A staple of the Lion City’s primary equity market, S-Reits have had a slow couple of months, with only one listing in the past six months — Keppel DC Reit’s S$513m ($391m) IPO on December 5, 2014.

Leading the reasons for this slowdown is the expectation of interest rates rising, which has created an overhang on all yield stocks. While that sets a fairly unconducive macro backdrop for S-Reits, a more Singapore-specific reason is also contributing to the no-show.

Several tax incentives that S-Reits have enjoyed over the past few years were due to expire on March 31. The uncertainty over the future of these exemptions had left many potential Reit sponsors and foreign investors preferring to wait for more clarity before making a move, said Tan Kok Huan, managing director, equity capital markets, DBS.

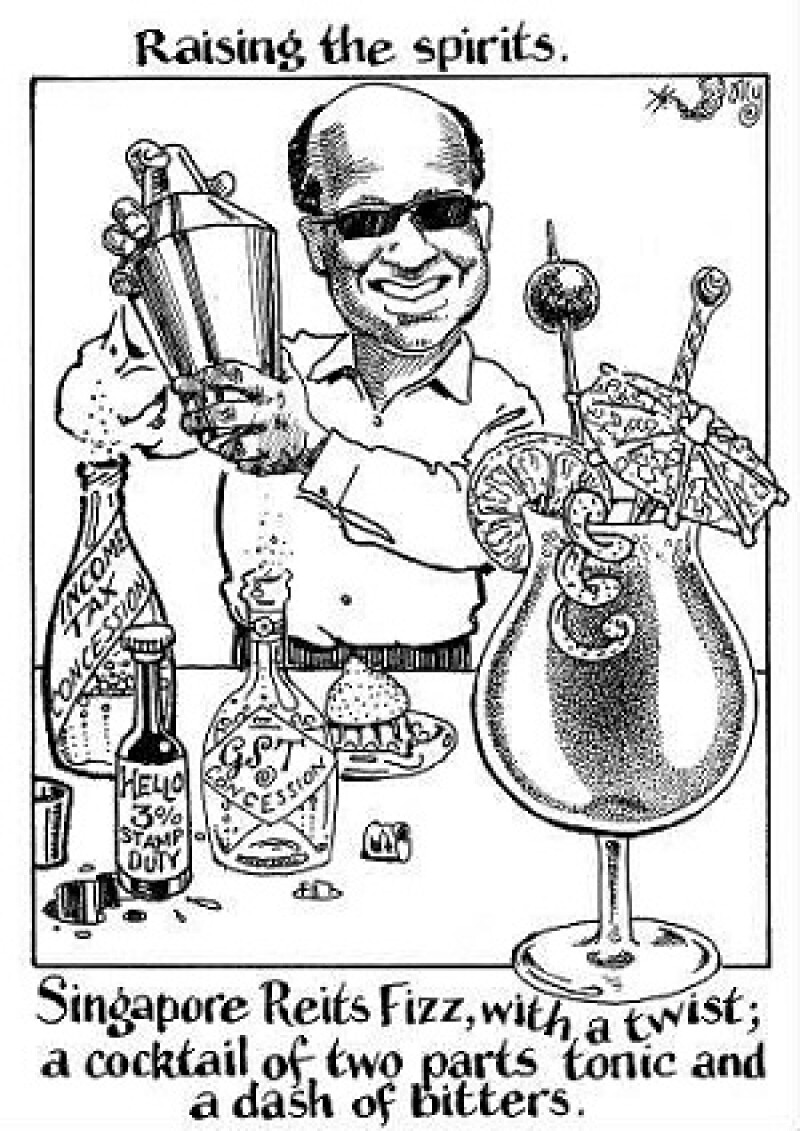

But the situation has finally cleared up for the market, after deputy prime minister and minister for finance Tharman Shanmugaratnam announced in the country’s 2015 budget that some of the concessions will be extended.

