There were mixed verdicts on what was achieved at last month’s UN Climate Action Summit. But few are challenging the extraordinary momentum that propelled more than 100 world leaders to join campaigners, civil society groups and the world’s private and public financiers to make their collective pledges in New York in the battle against global warming.

Watch EIB president Werner Hoyer's speech at the Climate Action Summit.

Among those to join the gathering were the world’s multilateral development banks. The MDBs confirmed their collective effort with an announcement on how they would optimise the impact of their climate finance through partnerships with private investors and other financial institutions.

Emma Navarro, the EIB’s vice president responsible for climate and environmental policy and who was in New York, says: “The role of the world’s multilateral development banks is absolutely crucial here.

“In terms of climate finance, we have committed to at least $175bn of climate financing by 2025 — $40bn of that will be mobilised from private sector investors. But in addition, the EIB and our partner MDBs have announced that we will also establish a common framework by COP25 with principles to help our clients deliver on the long term goals of the Paris Agreement.

“Just as it is clear that no one institution can do it alone, it is also abundantly obvious that the public and private sector need to work hand in hand. Longer term planning, building and strengthening partnerships that improve support for our clients is crucial.

“Without that long-term vision it is hard for public or private entities to take the necessary transformative climate action. Our approach is designed to help our clients to put in place long-term, holistic strategies to accelerate the transition to low carbon and climate-resilient development which is required.”

Climate finance and engagement with clients are key parts of MDB Paris Alignment, agreed last December at COP24. This was a notable milestone on the journey towards alignment with the Paris goals. Describing the global development agenda as being at a “pivotal point”, this joint declaration announced a framework that the world’s nine leading MDBs would use for their joint approach on Paris Alignment, broken down into six areas, or so-called building blocks.

Read the full joint declaration.

But the EIB is setting itself even more ambitious goals.

As President Hoyer announced at the summit in New York, the EU bank, which is owned by the 28 EU member states, stands on the verge of a radical push to embrace its role as the European Union’s climate bank.

From the General Assembly hall he said, “The incoming President of the European Commission Ursula von der Leyen said she wanted the EIB to be the climate bank. We have been a climate bank for 30 years. We were a driving force behind the multilateral development banks’ commitment in Paris four years ago.

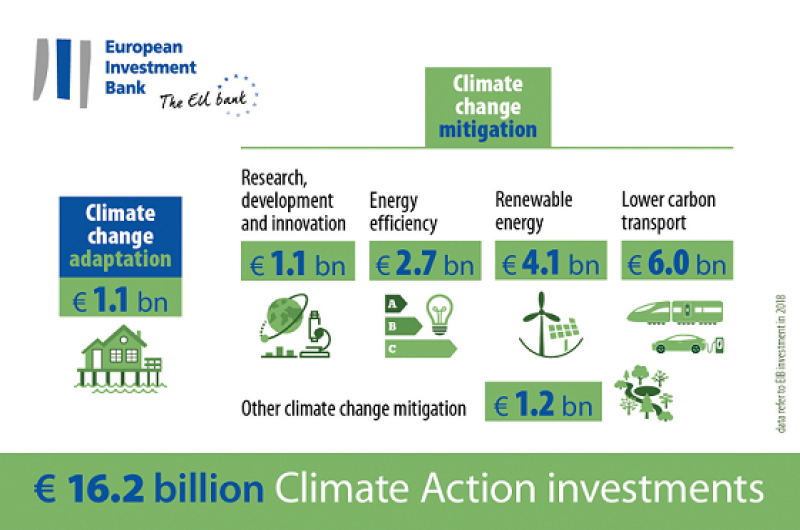

“There, we pledged that more than 25% of EIB activities are in precisely defined climate action. We delivered on that, we are now at 30% and we are proposing to our shareholders to increase that share for climate and environmental goals to 50% by 2025.

“This is extremely ambitious, but we are not stopping there — we need to look at the other 50%. So we will also align all the EIB Group’s financing activities with the goals of the Paris Agreement. That means projects that are not directly linked to climate must not contradict our climate ambitions. We aim for climate in everything we do.”

Watch Hoyer's full speech to the General Assembly.

Climate pioneer

One reason for that confidence is that well ahead of the Paris Agreement, which was ratified in 2016, EIB had established its credentials as a pioneer in the battle against the harmful impact of global warming.

