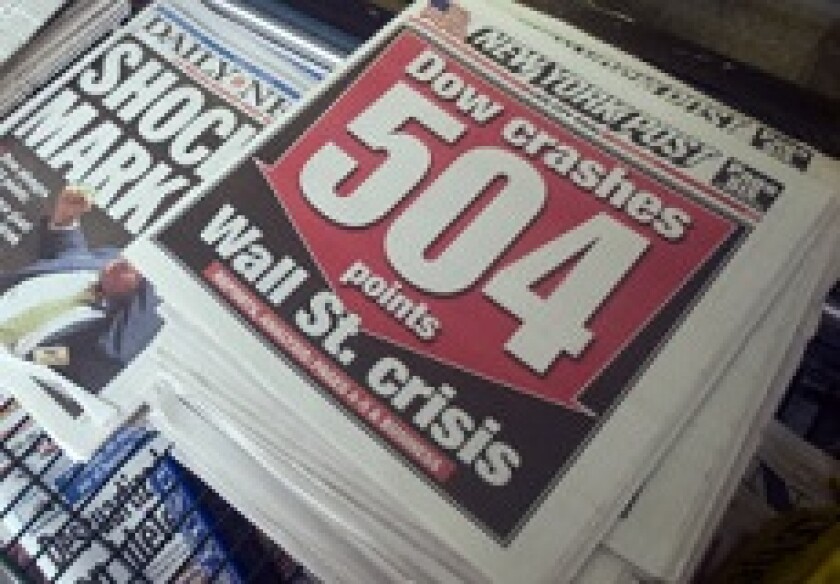

September 15, 2008: the day markets changed

Traders, bankers, lawyers, brokers tell their stories of what happened when Lehman Brothers went down, how it ruined some businesses and created room for others, and how it has changed financial markets — for better and worse.

Unlock this article.

The content you are trying to view is exclusive to our subscribers.

To unlock this article:

- ✔ 4,000 annual insights

- ✔ 700+ notes and long-form analyses

- ✔ European securitization issuance database

- ✔ Daily newsletters across markets and asset classes

- ✔ 1 weekly securitization podcast