Two steps forward

Top of the list is the concessionary income tax rate of 10% for foreign institutional investors, which has been renewed for another five years to March 2020. That is a huge boost to demand, as foreign institutional investors would otherwise be subject to a much higher 17% withholding tax.

Similarly, a 7% goods and services tax (GST) remission to allow Reits to claim back input tax on their business expenses, and a tax exemption on qualifying foreign sourced income in respect to overseas properties, have also been extended for five years.

But extensions are not the only positives that S-Reits are getting from the budget. The GST concession will also be extended to include fundraising by SPVs set up by Reits — a move that one Hong Kong-based ECM banker said was introduced to fight off competition from rival Hong Kong.

“Singapore has by far the most complete Reit framework in Asia and the only thing holding it back was the GST, which its closest rival Hong Kong does not have,” the ECM banker said. “By expanding the GST remission to those under a SPV structure, which most Reits adopt, Singapore has pretty much confirmed its status as Asia’s premium Reit market.”

One step back

While those changes will undoubtedly bolster the appeal of S-Reits, the decision to allow the expiry of a 3% stamp duty remission on the transfer of Singaporean properties to Reits is likely to have the opposite effect.

By allowing the measure to lapse, Singapore is increasing the cost of acquiring domestic assets, which will have a negative impact on what were already depressed earning margins, with top-line rental growth for most Reits stagnating at around 5%, said Wong Yew Kiang, a property analyst at CLSA.

Industrial Reits, in particular, will be worst hit since most have a pure-Singaporean portfolio, unlike some of their commercial peers, which already contain overseas assets. Mapletree Industrial Trust and Viva Industrial Trust, for example, only hold local assets.

One fallout from the tax changes is that Reits could switch to acquiring overseas assets instead. This shift has the potential to reprice the S-Reit market, causing yields to rise — since investors generally prefer Singaporean pure plays compared to pan-Asian trusts.

A reflection of this preference lies in the trading performance of S-Reits, with those containing overseas assets tending to trade at a 50bp-75bp premium to their domestic counterparts. The yield spread between the two is even higher if the overseas properties are mostly based in developing economies such as China, rather than more mature markets such as Australia or Japan.

“There are two sides to this. One, obviously, is that this will be a disappointment to Reits looking to acquire domestic assets or to companies trying to set one up, since acquisitions will become more expensive,” said Teo Wee Hwee, real estate tax leader at PwC Singapore. “The second, and I think the message is very clear here, is to push for Reits to become more regional, which matches the country’s ambitions to have a pan-Asia equity capital market.”

But while developing the S-Reit market into a regional market is a positive move, Teo thinks the authorities could have done a better job in helping companies make the transition.

“A better way to implement this will be to introduce some sort of grandfathering rules and give Reits, as well as companies in the process of listing, a one year leeway to react accordingly,” he said. “Right now they have little time to react to the changes, since [the concession] expires on March 31.”

Bypassing the rules

But according to CLSA’s Wong, the negative impact of the removal of stamp duty remission can be mitigated. Reits simply have to buy the companies owning the targeted domestic assets instead.

An S-Reit doing so would only be subject to a 0.2% stamp duty, far lower than the 3% incurred by buying the properties directly. There is a catch to this strategy, though, since the companies acquired will be subject to a 17% recurring income tax.

But that issue can also be mitigated by converting the companies purchased, which are usually in the form of an SPV, into limited liability partnerships (LLPs).

LLPs, which enjoy tax transparency in Singapore, are able to pass through tax, but this characteristic comes at a cost, since these entities are usually private and investors buying into them generally find it difficult to exit their positions. This is unlikely to be a problem in this instance, however, since investors are putting their money into the Reits, which are publicly listed, and not into the LLPs directly.

“Overall, I think the tax changes will probably have a slightly negative impact on companies looking to list Reits, although this has been slowing down anyway due to the expectation of rates going up,” said Wong. “But Singapore is still a very competitive market, since the critical mass for Reits is far bigger here than anywhere else in the region.”