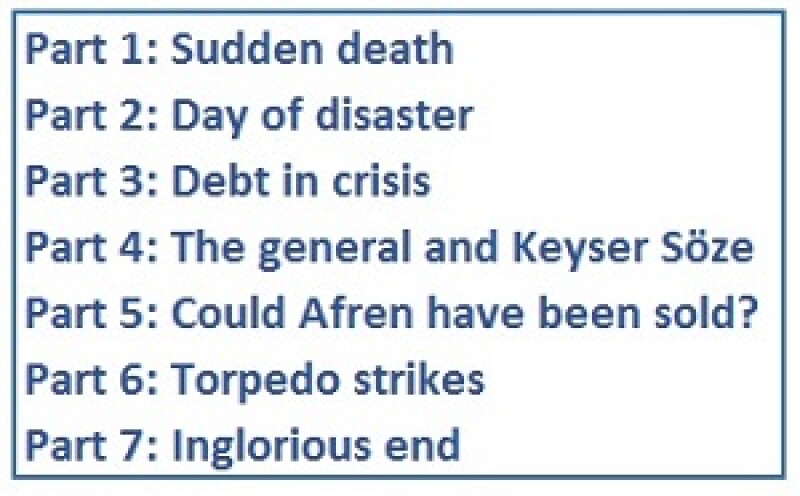

[Part 3: Debt in crisis] | [Back to main page]

By late May, Afren’s shareholder list included, according to sources close to the company, 20,000 retail investors, an oil company headed by a Nigerian former general, and a hedge fund founded by a man known in the City — admiringly — as ‘Keyser Söze’, after the fictional crime lord in the film The Usual Suspects .

Promoters of the restructuring were anxious to secure the support of South Atlantic Petroleum (Sapetro), the oil company of Nigeria’s former minister of defence, retired general Theophilus Danjuma, which, with 7% of the stock, was now Afren’s largest shareholder.

They also courted the hedge fund, SRM Global Master Fund, which, with 5%, was the second largest.

Sapetro had much to lose. Its shareholding had risen from below 3% to above 7% between September 26 and October 16, 2014, when the shares were trading between £1.10 and 93p, meaning it had bought at least 44m of its 78m shares for at least £40m.

SRM’s trajectory was different. It had been a small shareholder in Afren since before the corruption scandal, but it bought more stock after the shares tanked. Its stake passed the 5% mark on May 27 this year, when Afren was trading at 3p. SRM believed there was great potential value in Afren, even at this stage.

The Sunday Times reported on June 21 that Linn had travelled to Nigeria in May to meet Daisy Danjuma: the general’s wife, a one-time senator and the executive vice-chairman of Sapetro. The paper reported that the talks were positive but that she did not give Linn a firm commitment to vote for the restructuring.

When asked about this report, Daisy Danjuma directed GlobalCapital to Geoffroy Dedieu, the longstanding banker of the Danjuma family, and CEO of the general’s family office. GlobalCapital did not hear back from him.

Representatives of Blackstone and Ashmore also flew to Nigeria to meet the Danjumas, according to a source close to the restructuring.

As for SRM, the hedge fund of Jon Wood, a former proprietary trader at UBS, it had a history of buying into distressed stocks before fighting for more shareholder-friendly terms in restructurings.

This earned Wood hero status in some circles. He had opposed the UK government in a famous case — SRM Global vs HM Treasury — to seek compensation for former shareholders of Northern Rock after its nationalisation in February 2008. Wood was similarly pugnacious in other dealings: he led or took part in shareholder revolts at Lazard in 2002, ArcelorMittal in 2007 and Bear Stearns in 2008.

SRM often took cases all the way to court and Wood, who was vocal about his demands, was regularly quoted in the national press.

Wood’s aggressive attitude had earned him the nickname ‘Keyser Söze’, and a High Court judge once called him a “very hard and calculating man, albeit attempting to present himself in a much softer way”.

He remained atypically quiet throughout Afren’s restructuring, but was active in private, speaking a number of times with Linn and sometimes with the bondholders.

Throughout, SRM was implacably opposed to the restructuring, viewing it as an unjustified seizure of the company by the bondholders. Rather than default on its bonds and hence yield control to creditors, Afren should have conducted a rights issue, which would have enabled it to keep going and shareholders to have kept their stakes.

SRM remained determined to the last to vote against the restructuring, and continued to favour a rights issue instead, right until July.

A source close to Afren dismissed the idea of a rights issue, saying shareholders had never pushed the idea strongly enough in sufficient numbers.

Although Sapetro never voiced its views publicly, a source on the restructuring said last week that there had been a “high risk” the No camp would win the 25% of votes cast, necessary to defeat the dilution.

Board jumps before they are pushed

Other evidence of shareholder discontent was mounting. On June 25, Afren held its AGM. Shareholders voted down three of the board’s resolutions.

Strikingly, all but one of Afren’s directors resigned on the morning of the AGM, pre-empting what some shareholders had expected would be a bloodbath in which any existing director seeking re-election would have been voted against.

As one private shareholder put it to GlobalCapital the day before the AGM: “I’m looking forward to the results, including hopefully the odd head rolling.”

Chairman Imomoh was among those who stepped down, as was Toby Hayward. Linn alone stood for re-election, and received a comfortable 88% vote in his favour.

Two new directors, David Frauman and David Thomas, joined the board: it now had three members, down from 10 a year before. That concerned some shareholders, who thought management would be stretched.

While Asog was trying to fight for a better restructuring deal, some retail shareholders formed a breakaway group that was more hardline, called Afren Legal Action.

This group set out to mount a US-style class action against Afren, which could have been based partly on the allegations of fraud raised by Willkie in 2014.

Afren had settled with the former CEO and COO over those allegations in December, and there were no prosecutions in prospect. Afren Legal Action wanted those allegations brought to court, and began collecting what it claimed was further evidence of misconduct at Afren.

Some of its claims — notably, that Afren’s board had colluded with bondholders to push down its share price — were dismissed by an Afren employee as “fanciful and shocking”, a view shared by several of Afren’s shareholders, creditors and advisers.

The group found pro bono representation from Harcus Sinclair, a young law practice in London. On June 30, 2015, Harcus wrote to Afren, saying it was acting for a “group of private shareholders”. The letter raised “very serious concerns” over the write-off of the Kurdish assets, sale of the oil price hedges and proposed restructuring.

None of Afren Legal’s other assertions were included in the letter, on the lawyers’ recommendation.

[Part 5: Could Afren have been sold?] | [Back to main page]

.

Unless otherwise stated in this article, none of the individuals and institutions mentioned agreed to comment on the record.