It was a year in which the UK surprised the world by voting to leave the European Union, and a year in which the controversial businessman Donald Trump found himself destined for the White House. At the same time post-crisis banking regulation shifted beneath market participants’ feet, radically altering the way in which banks had to approach the new issue market.

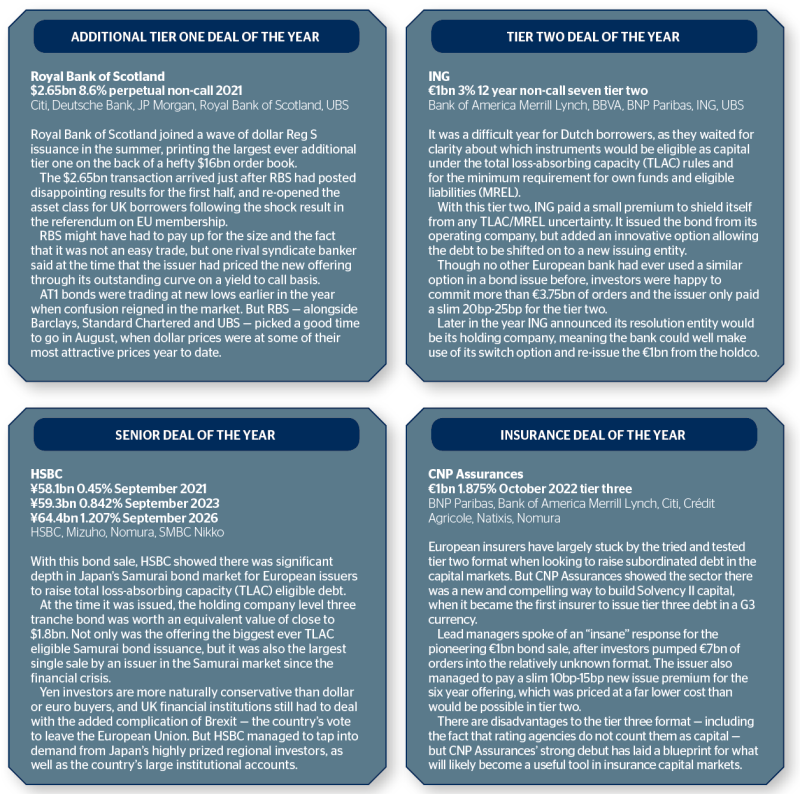

In a year of such big changes, GlobalCapital wanted to reward four trades that shrugged off the volatility and uncertainty to break new ground in the capital markets. The winners are presented here.