In a week when the Association for Financial Markets in Europe (Afme) said that first quarter issuance for European securitization in 2023 is down 43.9% against the same period last year, you could be forgiven for anticipating a bearish tone to this piece about the market’s future.

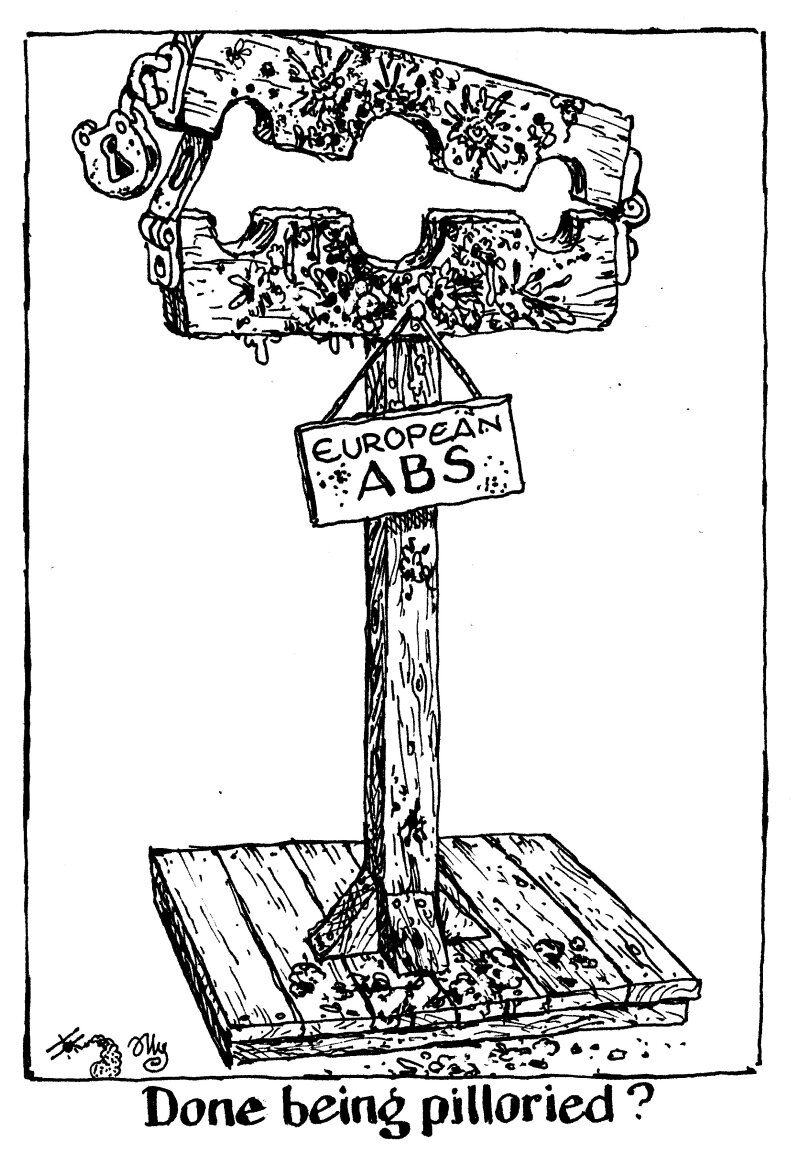

Since 2008, it has been treated with suspicion, with authorities keen to limit securitization’s liberty and — perhaps — excesses. It has been in the capital markets version of an open prison.

However, there are signs the shackles could soon come off.

Lloyds, the largest mortgage lender in the UK, is preparing to rejuvenate its flagship prime RMBS shelf, Permanent Master Issuer. In addition, four other big UK issuers are expected to bring prime RMBS deals before June. Meanwhile, UK supermarket Tesco is out with its own credit card ABS.

Sceptics will argue that two swallows don’t make a summer. With the impact of higher interest rates, persistent inflation and the war in Ukraine, it would seem strange to identify this as the moment when European ABS rises definitively from the ashes of 2008.

But as in almost all parts of the capital markets, the influence of central banks will be the driver. Lenders, whether they be in mortgages, credit cards or auto leasing, know that the years of cheap central bank funding programmes are over. In the UK, repayments for almost £176bn of the Bank of England’s Term Funding Scheme for SMEs (TFSME) begin in 2024. And it’s a similar story in the eurozone with the end of the European Central Bank’s Targeted Longer-Term Refinancing Operations, not to mention the eventual unwind of quantitative easing.

That will push issuers back into the public markets, including securitization. The revival of fabled bank issuance programmes, not to mention supermarkets — every little helps, after all — suggests more and more issuers are exploring the market.

The securitization market’s biggest problem is that it is light on investors — but a flurry of prime (and STS verified) deals could tempt those who are less familiar with the asset class, not to mention the allure of higher yields than have been available for years.

None of these arguments is new, however, so the question is: why would the market pick up now rather than three or four years ago?

That is because this decade has been characterised by crisis. Indeed, the 2022 Collins Dictionary word of the year was permacrisis. Issuers have been propped up by cheap money and investors have had enough complexity to deal with at rock bottom yields to be worrying about the delicacies of ABS.

A fresh crisis could derail monetary tightening. Central banks seem to have to fix every economic problem going these days and they have a predilection for loose monetary policy as the tool to do it.

But then again, perhaps we are now so used to operating through a crisis that, were another to occur, it would have to be of such magnitude to derail the ABS revival that securitizing assets would be the least of our worries.