Investors clamour for cheap AA refinancing

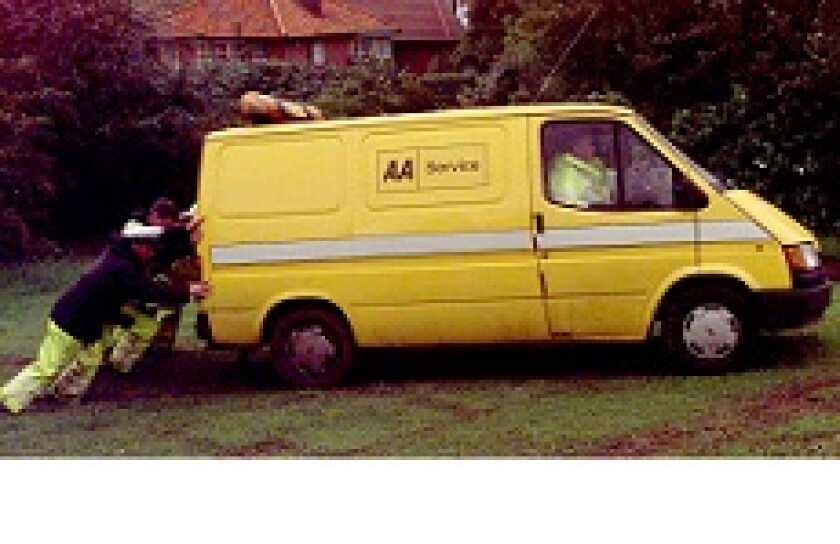

UK vehicle breakdown recovery and car insurance company the AA plc sold £550m ($726.63m) of new bonds on Tuesday as part of liability management exercise involving buying back existing debt and repaying a term facility, but it paid a juicy spread to get the deal done.

Unlock this article.

The content you are trying to view is exclusive to our subscribers.

To unlock this article:

- ✔ 4,000 annual insights

- ✔ 700+ notes and long-form analyses

- ✔ European securitization issuance database

- ✔ Daily newsletters across markets and asset classes

- ✔ 1 weekly securitization podcast