The European Commission published its proposed reforms to the Securitization Regulation, Capital Requirements Regulation (CRR) and Liquidity Coverage Ratio (LCR) regulations on Tuesday.

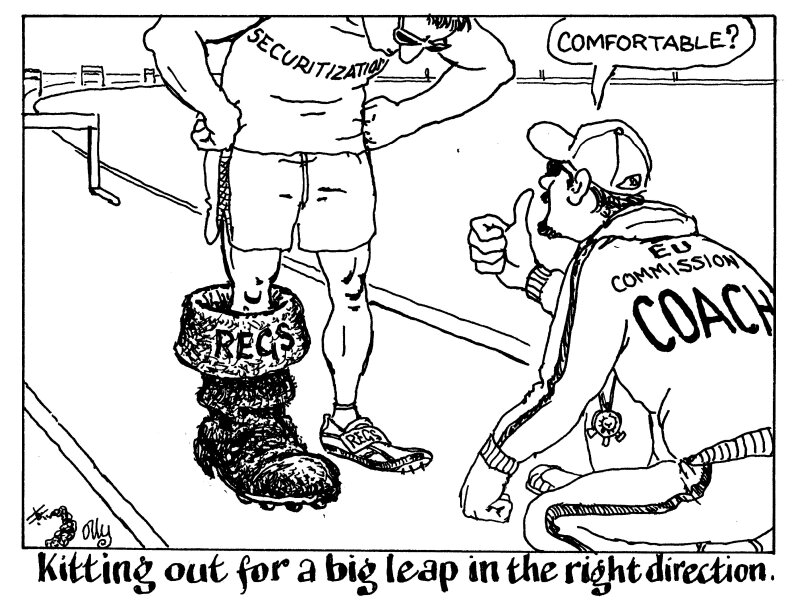

These measures are intended to “relaunch” the European securitization market, and the proposals are certainly a big leap in the right direction.

The proposal to expand eligibility for the 'simple, transparent and standardised' label to include tranches rated AA-, as well as the introduction of lower haircuts for "resilient" tranches are clear positives for the market.

However, the package is far from perfect. While it is good that the Commission has proposed simplifying the disclosure templates for private deals, this has been undercut by forcing all private deals to be reported to data repositories as well as making investors liable for any due diligence breaches.

Given securitization’s association with the 2008 global financial crash, it is only natural for the Commission to be cautious when reforming regulations, but there are also risks to adding unnecessary regulations to an already struggling market.

The good news is that these proposals are just the first steps in a long process to becoming law.

Market participants will be able to voice their concerns about the draft amendments for the LCR Delegated Regulation in a four-week consultation, set to end on July 15, and the regulatory proposals around Solvency II are still to come.

All the proposals must be debated and approved by the European Parliament and the European Council before they can become law, so the market still has plenty of time to make its arguments.

If the Commission truly wishes to relaunch the European securitization market, then it must listen to those arguments or risk undermining the good ideas it has suggested so far.