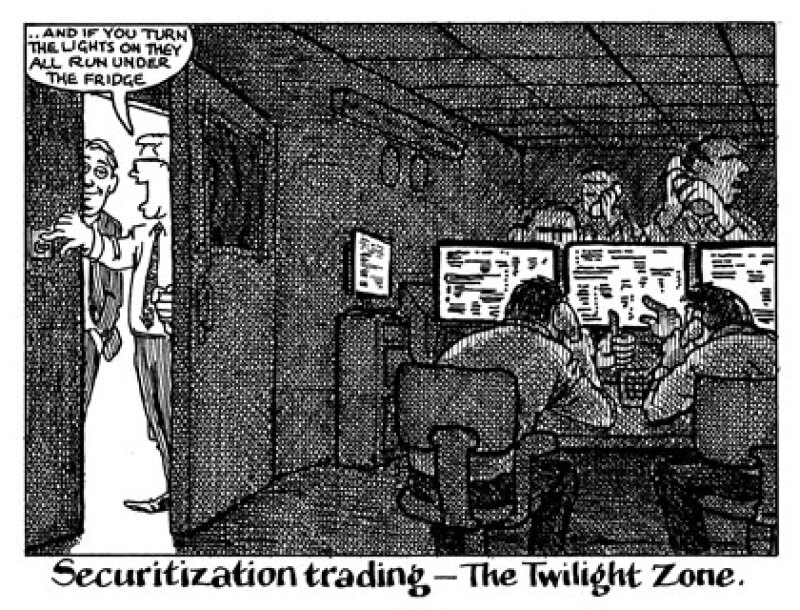

Trading of securitizations has been slow to catch on to the modern electronic trading systems employed in other areas of the capital markets. It is often said that this is down to the more complicated nature of structured products, but the reality is more simple — it is just easier to make more money when you can keep your cards close to your chest.

The Deutsche Bank fine is a classic case. The traders essentially lied about the price they had paid for the bonds, in order to inflate the profit on the sale to external customers.

A more transparent electronic trading system, that sheds more light on bids and offers in the market, would make this trickier to do. So it’s no surprise to hear, as GlobalCapital does on conference panels discussing e-trading in ABS, that “the market benefits” from not being 100% transparent.

It certainly benefits banks that are still willing to commit balance sheet to finance trading desks. But it’s also true that many investors share the same opinion, too. Plenty are happy to enjoy the “complexity premium” that comes with trading securitized products, even when it comes with the chance of being ripped off every now and again. Proposals in Europe to create a transparent depository of ABS holdings have caused an uproar in the buy-side.

The pace of change in financial markets can often be rapid, but it can also be lethargic. In the case of securitization trading, expect the latter.