Nancy Saich, the EIB’s chief expert on climate change, says: “Our approach even before Paris laid out clearly, via our 2015 Climate Strategy, that our lending policies should be underpinned by EU policies and also support a pathway to a low carbon world, based on the very latest scientific knowledge and on best practice.

“Putting this low-carbon approach together with the other commitments we made in 2015, which included risk screening to enhance the resilience of all our projects, show we are in a strong place to leap forward to higher climate ambition.”

Another factor behind the Bank’s confidence is the work undertaken over the last three years on climate resilience, culminating earlier this year in the launch of the EIB’s new climate risk assessment tool which screens all new investment projects for their physical climate risk.

What is alignment?

In many cases financial institutions originating or intermediating these flows need to go much further to address the challenge of climate change than individual governments have indicated through their nationally determined contributions (NDCs).

These are defined by the UN as “efforts by each country to reduce national emissions and adapt to the impacts of climate change.” But as the United Nations Development Programme/UN Framework Convention on Climate Change (UNDP/UNFCCC) cautioned in a report published last month, existing NDCs set the world on track for a rise in emissions of about 10.7% above 2016’s levels by 2030. This, adds the report, is “starkly at odds with the UN Secretary General’s calls for deep cuts”.

NDCs are generally at their weakest in developing economies where, according to the UNDP/UNFCCC analysis, the most critical factor l imiting raised ambition in this regard is “access to or availability of finance”. The UNDP/UNFCCC reports tha t global climate-related finance flows still fall “well short of the needs for a cleaner and more sustainable future,” adding that many developing nations say their NDCs are conditional on finance.

Blueprint for action

The strategy also pledges to “build on the solid success of our Climate Awareness Bonds to spur further sustainable growth of the green bond market”.

The EIB has spearheaded the development of this market, issuing close to €26bn in green bonds — focussed entirely on climate change mitigation actions — in 13 currencies since the launch of its ground-breaking inaugural transaction in July 2007.

But as Hoyer acknowledged last month, plenty needs to be done if this relatively new instrument is to fulfil its potential. Although the market for green and sustainable bonds has recently broken through the $800bn mark, Hoyer conceded that this progress “pales” in the context of a global fixed income market of around $100tr. “Saying that there is room for improvement is a clear understatement,” he added. A key theme addressed by the MDBs’ joint declaration is reporting and transparency, both on the greenhouse gas emissions of the projects they support and on the progress they are making towards alignment with the Paris goals. “We will further develop tools and methods for characterizing, monitoring and reporting on the results of our Paris-alignment activities,” the declaration says.

And in New York last month, the MDBs also announced a transparency framework for this reporting. EIB is very keen to see this work develop as they have been at the forefront of IFIs assessing and publishing global greenhouse gas (GHG) emissions data from investment projects.

“It’s vital we assess and report not only on estimated savings of greenhouse gas emissions, but also the amount of GHG emissions going into the atmosphere,” says Saich. “These ‘absolute’ emissions are what is actually changing the climate — and yet most institutions still aren’t reporting that.”

But there is one area not explicitly mentioned in the MDB’s declaration. This is the commitment to the concept of a ‘Just Transition’. Navarro believes this is fundamental. “We believe that the six building blocks in the MDBs’ declaration give us what we need to guarantee alignment with the Paris goals which we at the EIB aim to achieve by 2020. But we do see support for the Just Transition as being a vital part of MDB support for long-term strategies.

“It is essential that decarbonisation is complemented by initiatives promoting job creation and new economic activities in the regions and communities most affected by climate action.”

“Without this support, we would risk inciting further unrest against measures to protect our climate, such as the gilets jaunes movement we have seen in France. This is why we are already supporting our partners in vulnerable regions to address the social impact of decarbonisation.”

Aligning all the financing activities to the Paris Agreement in an organisation signing around €73bn of investments a year is an eye-watering task. Not least with a deadline of just over a year from now. But this is work that has been underway for some time in Luxembourg where the EIB is headquartered.

The Paris Agreement itself says that all financial flows have to be aligned with its temperature and resilience goals: no MDB can avoid that, and certainly not the biggest global multilateral.

Further reading from the EIB