Latest news

Latest news

January's ABS data center deals see tenant numbers drop but demand remains strong

Deals including some commercial mortgages expected to follow

Deal was priced 6bp tighter than most recent iteration of the asset class

More articles

More articles

-

FMS Wertmanagement is planning to issue its first Sofr-linked issue in 2019, which will be sold to the money markets in the form of asset-backed commercial paper.

-

Hercules Capital, a firm specializing in making loans to venture capital backed companies in the life sciences sector, is preparing a new ABS offering.

-

A last-ditch reprieve for the asset-backed commercial paper market late last year saved European banks running securitization conduits from a huge drawing on their liquidity reserves — but details of the fix are still being hashed out.

-

A former director in Deutsche’s insurance solutions business has joined Blackstone’s Tactical Opportunities team as a principal.

-

A year and a half of costly insurance losses from the disasters such as the 2017 US hurricanes and last year’s wildfires in California are grinding down investors in catastrophe bonds and other insurance-linked securities. That raises questions over the direction of a market that has experienced consistent growth up to now, writes Jasper Cox.

-

The European Securities and Markets Authority has launched three consultations on how sustainability risks and factors should be integrated into the main regulations governing European securities and investment markets — MiFID II, Ucits, the AIFMD and the Credit Rating Agency Regulation.

-

The European Supervisory Authorities (ESAs) on Tuesday brought the risk mitigation treatment of simple, transparent and standardised (STS) ABS deals in line with covered bonds for over-the-counter derivatives contracts. The announcement follows guidelines published last week by the European Banking Authority clarifying the finer points with regard to the STS framework that comes into effect next year,

-

A niche corner of the interbank lending market between Western and emerging market financial institutions has been thriving behind the scenes of volatility in public EM markets, as its activity spreads across regions and innovation in its financing products flourishes, writes Ross Lancaster.

-

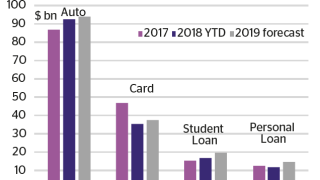

Consumer spending habits have changed beyond recognition since the financial crisis 10 years ago. US households are more wary of debt and are turning away from many of the traditional avenues of spending that have driven ABS markets for decades. While the market has come back since the depths of the crisis, securitization in 2019 is a different beast.