Developments in AI ought to be a major boon to SME financing, giving lenders access to more funding at lower cost.

The large language models (LLMs) of 2023 and 2024 were better for parlour tricks than practical applications. That has now changed, both because the models themselves have improved and people have had time to apply them to problems.

There are still very clear limitations. GlobalCapital asked ChatGPT 5 Thinking to write a version of this article and set a word count of 280 words. After considering for 39 seconds, it trailed off mid-sentence at the end of the first paragraph.

It’s easy to mock those sorts of blunders, but LLMs also have clear strengths. They can rapidly process and digest unstructured data with an accuracy and precision that would have seemed a long way off even two years ago.

That is a crucial task in debt backed by receivables and automating it successfully could lower costs and speed up issuance. In turn, that would unlock cheaper and more flexible financing of more granular and shorter dated receivables, opening secured funding to more SMEs.

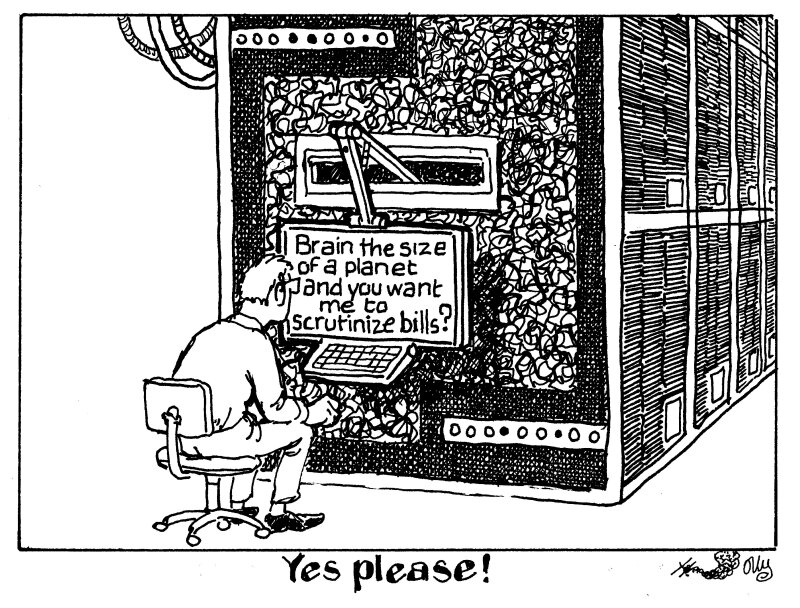

It might also allow lenders to apply a previously impossible level of scrutiny to each receivable in a portfolio, lowering the risk of fraud. AI agents could cross check that invoices are real and customers are who they say they are.

Crucially, if investors in deals want to develop the tech, it could keep an eye on a rapidly revolving portfolio on an ongoing basis.

That said, fraud is not an easy problem to solve. There is always a human element to it so strong governance is crucial. Technology has also stumbled before. Notably, invoice financing firm Stenn collapsed in late 2024 partly due to fraud, despite having its own underwriting technology and manual verification.

For all the false starts, the direction of travel on AI is clear. It is growing more capable with each new model release and making a significant contribution to understanding and underwriting receivables feels within reach.

The SME sector should benefit because of the nature of its receivables, and in turn it become a bigger part of the securitization market.