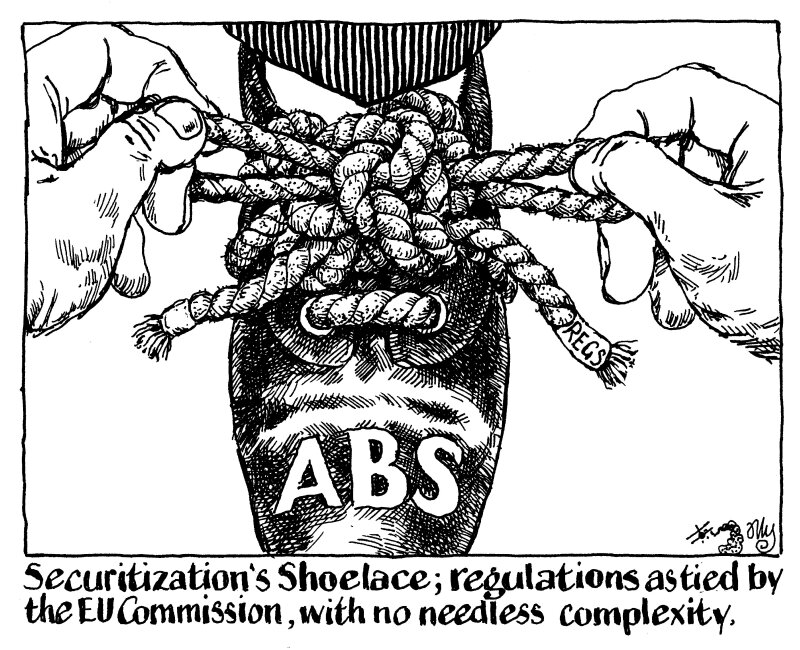

A reasonable initial reaction to the European Commission proposals on securitization regulation, published last week, would be that it looks very complicated.

There are new sanctions, new deal categories, new templates, new repositories and plenty more.

But apparently, the purpose of the proposal is to make the EU securitization framework less burdensome, and more principles-based.

In fairness, that statement is in the proposal on securitization regulation, while much of the added complexity actually comes from the paper on capital requirements — most notably the new idea of ‘resilient’ deals.

The point holds, however, that rather than sweep away needless complexity, the Commission has chosen to layer workarounds on top of existing workarounds.

It’s like using duct tape because you don’t know how to tie shoelaces. You might get somewhere, but it will be inelegant and unwieldy.

These proposals also set a course for regulatory divergence with the UK, which is working on its own rules changes. So far, the UK has simply copied over the pre-Brexit EU legislation with minor improvements.

As it pushes into the next phase of that work, the early signs are that it could end up with leaner regulation. Like the EU, it says it wants its regulation to be principles-based. Unlike the EU, UK firms might end up with some idea of what those principles are.

Other areas of financial regulation give an example of how it could work. For instance, the Financial Conduct Authority seems increasingly willing to rely on its ‘consumer duty’, which requires firms to act to deliver good outcomes for retail customers, rather than on specific rulebooks.

It’s taking the UK a little longer and it will need to get the principles right. But if UK policy makers are feeling competitive, they might just have the last laugh.