Since 2012 HSBC has had to pay billions of dollars in fines, plus an unknown amount in legal fees. The financial pain upsets shareholders and hurts return on equity, which the bank is targeting to reach 10% by 2017. S&P recently put the impact of regulatory costs at 60bp of ROE. Accordingly, among HSBC's top priorities is a fight against financial crime by implementing global compliance standards.

Part of the problem for HSBC has historically lain in its globally diversified operations, spanning 73 countries, serving 51m clients in 6,100 offices — which operated semi-autonomously and apparently were never integrated sufficiently into HSBC's corporate culture.

In 2012 it paid $1.92bn in settlements for money laundering by Household International, a mortgage and credit card company HSBC acquired in 2002. The bank also paid out $300m in litigation costs in 2013 related to the Bernie Madoff scandal, as well as £216m to UK regulators in 2014 for the bank's involvement in industry-wide foreign exchange rigging, and a further $275m to US regulators.

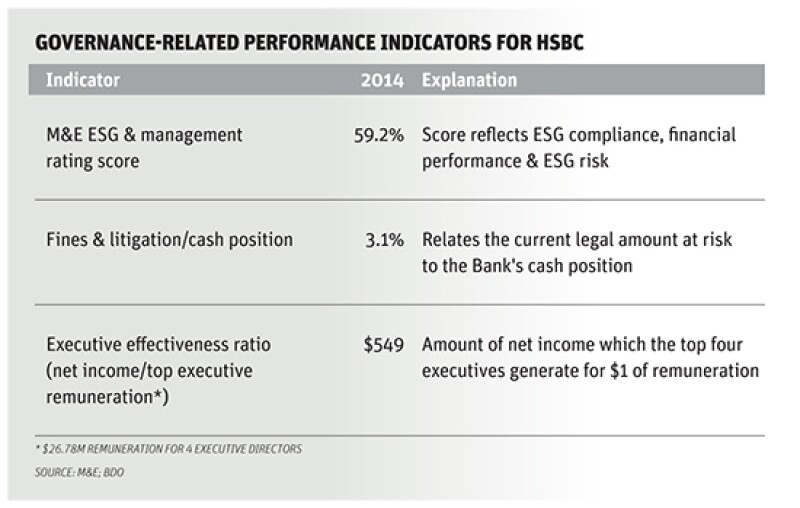

The results have taken their toll on HSBC´s profitability, with a cost/income ratio of 67% in 2014, down from its 46% pre-crisis level. In 2014 expense growth exceeded income growth (the gap described as "jaws") by 1.5%. The bank cites governance related costs and fines as a key reason behind the cost increases. Revenues were robust at $78.2bn (more than $10bn over 2013); net income was down to $14.7bn in 2014 from $17.8bn in 2013.

Governance efforts

HSBC has not been idle when it comes to governance. It has increased the staff involved in compliance issues to more than 7,200, more than doubling since 2011, and has eliminated much of the autonomy that national operations used to enjoy. Financial regulators in the US and UK have pushed the bank to put better compliance monitoring systems in place.

The "Monitor", a new third party control unit headed by Michael Cherkasky, is supposed to assess progress in implementing better governance and compliance. The bank is also trying to imbue better ethics in its employees. In 2014, some 145,000 of its staff received training in values. In addition, the bank writes in its current SEC 20F filing that, "we address this by bringing together annually non-executives from our major subsidiaries in an NED forum to discuss governance issues and share best practices".

These measures all appear relatively top-down and seem to reflect the view that governance and compliance are a matter of controlling employee behaviour. HSBC is missing a major opportunity to use compliance and governance as a network integrating operations and spurring growth and profitability.

Value drivers

When most US and European banks see governance and compliance as risk-mitigating expenses, they miss the opportunity to use governance and compliance processes as profitable value drivers. The cases of Itau Unibanco and its main Brazilian competitor, Banco Bradesco, demonstrate how governance can be intelligently employed to achieve constructive strategic aims and not reduce litigation risk of financial crime.

Banks in Brazil have gone overboard in implementing strict, yet profitable, governance practices against a backdrop of corruption across the country. Brazil is ranked 69/174 in Transparency International's Corruption Perception Index (China is 100/174).

The merger of the elephant banks Itau and Unibanco in Brazil at the beginning of the financial crisis in late 2009 is a good example of how quickly and effectively essential governance and compliance systems can be successfully implemented.

The two banks could not have been more different in culture and operational standards. Yet within two or three years, the merged bank Itau Unibanco implemented a governance structure among its 108,000 employees that not only drove the merger, but simultaneously raised operating efficiency.

Net income per client shot up from R$252/client ($84) in the first year of the merger, in 2010, to R$400 ($130) by the end of 2013, when the merger had largely been completed.

4,000% ROI

Using its ROS (ROI of Governance, Compliance & Legal) method, Management & Excellence (M&E) estimates the total returns from governance measures at Itau Unibanco alone were roughly R$4.14bn ($1.4bn) between 2011 and 2013. This is 10.7% of the cumulative net income of the period and is the contribution of governance to net income from added efficiencies and revenues.

The direct costs of these governance measures are estimated at a few hundred million reais at most, generating a ROI of nearly 4,000% for the governance programme.

Applied to HSBC, this would have meant $1.47bn in net income from added revenues and operating efficiencies alone, not including $1bn or so less in fines. Thus, conceivably, better governance could have added $2.47bn to HSBC's bottom line in 2014.

Clearly, HSBC is global while Itau Unibanco is essentially Latin American. But precisely for this reason, potential gains from governance as a value driver could be greater than for Itau Unibanco or other regionally more limited banks. The apparent grave weaknesses in HSBC's group-wide governance and compliance processes could be a sign of an even greater upside.

The similarity between the Itau Unibanco merger and HSBC is that the latter actually still needs to be merged and unified in terms of its processes. In February 2015, HSBC admitted that the bank was in the past "run in a more federated way than it is today and decisions were frequently taken at a country level”.

Itau Unibanco, which completed over a dozen mergers and acquisitions in its recent history, including BankBoston's Brazilian operation, built up governance as an intricate network of control and communications channels reaching into every corner of the bank's operations. In this, top management could pass down directives and control all layers of the bank while lower levels could report back progress and performance.

It integrated new IT systems which connected market data to R&D, made rogue trading almost impossible, and interactively communicated a new culture, driving employee satisfaction and pride rates up to nearly 90%. Ethics codes were detailed and spanned everything from emotional appeals to highly specific behavioural codes. Ethics training involved most of the bank's 100,000 employees within three years.

Net income per employee went up from R$123,000 in 2010 to R$172,000 by the end of 2013. Administrative costs declined from 25% of revenues to 16%.

.

Dr William Cox is CEO of Management & Excellence (M&E), which is partnered in Asia with BDO Financial. M&E/BDO Hong Kong specialise in calculating and raising the ROI of governance and other management processes.