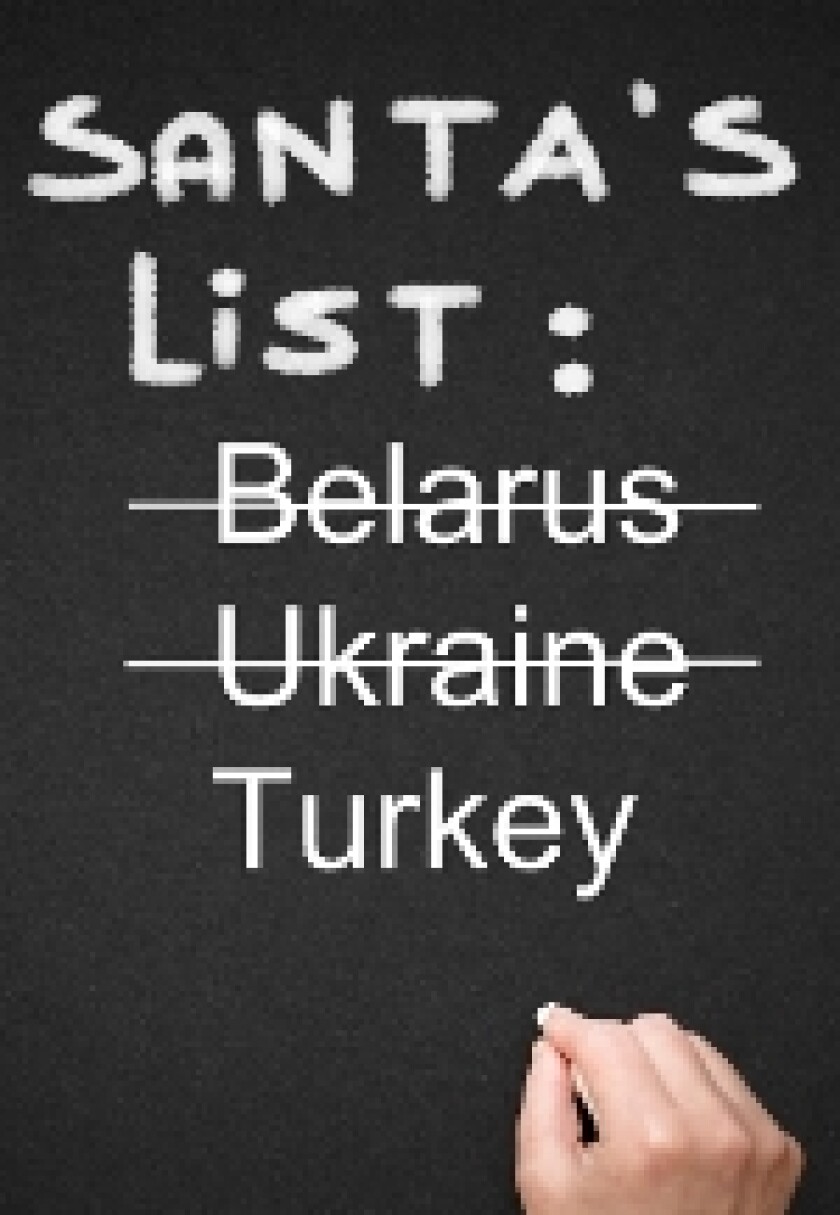

Though it is impossible to tell what the effect of US sanctions on Ukraine may be until they are imposed, if indeed they are imposed, Ukraine’s neighbour Belarus offers a glimpse of what approaching the Eurobond market under a cloud of sanctions is like.

When Belarus, rated B3 by Moody’s and B- by Standard & Poor’s, released the request for proposals for its most recent Eurobond attempt in 2012, western banks were quick to line up to tell EuroWeek that it would not be pitching for the mandate.

There were no official guidelines set down as to which banks could help the country raise funds, but banks' internal compliance on such matters was stricter after the pasting the last set of leads had been given in national newspapers in 2011 for helping to finance the country's government. Its president Alexander Lukashenko had been put on an EU and US list of individual financial sanction targets after his aggressive handling of a peaceful protest — a very similar situation to that unfolding in Kiev.

One of the lead arrangers of Belarus’s $800m bond in January 2011, Royal Bank of Scotland, released a statement in August of that year saying that, given the sanctions, the deteriorating political situation in Belarus and the fact that the country had reneged on key elements of its IMF programme, it had ceased any type of capital raising for or on behalf of the country.

The mandate for what was supposed to be Belarus’s 2013 outing in the Eurobond market eventually went to Russian banks Sberbank and VTB Capital in February, but even in the extraordinary bullishness of thatf quarter the bond was not placed. Some international banks of course said that the deal would have been easier had the borrower employed — or been able to employ — their vast distribution networks.

On the investor side of the equation, if the US imposes sanctions on Ukraine, it is the severity of such sanctions that determines how bad the technical sell off will be as a result. For some funds the country will immediately be added to their own black list. One US based portfolio manager said that his strictest fund gives his firm five days to sell out of names added to the black list. In other words, the market may face a fire sale.

Other investors with softer mandates say that it would have a more limited impact unless the country ends up on a Financial Action Task Force list of non-cooperative countries or territories.

Bankers and investors are trained to set aside emotions in executing trades. But even if they can leave aside their personal misgivings about the government’s treatment of Ukrainians, the bomb alerts at airports and train stations and their fears that more disruption could come next year, that may not be enough to allow banks to pitch for a mandate or investors to buy a deal.

The many bankers that told EuroWeek last month that they expected Ukraine’s bond market to flourish in 2014 are likely to be disappointed.