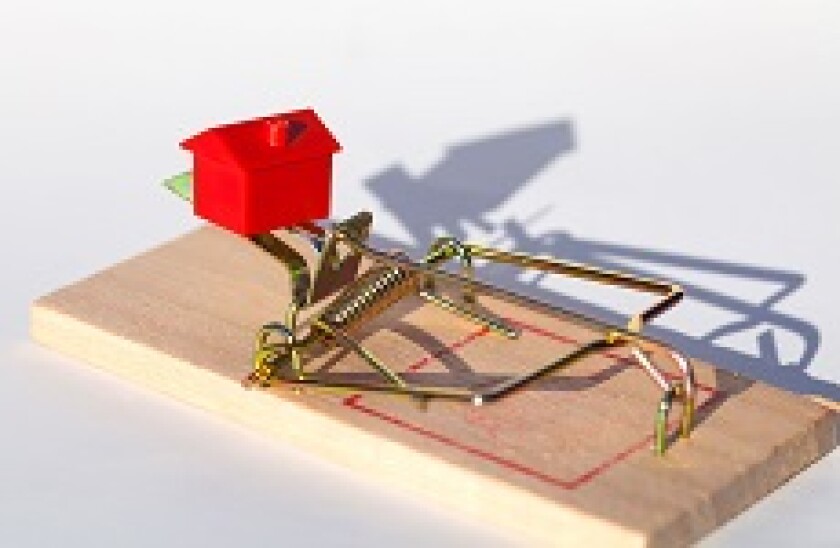

IMF: beef up housing rules to avoid crash

House prices in some advanced and emerging countries are at risk of a crash that could trigger a new bout of financial volatility, the International Monetary Fund warned on Thursday. It said that governments should tighten financial rules rather than hike interest rates to take steam out of the market, in an analysis published ahead of the spring meeting of its 189 country members next week.

Unlock this article.

The content you are trying to view is exclusive to our subscribers.

To unlock this article:

- ✔ 4,000 annual insights

- ✔ 700+ notes and long-form analyses

- ✔ European securitization issuance database

- ✔ Daily newsletters across markets and asset classes

- ✔ 1 weekly securitization podcast