Asian Development Bank ADB

-

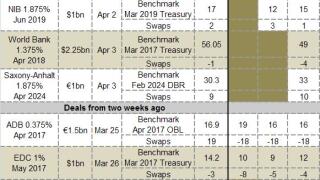

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Asian Development Bank was set to price a long two year dollar global on Monday afternoon, days after the World Bank printed a trade with a similar maturity. Demand was strong enough for the supranational to increase the deal above the minimum size.

-

The Asian Development Bank will sell its first Kangaroo bond of 2014 on Thursday. Searing demand for the five year fixed and floating rate paper, driven in part by ADB’s rarity, means the issuer is likely to sell the largest Kangaroo trade since the opening month of 2013.

-

ADB and EIB kicked off what SSA bankers expect to be a busy week in sterling, as holidays in Japan and much of Europe, a Federal Open Market Committee meeting and non-farm payrolls data are set to make benchmark issuance in dollars or euros tricky.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Supranationals and agencies are taking advantage of a flood of Japanese demand for medium term notes and Uridashi since the start of the new Japanese fiscal year on April 1 — but competition from other sectors for the buyers’ attention is increasing, bankers warned.

-

Read on to see how selected benchmarks are faring in secondary. Trading levels given are bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

The Asian Development Bank wowed this week with its first euro benchmark. Not only did it get a deal away at decent levels but the level of demand meant it increased the size. But whether this means the beginning of a raft of non-European supranationals embracing a long untapped investor base of euro-buyers depends all too much on the vagaries of the euro/dollar basis swap.

-

A swap spread deep in the depths failed to deter investors from diving into the Asian Development Bank’s (ADB) first ever euro benchmark on Tuesday, with the issuer able to tighten pricing and increase the April 2017 bond’s size to €1.5bn. ADB’s success should pave the way for other dollar funding supranationals to enter the euro market, said bankers.

-

The Asian Development Bank is looking to capitalise on increased central bank demand for Kauri paper, setting out to syndicate its first Kauri issue in nearly a year on Tuesday.

-

Read on to see how benchmarks priced in January are faring in the secondary market. Trading levels given are the bid-side spreads versus mid-swaps and/or an underlying benchmark as of Thursday's close. The source for secondary trading levels is Interactive Data.

-

Read on to see how benchmarks priced in the first three weeks of the year are performing in the secondary market. Trading levels given are the bid-side spreads versus mid-swaps and/or an underlying benchmark bond as of Thursday's close. The source for secondary trading levels is Interactive Data.