Latest news

Latest news

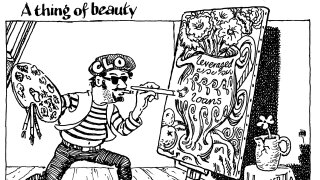

Borrowers take advantage of robust CLO demand to tighten leveraged loan pricing

New realm for ex-Natixis banker, as HSBC Innovation Bank hires

Manager reset the deal for the second time as the end of its reinvestment period approached

More articles

More articles

-

Mezzanine tranches come wide of recent new issues

-

◆ What is pushing CLO mezz wider ◆ FIG pre-funding underway ◆ What happened at the World Bank/IMF Annual Meetings

-

Triple-C loan pricing has been shunted wider while the true credit quality of loans trading at par is obscured

-

US-China trade tensions widen pricing as investors seek opportunities in more volatile market

-

Triple-A rated notes price 2bp lower than RLAM debut CLO

-

Manager weighs tight legacy liability pricing against rising cost of capital for CIFC European CLO II reset

-

Pricing on triple-A rated notes land 2bp tighter than on Tikehau new issue

-

GlobalCapital is pleased to announce the launch of its 2026 European Securitization Awards

-

Demand from investors for triple-A rated notes increases CLO size